[ad_1]

It has been raining passive funds within the mutual fund business for the final couple of quarters. There are 184 index funds and exchange-traded funds (ETFs) at the moment, out of which 87 have been launched within the final three years (greater than half of which got here into being in 2021 alone).

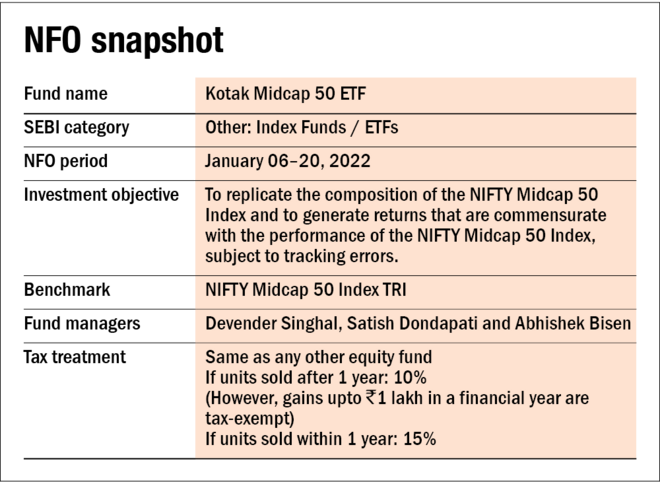

Kotak Mutual Fund has rolled out an ETF within the mid-cap area. The brand new fund provide (NFO) will shut for subscription on January 20, 2022, after which it may be bought and bought on the inventory exchanges. Listed here are the important thing particulars of the brand new fund provide:

Concerning the technique

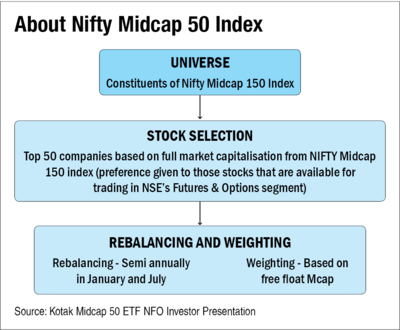

The newly-launched fund can be the primary to imitate ‘Nifty Midcap 50 TRI’. The latter includes the highest 50 shares primarily based on full market capitalisation from the Nifty Midcap 150 index (representing 150 corporations ranked 101-250 as per full market capitalisation from the Nifty 500 Index). Thus the first goal of this underlying index is to seize the motion of the midcap section of the market.

As this index captures the highest 50 corporations from the universe of Nifty Midcap 150, there are some refined and not-so-subtle variations between the 2 indices. First, the highest 5 sectors are broadly the identical; nevertheless, their weightage within the Midcap 50 index is barely increased. Additional, the highest 5 holdings make up solely 10 per cent of the Midcap 150 portfolio, however it’s virtually double within the case of the underlying index of the fund into consideration.

Mid-cap funds have been within the limelight currently because of the post-covid restoration on the bourses. Whereas such funds can present increased returns vis-à-vis diversified fairness funds akin to flexi-caps over the long run, this comes at the price of comparatively increased threat, provided that they spend money on much less mature corporations. At Worth Analysis, we imagine that mid-cap funds add worth in the long run, aggressive development portfolio. However they’re meant to be a supplementary holding, which implies that traders ought to keep away from allocating greater than 15-20 per cent of their portfolio into them.

Concerning the efficiency

Amid the rising curiosity for passive investing, we see that within the mid-cap area, the vast majority of the actively managed funds have overwhelmed the index comfortably (see ‘Efficiency comparability’) until mid-2020 however have barely trailed subsequently. Nonetheless, the Midcap 50 index (a subset of the Midcap 150 index), which this new fund goes to trace, has constantly lagged during the last 10 years towards each the actively managed mid-cap funds in addition to its guardian index. Traders ought to be aware that these are historic tendencies and can’t be extrapolated into the long run.

Concerning the AMC

The wholly-owned subsidiary of Kotak Mahindra Financial institution Restricted, Kotak Mutual Fund has been current within the mutual fund business since 1998. As of December 2021, the AMC managed property price about Rs 2.85 lakh crore, rating fifth within the 41-player mutual fund business.

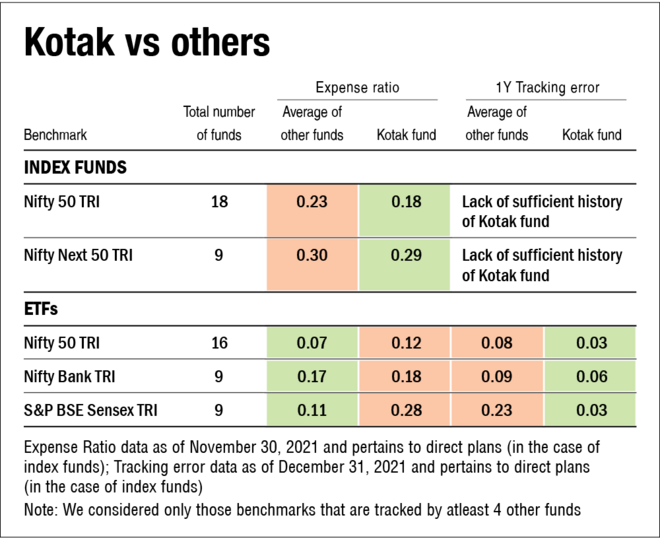

Within the open-end fairness funds section, the fund home manages an asset base of round Rs 97,639 crore throughout 21 home funds. Out of this, the share of passive fairness (index funds/ETFs) is barely Rs 9,979 crore unfold amongst 9 funds. We analysed these funds by way of their expense ratio and monitoring error (the 2 most necessary parameters for analysing passive funds) towards different funds monitoring the identical benchmark. The AMC has performed an honest job of retaining a low monitoring error within the case of ETFs. For the reason that two index funds mimicking Nifty 50 and Nifty Subsequent 50 haven’t but accomplished even a 12 months, the identical cannot be evaluated. Additional, whereas the fund home’s expense ratio within the case of index funds (direct plans) is decrease, the identical is simply the other in ETFs in contrast with the common of different funds monitoring the identical index.

[ad_2]

Source link