[ad_1]

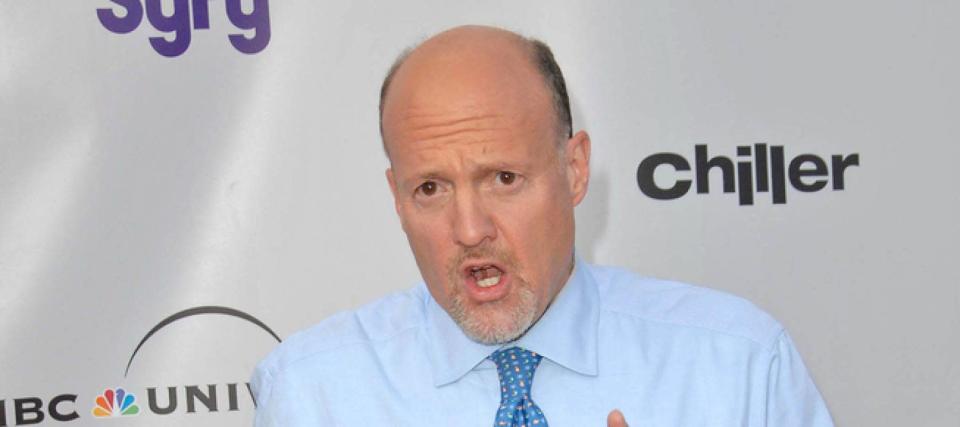

In December, Mad Cash host Jim Cramer advised members of the CNBC Investing Membership that 2022 is the yr “to personal corporations that make stuff, that do tangible issues, that innovate.”

Now that the calendar’s flipped and development shares are slumping a bit, placing your cash behind established corporations that create distinctive, in-demand merchandise makes an terrible lot of sense.

Cramer lately introduced his high inventory picks for 2022. True to his phrase, there isn’t an overhyped tech unicorn within the bunch.

Let’s discover out why the prognosticator believes so strongly in these 4 corporations.

Honeywell (HON)

“At this level within the enterprise cycle, the playbook says you must go together with extra tangible corporations that make actual issues and generate actual income,” Cramer stated final week on CNBC.

One firm he feels suits that invoice is Fortune 100 mainstay Honeywell. (The corporate was ranked 94 in 2021.)

As a worldwide industrial conglomerate, Honeywell gives an attractively diversified mixture of providers and merchandise that vary from aerospace and constructing applied sciences to security and productiveness options.

Regardless of a snarled world provide chain and decreased demand from its deep-pocketed airline clients, Q3 2021 noticed Honeywell enhance gross sales by 8% yr over yr. Earnings per share elevated by 29% over the identical interval.

Bausch Well being Corporations (BHC)

Bausch Well being is a Canadian pharmaceutical firm that develops, manufactures and markets pharma merchandise and branded generic medication that focus on all kinds of well being issues.

Pharma and healthcare corporations are at all times intriguing performs throughout instances of excessive inflation, as their merchandise stay in demand even when costs rise.

Cramer, nevertheless, is most excited by the truth that Bausch plans on breaking itself into three separate entities: eye well being, medical aesthetics and prescription drugs.

“I like a giant breakup story,” he stated throughout a current episode of Halftime Report. “Amongst deliberate splits at Johnson & Johnson, Normal Electrical and Bausch, I like Bausch Well being as one of the best breakup.”

Bausch’s inventory has risen slightly below 15% prior to now 12 months.

Chevron (CVX)

Chevron is wanting fairly good.

America’s second largest oil firm continues to profit from the continuing inflation-driven rally in power costs. But it surely additionally plans on investing a gargantuan sum of cash into its renewable pure gasoline and hydrogen companies — $10 billion by 2028 — that ought to maintain the corporate related for many years to come back.

Chevron had an expectation-topping Q3 final yr: $6.1 billion in earnings, $5.6 billion in debt discount and $2.6 billion in dividends paid out to buyers.

The corporate’s inventory is up over 30% in simply the final 4 months. It may go even increased.

“I like Chevron as a result of I simply assume that oil continues to be undervalued even after final yr,” Cramer stated.

Eli Lilly (LLY)

Pharma big Eli Lilly expects the sale of COVID antibody-based therapies to assist it make a projected $28 billion in gross sales for 2021, however the firm can also be making progress with its experimental Alzheimer’s drug, donanemab.

In June, the Meals and Drug Administration designated donanemab a “breakthrough remedy” primarily based on preliminary scientific proof. Meaning the FDA will expedite the drug’s overview. A call relating to the drug’s approval is anticipated within the second half of 2022.

A wager on Eli Lilly isn’t merely a speculative play primarily based on new medication. The corporate’s inventory is up greater than 215% during the last 5 years — a really profitable pickup lately, particularly if you happen to had invested utilizing free funding apps.

Extra from MoneyWise

This text gives data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any form.

[ad_2]

Source link