[ad_1]

RBL Financial institution has come beneath shut scrutiny after its sudden exit of CEO Vishwavir Ahuja, and RBI sending its nominee to the board of the financial institution, on the similar time. Whereas there are rumours that there is perhaps some bother on the financial institution amid its rising NPAs (worsening mortgage ebook high quality), we do not know something concrete but and subsequently allow us to not talk about the rumours. However, allow us to check out some laborious numbers.

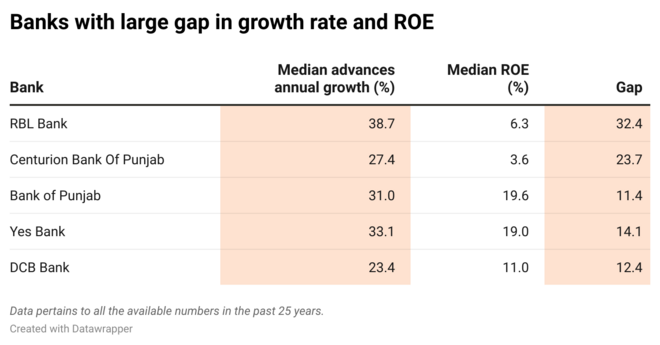

Trying on the historic progress fee and effectivity of RBL Financial institution, there are some frequent strands with such previous troubles. In a lust to develop a lot sooner, RBL has been lending at a really quick tempo. The median advances annual progress stands at round 39 per cent, because the monetary yr 2006. Nevertheless, its median ROE stood at solely 6.32 per cent. The hole between what it earns and the way a lot it grows is without doubt one of the largest in banking historical past. Another such banks had been Centurion Financial institution of Punjab (merged), Financial institution of Punjab (merged), Sure Financial institution and DCB Financial institution, as per the information historical past.

However earlier than coming to any conclusion allow us to clarify the significance of ROE (return on fairness) in a financial institution and why advances (mortgage ebook) progress ought to be checked out within the context of it.

When a financial institution lends cash, it does it from two primary sources. One, from its personal pocket and secondly from depositors, fairness buyers or different lenders. For instance, if a financial institution lends Rs 100 to debtors, it places at the least round Rs 12 (also called capital adequacy ratio in a really simplistic time period) and the remainder comes from depositors, lenders or fairness buyers.

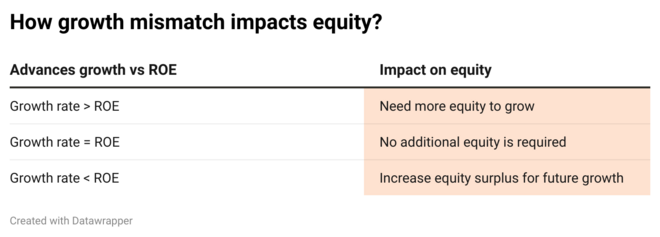

Return on fairness is the revenue earned on a base of personal fairness. If one desires to develop its lending measurement, it may do it from revenue earned from lending operations (represented by ROE). If the ROE is 15 per cent, the corporate can afford to develop its advances at round 15 per cent. What if it desires to develop extra? It must increase extra capital to develop to take care of the minimal capital adequacy ratio. This results in dilution of the prevailing shareholders. Meaning the identical price of the corporate can be unfold to extra shareholders.

Why is an excessive amount of dilution unhealthy?

Dilution is a traditional phenomenon within the lifetime of a financial institution to develop to a scale. Nevertheless, when the financial institution tries to develop method an excessive amount of than their sustainable progress fee, it results in three issues: First, massive dilution of the prevailing shareholders. Secondly, financial institution’s probabilities of making unhealthy loans go increased. Rising a lot increased than the sustainable progress fee means banks will not be geared up sufficient to evaluate mortgage high quality in a brief span of time. Third, it’s simple to cover your unhealthy loans. When advances ebook enhance at a excessive tempo, current unhealthy loans as per cent of advances look dwarf. Consequently, troubles begin brewing.

[ad_2]

Source link