[ad_1]

Indians’ love for gold is well-known. Nevertheless, it’s a important contributor to the present account deficit. Given this, the Indian authorities has provide you with Sovereign Gold Bonds, the Gold Monetisation Scheme and gold cash. Let us take a look at them, one after the other.

SOVEREIGN GOLD BOND SCHEME

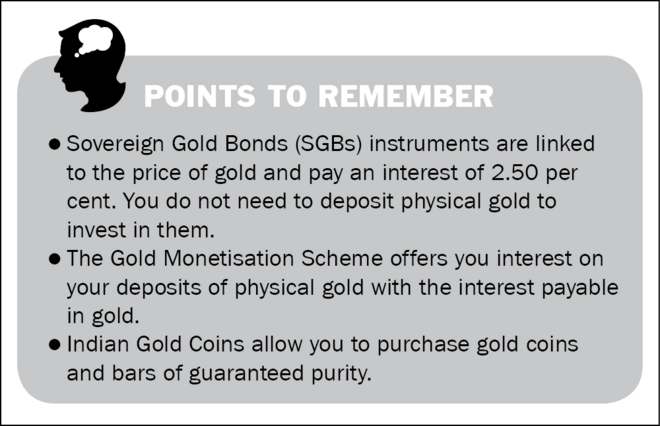

With the intent to offer gold-like returns, together with some curiosity, the federal government has launched Sovereign Gold Bond Scheme. Sovereign Gold Bonds (SGBs) are provided yearly in tranches. The primary tranche was provided in November 2015. Within the monetary yr 2021-22, six tranches of SGBs has already been notified.

Options

- Eligibility: Restricted on the market to resident Indian entities, together with people, HUFs (Hindu undivided households), trusts, universities and charitable establishments.

- Investments: Traders are required to purchase a minimal of 1 gm of gold. The utmost restrict that may be subscribed is 4 kg for a person in a monetary yr and 20 kg for different subscribers.

- Curiosity: A hard and fast price of two.50 per cent each year payable semi-annually on the preliminary worth of the funding. That is taxable.

- Tenure: The tenure of the bond is eight years, with an choice to exit from the fifth yr onwards. Capital-gains tax on maturity is exempt for people.

Funding goal and dangers

The primary goal of the Sovereign Gold Bond Scheme is to scale back the demand for gold within the bodily kind by encouraging folks to purchase it within the paper kind. The speed of curiosity is at present fastened at 2.50 per cent per yr, payable on a half- yearly foundation.

Suitability and options

- Appropriate for traders who wish to make a lump-sum funding in gold for a interval of 5 to eight years.

- Not appropriate for traders who want to purchase gold within the bodily kind.

- Options may be Gold change traded funds and Gold mutual funds.

Gold bonds are issued by the RBI on behalf of the federal government. Underneath the scheme, gold bonds are issued in multiples of 1 gm. The Scheme presents a superior various to holding gold in bodily kind. The dangers and prices of storage are eradicated. SGBs are free from points like making costs and purity. These bonds may be held in demat kind, eliminating the danger of lack of scrip.

Capital safety and inflation safety

There isn’t a capital safety in Sovereign Gold Bond Scheme. Traders get returns linked to gold costs. There’s a provision of curiosity fee. The curiosity payout is fastened and assured for the tenure of the scheme. This scheme shouldn’t be inflation protected. The value of the gold bond is linked to gold costs. If gold costs mixed with curiosity funds, outpace inflation, the bond offers constructive actual returns however not in any other case.

Ensures

The curiosity payout is fastened and assured for the tenure of the scheme. The amount of gold for which, the investor buys gold bonds is protected.

Liquidity

The scheme has a lock-in interval of 5 years. Gold bonds may be transferred, nevertheless. Additionally, when you maintain these bonds in demat kind, then you may commerce them on the inventory change anytime, even earlier than 5 years, however liquidity and value threat might exist.

Taxation

Capital-gain tax arising on the redemption of SGB (i.e. on the time of maturity after eight years) to a person has been exempted. The indexation profit will probably be supplied to LTCG arising to any particular person on the switch of bonds.

Exit possibility

The tenure of the bond is for at least eight years, with the choice to exit within the fifth, sixth or seventh yr. To redeem the gold bond, traders can method the middleman involved 30 days earlier than the coupon fee date. Request for untimely redemption can solely be entertained if the investor approaches the middleman at the very least at some point earlier than the coupon-payment date. Redemption proceeds are credited to the client’s checking account. On maturity, the investor will get the equal rupee worth of the quantum of gold invested.

The place and the way to purchase

Gold bonds may be purchased by banks, put up places of work and the Inventory Holding Company of India. They’re obtainable each in demat and paper varieties. Know-your-customer (KYC) norms are the identical as these for the acquisition of bodily gold.

GOLD MONETISATION SCHEME

The Gold Monetisation Scheme lets you earn curiosity on the gold you personal. It additionally saves the storage price for gold. To realize profit from the scheme, you have to deposit gold in any bodily kind, jewelry, cash or bars. This gold will then earn curiosity based mostly on its weight. You get again your gold within the equal of 995 fineness gold or Indian rupees, as you need (this feature is to be exercised on the time of deposit).

The deposited gold is lent by banks to jewelers at an curiosity that could be a little increased than the curiosity paid to the client. The minimal amount of deposits is pegged at 30 gm to encourage even small deposits.

Options

- Eligibility: Restricted on the market to resident Indian entities, together with people, HUFs (Hindu undivided households), trusts, universities and charitable establishments.

- Tenure: One to a few years; 5 to seven years; twelve-fifteen years.

- Minimal deposit: 30 gram (any kind – bullion or jewelry).

- Curiosity and taxation: Curiosity paid in gold or rupee phrases as per the financial institution scheme. Totally tax exempt, no capital features.

Tenure

The designated banks settle for short-term (one to a few years) financial institution deposits, in addition to medium (5 to seven years) and long- time period (twelve to fifteen years) authorities deposits. Untimely withdrawal is allowed with a penalty topic to a minimal lock-in interval which differs from financial institution to financial institution.

How one can open an account

You want to first go to a set and purity-testing centre to determine the purity of your gold. You’ll be able to deposit your gold if it clears the criterion set for gold content material. You’ll be supplied with a certificates of purity and gold content material. You have to to current the certificates to the financial institution the place you wish to open the account. Do not forget that for the reason that gold that you simply deposit will probably be melted, you will not get again the gold in the identical kind as you had deposited.

Taxation

The earnings from the scheme are exempt from capital-gains tax, wealth tax and revenue tax.

Redemption

You’ll be able to take money or gold on redemption, however the choice needs to be said on the time of deposit.

Curiosity

Curiosity to be paid to the depositors of gold may be valued in gold or denominated in INR as per the financial institution’s scheme. For instance, whether it is paid in gold and a buyer deposits 100 gm of gold and will get 1 per cent curiosity, then, on maturity, he has a credit score of 101 gm. However, whether it is paid in rupee kind, will probably be calculated on the worth of gold prevailing on the date of creation of deposit. The rate of interest is determined by the banks involved.

INDIAN GOLD COIN

The Indian Gold Coin is a part of the Indian Gold monetisation program. The federal government has launched the Indian gold coin, with the Ashoka Chakra on one facet and Mahatma Gandhi’s image on the opposite. It’s the solely BIS hallmarked coin in India. The coin is accessible in denominations of 5 gm and 10 gm. Not too long ago, the federal government has allowed minting of Indian Gold Coin in smaller denominations of 1 gm and a pair of gm additionally. Gold bars/bullion of 20 grams are additionally obtainable. The Indian Gold Coin has superior security measures and tamper-proof packaging.

Options

- Purity: 24-carat purity and 999 fineness. As per the brand new guidelines, will probably be made obtainable in 24-carat purity of 995 fineness additionally.

- Availability: Distributed by designated and recognised MMTC shops, jewellers, banks and put up workplace.

[ad_2]

Source link