[ad_1]

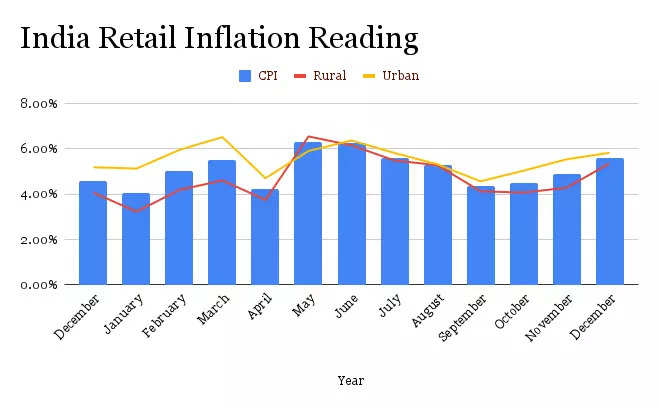

NEW DELHI: Retail inflation based mostly on shopper worth index (CPI) jumped to five.59 % for the month of December, information launched by authorities confirmed on Wednesday.

The inflation determine for the month of November was recorded at 4.91 %.

The spike in inflation numbers is principally on account of uptick in meals costs.

Meals costs, which contribute to almost half of the CPI, rose 4.05 % year-on-year in December, in contrast with 1.87 monthly a month earlier than. Costs of edible oil rose almost one-fourth from a yr in the past.

Retail gas costs rose 10.95 % in December year-on-year in comparison with 13.35 % within the earlier month, the info confirmed.

Annual core inflation, excluding unstable meals and vitality costs, was estimated at between 6 % and 6.01 % in December, in line with three economists, in contrast with 6.08 % and 6.2 % within the earlier month.

As well as, costs of gas & gentle, clothes & footwear, cereals, milk merchandise, oils and fat additionally confirmed a surge in December.

The Reserve Financial institution of India (RBI) primarily components in retail inflation whereas arriving at its bi-monthly coverage.

Reserve Financial institution’s financial coverage committee (MPC) has been tasked by the federal government to tame retail inflation based mostly on shopper worth index (CPI) at 4 per cent (+,-2 %).

The RBI left its repo fee unchanged at 4% for a ninth consecutive coverage assembly final month, sticking to its concentrate on financial development as India nonetheless faces challenges from the coronavirus pandemic.

IIP grows 1.4% in November

In a separate set of information launched by the federal government, industrial manufacturing rose 1.4 % in November 2021.

Whereas manufacturing sector’s output grew 0.9 %, the mining output climbed 5 per cent, and energy era elevated 2.1 %.

The IIP had contracted by 1.6 % in November 2020.

Industrial manufacturing has been hit as a result of coronavirus pandemic since March 2020, when it had contracted 18.7%

It shrank 57.3 % in April 2020 on account of a decline in financial actions within the wake of the lockdown imposed to curb the unfold of coronavirus infections.

Additionally Learn:

[ad_2]

Source link