[ad_1]

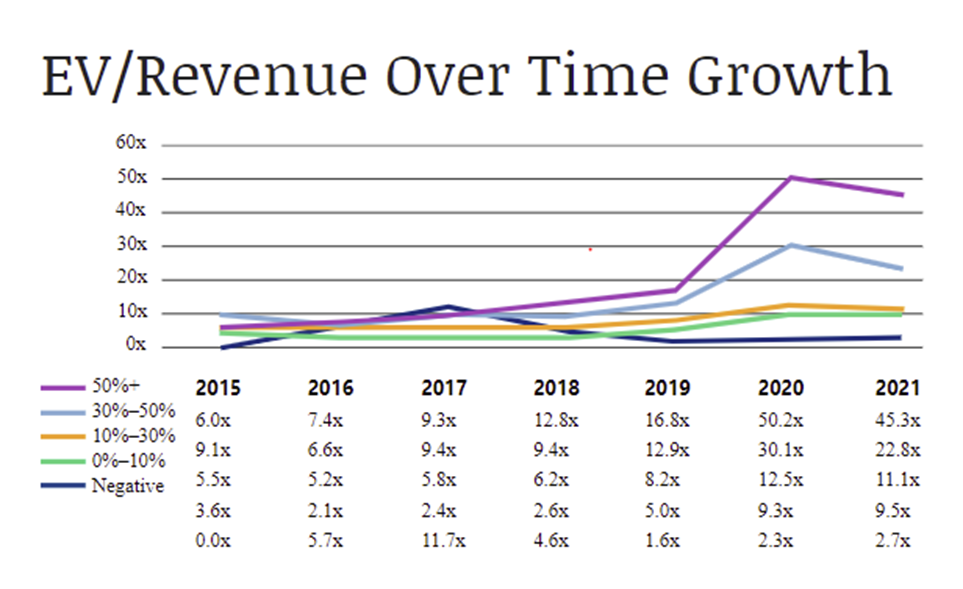

The circulate of capital in SaaS is changing into more and more bifurcated. There are the “haves” (public firms with income progress of over 30%) and the “have nots” (everybody else) of B2B software program.

The chart beneath demonstrates simply how drastically the “haves” separated themselves from the remaining. With common EV/income a number of up +28.5x for firms that grew over 50% and +9.9x for firms that grew 30%-50% since 2019, in comparison with simply +2.9x for those who grew by 10%-30%.

The actual trick is figuring out why sure firms are “haves” and the way they continue to be that method. Put in another way, what’s it about firms like Zoom, Datadog, Monday.com and Asana that drive their outsized valuations? Extra importantly, are there methods or techniques that administration groups can make use of to optimize for one of these consequence?

Development in EV/income over time. Picture Credit: OpenView Companions

Current analysis reveals that there are three key steps to changing into a “have”:

- Continued execution towards giant and rising market alternatives.

[ad_2]

Source link