[ad_1]

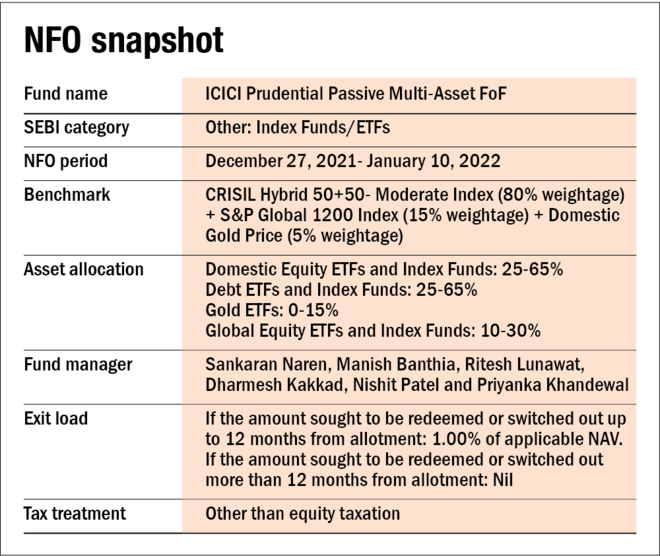

ICICI Prudential Mutual Fund has launched a brand new fund of funds within the multi-asset house. The fund will put money into index funds and ETFs throughout the varied asset courses of the fund home or of some other fund firm.

The scheme opened up for a subscription on December 27, 2021, and can shut on January 10, 2022.

Concerning the technique

The fund will make investments throughout the varied asset courses equivalent to home and world fairness, debt and gold via index funds and ETFs. Home fairness is seemed upon to generate capital appreciation via India development story. The debt asset class goals to generate secure returns and long run wealth creation alternatives. Gold is seemed upon as a possible hedge towards inflation, and the worldwide fairness might be used to have diversification advantages and assist put money into megatrends.

As per the AMC, the fund will observe the Valuations, Triggers and Technicals (VTT) funding strategy to determine on the fund’s asset allocation. The valuations will assist confirm whether or not an asset class is dear or low cost based mostly on numerous indicators. Triggers are occasions equivalent to rates of interest actions, world elements, and so on., which may affect (constructive/destructive) any asset courses. Technicals will assist choose ETFs/Index funds based mostly on their relative efficiency.

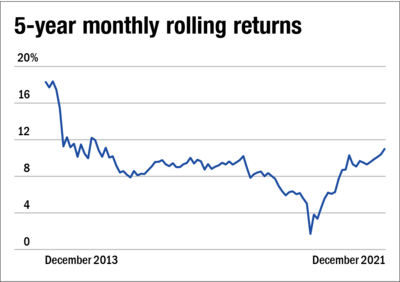

The graph reveals the common returns delivered by the class of multi-asset funds in any 5 years.

Concerning the AMC

As on November 2021, ICICI Prudential Mutual Fund manages belongings price over Rs 4.78 lakh crore throughout 134 open-end schemes making it the second-largest fund home.

In the case of the passive line-up of the AMC, it ranks fifth with 39 schemes (together with index funds, ETFs and FoFs), managing belongings price over Rs 46,500 crore. Of those, belongings price over Rs 16,300 crores are managed throughout the 13 funds of funds, whereas the remaining is in index funds and ETFs. The fund home has the very best variety of FoFs within the trade.

It at the moment has one actively managed multi-asset fund launched in 2002 and manages belongings price over Rs 12,200 crore.

Additionally learn:

Three questions it is best to ask earlier than investing in an NFO

[ad_2]

Source link