[ad_1]

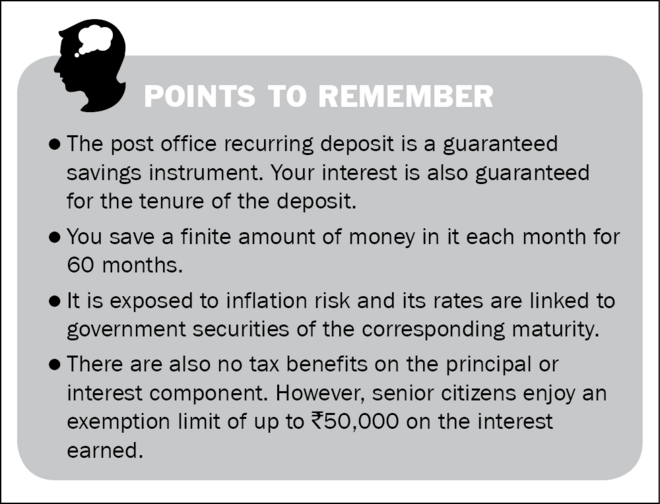

The Put up Workplace Recurring Deposit (PORD) is a scientific financial savings plan, the place you save small however finite equal sums of cash every month for a interval of 60 months. The financial savings within the PORD earn mounted curiosity, which can be utilized to build up sizeable and predetermined financial savings over time.

Options of Put up Workplace Recurring Deposit

- Eligibility: You have to be a resident Indian ideally with a publish workplace financial savings account.

- Entry age: No age restrict is talked about. Minors above 10 years can open an account of their title immediately.

- Investments: Minimal-Rs 100 and above in multiples of Rs 10 thereof. Most-There is no such thing as a higher restrict.

- Tenure: 60 months (5 years).

- Account-holding classes: Particular person, Joint, Minor via the guardian, and Minor above 10 years.

- Nomination: Facility is out there.

- Exit choice: Untimely closing of the account is permitted with a penalty.

Funding goal and dangers

- The principle goal of the PORD is to offer an assured return, compounded quarterly, on each month-to-month deposit revamped 60 months. Although it affords no tax incentives, it’s a most popular instrument amongst small savers due to the federal government backing that it affords.

- There is no such thing as a threat related to this funding.

Suitability and options

- Appropriate for conservative traders looking for assured returns by investing repeatedly for medium-term targets round 5 years away.

- Not appropriate for long-term wealth creation, given their incapacity to offer any significant returns above the speed of inflation.

- Options might be SIP in debt mutual funds which might provide higher, although not assured, returns, and Financial institution recurring deposit.

Fee of curiosity in Put up Workplace Recurring Deposit

The speed of curiosity in PORD is 5.80 per cent compounded quarterly.

Capital & inflation safety

The capital within the PORD is totally protected, with assured returns, because the scheme is backed by the Authorities of India. The PORD will not be inflation-protected. Each time inflation is above the assured rate of interest, the scheme earns no actual returns. However when the inflation fee is under the assured fee, it does handle a optimistic actual return.

Ensures

The principal and curiosity on the Put up Workplace Recurring Deposit are completely assured. The rate of interest is at the moment 5.80 per cent every year compounded quarterly. The rate of interest on this accretion is notified quarterly and is aligned with G-sec charges of the same maturity, with an expansion of 0.25 per cent. Nevertheless, it is going to stay unchanged for the depositor as soon as he has made the deposit.

Liquidity

One-time withdrawal of as much as 50 per cent of the steadiness is allowed after one yr. Nevertheless, it’s handled as a mortgage and might be repaid in a single lump-sum or in equal month-to-month instalments until maturity of the PORD together with curiosity @ 2% + RD rate of interest relevant to the PORD account. The account can be closed prematurely after three years from the date of account opening however in such a case, Put up Workplace Financial savings Account rate of interest can be relevant.

Tax implications

There is no such thing as a tax benefit on these deposits and the curiosity earned on maturity is handled as earnings from different sources when computing earnings tax.

The place to open an account?

You may open the account in any publish workplace.

Find out how to open an account?

After getting chosen the publish workplace to open the PORD account, you’ll first have to open a publish workplace financial savings account to hyperlink the month-to-month cost to the PORD and you will have the next paperwork:

- An account opening type, which the publish workplace will present

- Two passport measurement pictures

- Aadhaar card. Within the absence of the identical, you’ll want to present a replica of the acknowledgement of your Aadhaar utility

- Tackle and identification proof such because the Aadhaar card, a replica of the passport, PAN (everlasting account quantity) card or declaration in Kind 60 or 61 as per the Earnings-Tax Act 1961, driving licence, voter identification card, or ration card

- Carry the unique identification proof for verification on the time of account opening

- Select a nominee

Find out how to function the account?

- You have to credit score the preliminary account opening sum to the account with a pay-in slip.

- Fee might be made in money, by cheque or instructing the financial institution to switch cash to the PORD.

To view the present charges on the schemes, go to vro.in/s34211

*Joint B accounts are the accounts that may be operated by both of the account holders/both of the survivors.

[ad_2]

Source link