[ad_1]

Are you aware what Farnam Road is? It is a web based publication that’s named after the road on which Berkshire Hathaway’s headquarters is situated within the small metropolis of Omaha in america. The Farnam Road web site (fs.weblog) describes itself as ‘Mind Meals’. It isn’t solely devoted to investing or to Warren Buffett although anybody who reads it’s going to discover a form of a connection, a commonality of themes between the concepts on the weblog and the best way Buffett and his deputy method investments.

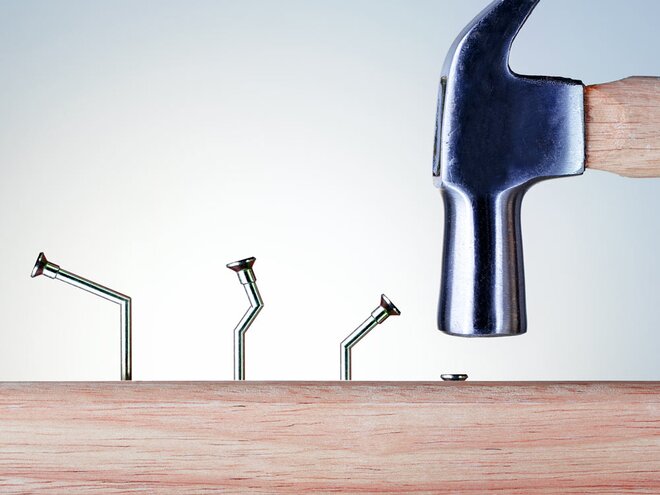

One in all such most attention-grabbing themes is that of ‘circle of competence’. On the Farnam Road weblog, there’s a fascinating story a few baseball participant named Ted Williams who the weblog says was the best hitter ever in that recreation. I do know nothing about baseball so bear with me right here. This man succeeded in hitting the ball 40 p.c of the time which is outwardly distinctive in that sport. Utilizing an attention-grabbing diagram, the article reveals the important thing to Williams’ success in what he didn’t try and hit. When it comes to the place the balls got here (roughly like line and size in cricket, so far as I could make out), he knew the place his zone of success was and tried to keep away from all the things exterior that.

This zone was his ‘circle of competence’. Exterior that, was what one may name the ‘doughnut of incompetence’, which is my phrase to explain no matter lies exterior the circle. It is good to have as massive a circle and as small a doughnut as attainable, however the vital factor is to know the place the boundary lies and keep inside it. Buffett and Munger have famously by no means dabbled a lot with expertise shares. They now have an enormous holding in Apple however invested within the inventory solely when it successfully grew to become a luxurious shopper durables firm. Traditionally, individuals have mentioned that the pair misjudged the expansion of tech.

Munger has an amusing incident to relate from the start of his profession. One of many earliest shares he purchased was from William Miller Devices, an organization whose founder had invented a greater manner of recording sound, one thing like an improved wax cylinder. He thought that it was going to take over all recording expertise and Munger thought so too. Nonetheless, another person, across the identical time, invented the magnetic tape. Tape was so superior that the corporate that Munger had invested in bought simply three devices. Your complete funding was a write-off.

The traditional response to this is able to have been to study extra about every expertise and thus predict higher. However no, that was not Munger’s conclusion. As a substitute he determined that altering applied sciences have been one thing to be averted. When you’ve got two issues to spend money on, one you perceive and the opposite you can’t, what’s the level of investing within the one you don’t? 75 years have passed by since then, however this concept of staying inside one’s ‘circle of competence’ has served Munger and Buffett effectively. As he says, “I attempt to keep away from being silly. I am not attempting to achieve my too-hard pile. The only most vital factor is to know the place you might be competent and the place you are not. The human thoughts tries to make you consider you might be smarter than you might be. Rub your nostril in your errors.”

That is a tough factor to do – rub your individual nostril in your errors, however it’s one of many secrets and techniques of success. Most of us, when our investments go improper, attempt to justify why we weren’t truly accountable, that one thing unexpected occurred.

In fact, saying that one mustn’t stray into the doughnut of incompetence is straightforward, doing it is perhaps more durable. Once we begin investing, few of us know something about something in any respect. Given the boundaries of 1’s life experiences, the circle of competence is extra like a dot. So how does one start? The plain – and really workable – reply is mutual funds, supplemented by a self-conscious effort to amass data. The assertion ‘I do not know X‘ ought to by no means be acceptable, as an alternative, it must be ‘I do not know X but’.

[ad_2]

Source link