[ad_1]

On Samco Mutual Fund’s debut fund launch, we spoke with Umesh Kumar Mehta. Watch the video the place he elaborates on the driving forces for Samco group to get into the mutual fund enterprise, the funding philosophy on the AMC, how they intend so as to add worth in a crowded area and the roadmap of their journey forward.

A number of companies have utilized for mutual fund licenses within the final couple of years, and a few already have SEBI’s go-ahead. Certainly one of them is Samco Asset Administration Pvt. Ltd., sponsored by Samco Securities Restricted, an fairness brokerage agency headquartered in Mumbai and based in 2015 by Jimeet Modi, Group CEO.

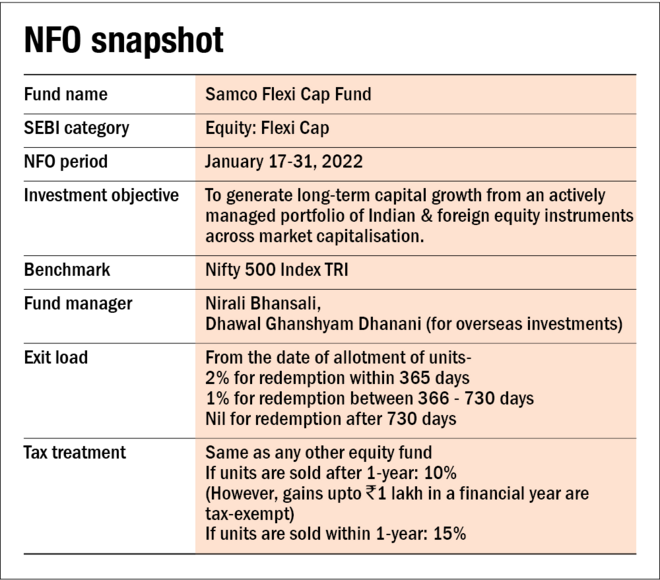

The fund home could be beginning their journey with the launch of their fund within the flexi-cap class. The scheme’s new fund supply (NFO) is open for subscription from January 17, 2022, and can shut on January 31, 2022. Nirali Bhansali will handle the home fairness portion of the scheme, whereas Dhawal Dhanani is the devoted fund supervisor for abroad investments. The fund is benchmarked in opposition to the Nifty 500 Index TRI. Listed below are the important thing particulars of the brand new fund supply.

As a part of the launch of this fund, the fund home has launched a ‘Unitholders Handbook’ the place it has tried to offer an understanding of what the AMC could be attempting to do, what it will not do and the way it plans to stay to a disciplined plan to attain its goal. The handbook states that the AMC goals to pioneer the idea of stress testing and actually lively investing whereas being extremely clear.

We interacted with the AMC’s CEO, Umesh Kumar Mehta, on the event of the launch of their debut fund. Elaborating on the idea of stress-tested investing, he acknowledged, “Stress examined investing is deploying cash in these companies that may survive and endure stress or a wide range of shocks within the economic system and are additionally capable of generate excessive risk-adjusted returns. So why stress-tested investing? As a result of the life of companies is getting shorter these days due to enterprise capital funding, infinite technological disruptions, and so on. So that’s the reason why out of the 30 Sensex firms 20 years in the past, solely six are in existence immediately. For that matter, out of Fortune 500 firms, half have disappeared within the final 15 years, Evergrande being one of many newest examples.”

The AMC states that Samco Flexi Cap Fund would observe the 3E technique, i.e., investing in efficient firms at an efficient value and sustaining efficient prices to construct a portfolio designed to generate a excessive risk-adjusted return. Although the fund would function as a flexi-cap, it goals to construct a portfolio of about 25-stock portfolios which they consider gives an ideal stability of diversification and focus. The scheme will observe a progress investing technique investing in Indian and world equities in a ratio of 65:35.

During the last 12 months or so, we’ve seen that many fund homes make provisions to spend money on international securities and have a devoted fund supervisor for a similar. However we’re but to see any international fairness allocation in them. On the matter, AMC’s CEO stated that “On day one, the second we get the funds, we’ve 9 worldwide and 16 home names prepared whereby as much as 35 per cent we’ll spend money on worldwide shares and 65 per cent will likely be in home. So that is what we’ll preserve, and this ratio will roughly stay all through the scheme’s life. “

Shedding gentle on their future product line-up, the CEO stated that the AMC is within the technique of launching its ultra-short period fund, as a parking fund, within the subsequent couple of months or so. After that, they’ve a world fairness fund and an ELSS fund within the pipeline, which they goal to launch earlier than the tip of this 12 months.

[ad_2]

Source link