[ad_1]

Santa Claus is handing out presents on Wall Road.

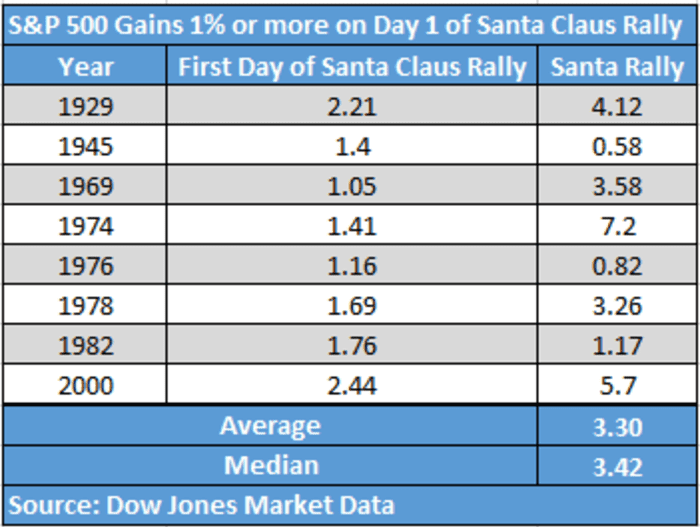

The so-called Santa Claus rally that tends to materialize within the U.S. inventory market within the remaining week of December and the primary two buying and selling periods of the brand new yr, is off to its greatest begin since 2000-01, when the market gained 5.7% over the interval, in response to Dow Jones Market Information.

Dow Jones Market Information

In actual fact, within the eight events since 1929 when the index has gained no less than 1% to begin that seven-session buying and selling interval close to the tip of yr, the Santa Claus rally has produced a achieve 100% of the time, with a mean achieve of three.3%.

On Monday, the S&P 500

SPX,

closed in report territory, up round 1.4%, with the session technically marking the beginning of the seasonal interval known as a Santa Claus rally; when positive factors maintain up, the inventory market tends to carry out nicely, the information present.

The upbeat temper to begin the ultimate week of buying and selling in 2021 was serving to to elevate the Dow Jones Industrial Common

DJIA,

and the Nasdaq Composite Index

COMP,

with even higher-risk property akin to bitcoin

BTCUSD,

being pushed upward to begin the week.

Join our Market Watch Newsletters right here.

Learn: If Santa Claus doesn’t come to Wall Road in December, the Grinch hits the inventory market in January, historical past says

How does the market carry out for the remainder of January?

January, on common, tends to finish greater, with a imply achieve of two.94% and median rise of three.7%, when the S&P 500 has began the Santa Claus rally interval with an advance of no less than 1%.

Try: Merry Christmas, Wall Road! However there’s no New 12 months’s Day vacation for the inventory market this yr—right here’s why.

The Santa Claus rally pattern was first recognized by Yale Hirsch, the founding father of the Inventory Dealer’s Almanac, which is now run by his son Jeff.

Hirsch was recognized for saying that “if Santa ought to fail to name, bears could come to Broad and Wall.”

Ryan Detrick, chief market strategist for LPL Monetary, notes that losses throughout the Santa Claus rally interval have tended to result in unfavorable outcomes for January. These embody losses throughout 1999, 2005, 2008, 2015 and 2016.

To make certain, previous efficiency is not any assure of future efficiency, and the statistical traits for the market’s efficiency submit—Santa Claus rally are pretty skinny.

MarketWatch columnist Mark Hulbert writes that even with statistics and concept on its aspect, “the Santa Claus rally doesn’t quantity to a assure.”

Ken Jimenez contributed.

[ad_2]

Source link