[ad_1]

What’s Kisan Vikas Patra?

Kisan Vikas Patra (KVP) is a well-liked and protected small-savings instrument that doubles the invested cash in 10 years and 4 months on the present fee. This scheme is backed by the federal government. After withdrawing it, the federal government relaunched it on November 18, 2014. The cash raised by way of the KVP is utilized in welfare schemes for farmers.

Options of Kisan Vikas Patra

- Eligibility: One needs to be a resident Indian to buy this product.

- Entry age: No age restrict is talked about.

- Minimal investments: Minimal: Rs 1,000. Most: There isn’t a higher restrict.

- Different features: Untimely encashment is allowed.

- Account-holding classes: Particular person, Joint, Minor by way of the guardian, and Minor above 10 years.

- Nomination: The ability is out there for current buyers.

- Exit choice: Untimely withdrawal is permitted at a price for buyers.

Rate of interest for Kisan Vikas Patra

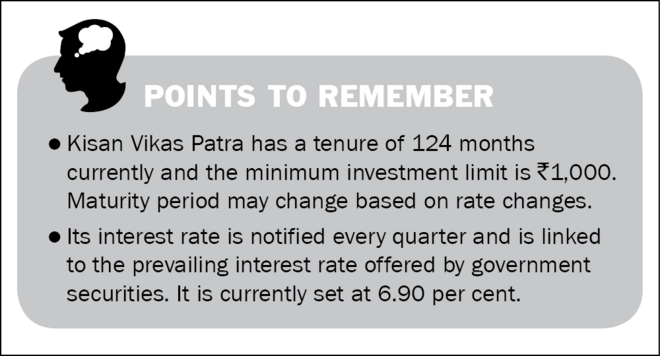

The rate of interest for KVP is 6.90 per cent compounded yearly.

Maturity interval of Kisan Vikas Patra

The maturity interval could change primarily based on fee modifications. Presently, it’s 124 months; 10 years 4 months.

Capital safety and inflation safety

The capital within the KVP is totally protected, because the scheme is backed by the Authorities of India. The KVP isn’t inflation protected. Which means that each time inflation is above the present assured rate of interest, the deposit earns no actual returns. Nonetheless, when the inflation fee is underneath the assured fee, the KVP can handle to offer a optimistic actual fee of return.

Funding goal and dangers

The principle goal of the KVP is to double the sum deposited. The target of doubling the funding is straightforward for any investor to know. The federal government backing and assure make it a preferred route of investments for small savers.

Suitability and alternate options

Ensures

The rate of interest within the KVP is assured. Presently, it’s 6.90 per cent compounded yearly. The KVP charges are notified each quarter as per the prevailing government-bond charges. Nonetheless, after getting made an funding, the speed will stay unchanged for you all through the tenure.

Liquidity

Liquidity is obtainable as loans and withdrawals, that are topic to circumstances. The minimal lock-in interval is 30 months, after which it may be encashed by paying a penalty. Additionally, it may be transferred from one particular person to a different any variety of occasions.

Tax implications

There isn’t a tax profit on the deposit or the curiosity that the KVP earns. There isn’t a tax deducted on the supply.

The place to purchase

One can purchase the KVP at any head publish workplace, common publish workplace, any designated nationalised financial institution, or State Financial institution of India.

Easy methods to purchase

- You need to fill the KVP utility type obtainable on the publish workplace or the designated banks.

- Unique id proof for verification on the time of shopping for is required.

- You possibly can select a nominee.

Different info

- The KVP may be encashed at any publish workplace or nationalised financial institution in India, supplied one has obtained a switch certificates to the specified publish workplace or financial institution.

- The KVP is transferable throughout publish workplaces and designated banks for current buyers.

- Curiosity revenue is taxable however no tax is deducted on the supply.

To view the present charges on the schemes, go to vro.in/s34211

[ad_2]

Source link