[ad_1]

Penny shares are so-referred attributable to their small share worth. Within the Indian context, penny shares are shares with a share worth of lower than Rs 10. For the reason that share worth is small, an investor or speculator should purchase massive portions of the inventory. Nevertheless, it’s exactly this motive that makes them fairly unstable. Furthermore, penny shares is usually a hub of operator-driven manipulation. Subsequently, one must be extraordinarily cautious when shopping for these shares.

This brings us to our agenda. For the previous few weeks, we’ve been noticing information tales relating to the variety of penny shares that turned multibaggers (i.e., a inventory that has at the very least doubled). The truth is, from March 2020 to January 11, 2022, out of 1,207 penny shares, 921 have been multibaggers. That’s, 76 per cent of the penny shares have at the very least doubled.

This bought us to pondering that whereas the returns are substantial, what are the possibilities that such shares would keep their stellar efficiency?

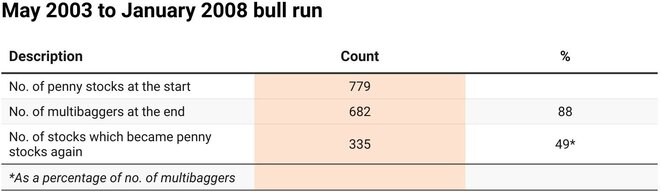

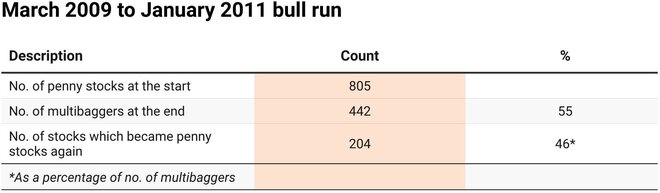

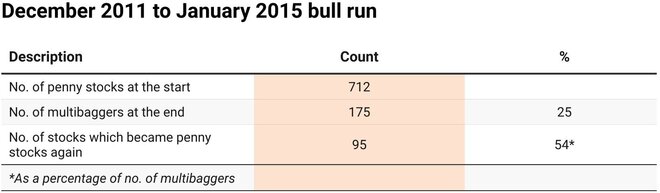

Moreover, we needed to know what number of of those grew to become penny shares once more at first of the subsequent bull run. So we dug by means of three bull runs (i.e., at the very least 20 per cent CAGR) of the previous to determine this out:

1. Could 2003 to January 2008 – 52 per cent CAGR

2. March 2009 to January 2011 – 65 per cent CAGR

3. December 2011 to January 2015 – 24 per cent CAGR

Here’s what we discovered.

Within the first two bull runs, the share of penny shares that turned multibaggers is substantial. With renewed vigour and excessive speculative curiosity, these penny shares delivered substantial returns over the course of the bull run. Nevertheless, what’s of curiosity is what occurs after the bull run has ended. Right here the image is unanimous. Round half of the multibagger penny shares returned to their penny inventory standing, throughout the three bull runs.

So what must be your takeaway from this? Nearly all of the exercise on this house is speculative. The chances of producing excessive and sustainable returns should not stacked in your favour. There are very uncommon occurrences of a penny inventory’s good fortunes being backed by a superb enterprise. To separate the wheat from the chaff would require an amazing quantity of labor and quite a lot of luck.

[ad_2]

Source link