[ad_1]

Seemingly revolving door has stumped many analysts and buyers

Article content material

Nutrien Ltd. misplaced its second CEO in a 12 months after the corporate stated Tuesday its chief govt Mayo Schmidt had resigned and left the corporate, however offered no motive for the departure.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

“The Nutrien Board of Administrators will … search to pick a long-term chief that may take the corporate into its subsequent section,” Russ Girling, chair of the board, stated in a press launch. Girling stated the corporate would take into account inside and exterior candidates, however didn’t elaborate on what he meant by “subsequent section.”

Schmidt was appointed chief govt in April 2021 after Nutrien introduced that his predecessor Chuck Magro had resigned however by no means provided a proof for the exit. On the time, Schmidt was chair of Nutrien’s board — having come from Agrium Inc., which merged with Potash Corp. of Saskatchewan in 2018 to type the present firm.

Each Schmidt and Magro additionally resigned from the board on the time of their exits. Magro is now chief govt at Delaware-based agriculture expertise firm Corteva Inc.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

In the meantime, Ken Seitz, govt vp and chief govt of Nutrien’s potash division and the previous chief govt of Canpotex, a potash exporting firm co-owned by Nutrien, was appointed interim chief govt.

The seemingly revolving door on the high of the Saskatoon-based diversified agricultural firm, which has seen a meteoric rise in share worth because the pandemic started, has stumped many analysts and buyers.

“What’s perplexing is that these adjustments are taking place at a time when the ag cycle is strong,” wrote P.J. Juvekar, an analyst with Citigroup International Markets Inc., noting that for the near-future “it does elevate questions in regards to the long-term technique.”

Ben Isaacson, an analyst at Scotiabank, predicted buyers would penalize the corporate for “perceived dysfunction on the board and senior management ranges.”

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

The corporate’s share worth was buying and selling down greater than 4 per cent to $91.32 Tuesday on the Toronto Inventory Trade. The inventory has shot up from a five-year low of $40.14 in March of 2020 to achieve $96.24 on the finish of final 12 months.

Megan Fielding, a spokesperson for Nutrien, declined to make any govt out there for an interview.

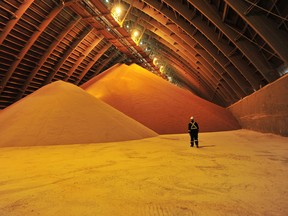

Nutrien has thrived amid sturdy agricultural fundamentals which have produced a beneficial surroundings for the crop nutrient and fertilizers it produces and sells at a world retail community. By the primary 9 months of 2021, it notched file earnings earlier than curiosity, taxes, depreciation and amortization of US$4.7 billion and guided for full-year adjusted EBITDA of US$7.1 billion, on the excessive finish, together with US$2.75 billion from potash, US$2.4 billion from nitrogen, US$1.80 billion from retail gross sales and US$540 million from phosphate gross sales.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

Nevertheless it faces a shifting aggressive panorama, with new opponents in its foremost potash enterprise, in addition to adjustments from the vitality transition and decarbonization.

In August, the Australian mining large BHP Group introduced it will spend $7.5 billion to assemble the Jansen potash mine in Saskatchewan. It’s anticipated to begin producing 4.35 million tonnes of potash per 12 months starting round 2029, and will function for 100 years.

Traditionally, Schmidt and different executives have emphasised Nutrien is able to producing round 18 million tonnes of potash, however at all times stored 4 to 5 million tonnes of capability idle, which has allowed it to behave as a swing producer. This 12 months, it’s anticipated to supply a file 14 million tonnes.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

Schmidt had repeatedly stated that he expects two to a few per cent annual progress in demand for potash for the following decade. Even when BHP’s Jansen begins producing round 2029, “the market will simply take up … extra manufacturing,” he stated in November throughout an earnings name.

That very same month, at a Morgan Stanley funding convention, Nutrien’s chief technique officer Mark Thompson stated that new potash initiatives typically take longer to construct and are “dearer” than predicted, and emphasised Nutrien is a low-cost producer that might thrive in any worth surroundings.

Nonetheless, BHP’s foray into potash is bound to shuffle sector dynamics: Nutrien, with its US$40 billion in market capitalization, has been one of many largest crop nutrient corporations on this planet, however it’s tiny in comparison with BHP’s US$155.7-billion market cap.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

Scotiabank’s Isaacson wrote that he expects the string of unexplained departures at Nutrien final 12 months, together with the exit of Mike Frank, chief govt of retail, will create a inventory “overhang” on Nutrien, and set off questions on technique, together with whether or not the corporate will search to strike a cope with BHP, and whether or not it ought to cut up off its retail enterprise from its pure useful resource manufacturing enterprise.

In mid-December, CIBC Capital Markets analyst Jacob Bout hosted a fireplace chat with Ken Seitz, then-CEO of the potash division, and wrote in a be aware that the corporate is predicted to signal a significant contract to produce potash to China by February.

Potash costs have been surging amid excessive demand, international supply-chain disruptions, and uncertainty brought on by sanctions on Belarus, a significant producer of potash, and Bout predicted “stable free money flows” for Nutrien in 2022. He referred to as the corporate a play on fertilizer costs: for each 10 per cent improve in fertilizer costs, Nutrien sees a 20 per cent enchancment in EBITDA, Bout estimated.

Commercial

This commercial has not loaded but, however your article continues under.

Article content material

The corporate has different irons within the hearth, together with a partnership with the U.S. Division of Power to supply low-carbon ammonia, which it wish to promote as a clear gas for marine vessels.

As meals safety rose in precedence world wide final 12 months, Schmidt had stated the corporate had fired on all cylinders — growing its potash manufacturing, realizing greater margins in its nitrogen enterprise, and even rising market share and margins in its retail enterprise regardless of supply-chain hiccups.

-

Nutrien searches for brand spanking new CEO after Mayo Schmidt resigns lower than a 12 months into the job

-

Nutrien CEO Mayo Schmidt sees farmers spending massive on fertilizer

-

Nutrien assured in potash demand regardless of BHP’s huge Jansen undertaking

-

Nutrien shares surge after announcement it’s going to enhance potash output

“Our distinctive outcomes this quarter spotlight our crew’s sturdy execution, vital aggressive benefits and leverage the strengthening market fundamentals,” Schmidt stated through the third-quarter earnings name in November.

The one query is why amidst file outcomes and a vivid outlook, two chief executives have departed the corporate in lower than a 12 months.

“We have no idea the rationale why, and will by no means discover out,” Isaacson wrote, calling it “an sudden twist.”

Monetary Put up

• Electronic mail: gfriedman@postmedia.com | Twitter: GabeFriedz

Commercial

This commercial has not loaded but, however your article continues under.

[ad_2]

Source link