[ad_1]

The FIRE (monetary independence/retire early) motion has obtained fairly well-known for the final couple of years in India. Each investor I meet lately desires to realize FIRE asap. I wish to talk about some necessary factors associated to FIRE motion and kinds of FIRE in the present day with you all.

What’s FIRE?

FIRE or Monetary independence retire early is all about creating sufficient wealth for your self as early as doable, so that you’re financially unbiased and free from worries of cash. When you obtain FIRE, your wealth is sufficient to generate an inflation-adjusted earnings for you which ones lasts your lifetime

Let me offer you an instance.

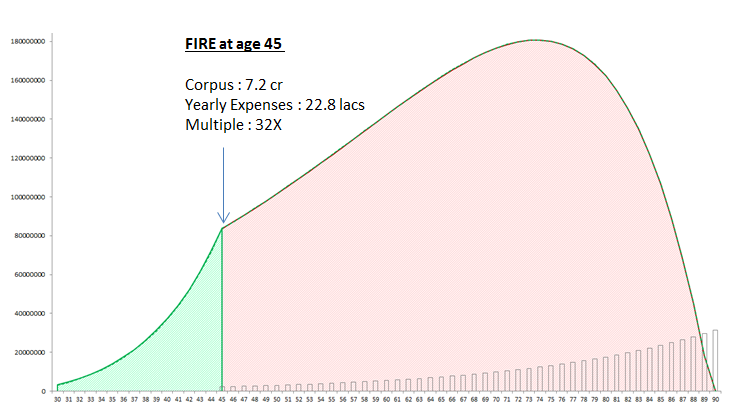

Think about a 30 yr outdated particular person with the month-to-month bills of 75,000 per 30 days (or 9 lacs a yr) who has 18 lacs of present corpus and is able to now aggressively make investments Rs 80,000 per 30 days for the subsequent 15 yrs and can enhance the SIP by 8% annually. The investments progress will occur at 12% and the inflation assumed is 7% (pre-retirement) and 6% post-retirement together with post-retirement returns of seven%

Under is how his corpus will develop and attain a degree at age 45 (in 15 yrs time). He’ll obtain FIRE on the age of 45 with a corpus of seven.2 crores. At the moment his bills could be round 22.8 lacs approx. And his corpus might be round 32X (32 occasions his bills). His graph would appear like this.

Word that the above graph is predicated on the tough calculations and assuming that each one different targets are taken care of individually.

Do you cease working if you obtain FIRE?

Truly NO

It’s your selection if you wish to work after FIRE or not. You possibly can cease working if you want, however if you happen to nonetheless need to work, you may & any cash you earn might be a cherry on the highest and can solely add as much as your FIRE objective.

Prime 3 explanation why individuals need to obtain FIRE?

- It’s getting harder and harder to be employed until 60 lately, and therefore individuals don’t need to rely on the truth that they’ll hold incomes for a really very long time

- When you obtain FIRE, life is much less hectic and also you get energy in you to reside life in your phrases. Folks need to create a state of affairs the place they don’t have to bounce to the tune of their managers and employers

- Folks additionally need to get out of hectic and demanding jobs by the point they hit a mid-life disaster and which means shifting to a job that’s extra satisfying, even when it pays little or no. That is doable solely when you could have already created sufficient wealth

However, FIRE is hard!!

Is it very straightforward to realize FIRE?

NO, is the reply

Neglect FIRE, even regular retirement at 60 just isn’t doable for many individuals in India. We are able to clearly see {that a} huge variety of traders could have a nasty retirement as a result of they don’t seem to be residing their monetary lives in the appropriate means and should not on the trail to creating ample wealth.

FIRE in that sense will solely be achieved by a small minority.

Our staff has labored with tons of of traders within the final a few years and listed here are a few of my feedback on attaining FIRE

- The general public who obtain FIRE try this not due to implausible returns, however very aggressive saving and deploying that cash in significant investments.

- When you hold your bills in examine and hold it on the decrease aspect, it merely signifies that it turns into simpler so that you can obtain FIRE as a result of FIRE is not only about wealth, however each wealth and your bills

- The general public who obtain FIRE are those that earn fairly nicely. When you earn 4 lacs a month and your bills are 50k per 30 days, You’re incomes 8 occasions of bills each month. That helps so much

- The general public who should not capable of management their way of life and hold upgrading their life discover it robust to realize FIRE regardless of having good wealth because the objective submit retains shifting.

In easy phrases, if you wish to understand how does an individual who achieves FIRE appears like, its like this

- The particular person has an excellent earnings

- The particular person saved a really huge portion of that earnings (typically greater than 60-70%)

- The particular person just isn’t extravagant and principally lives a frugal and easy life (however not compromising on enjoyable and wishes)

- The particular person makes smart funding selections (typically incomes at the least greater than inflation)

- The particular person has principally created liquid belongings and never blocked his cash, as a result of you could generate money move on the finish

- The particular person is kind of assured of managing the cash submit FIRE and incomes respectable returns (he gained’t hold all cash in FD)

So what are varied kinds of FIRE?

Let me now discuss varied kinds of FIRE. You possibly can choose which kind of FIRE you need to work on and you’re going to get some concepts

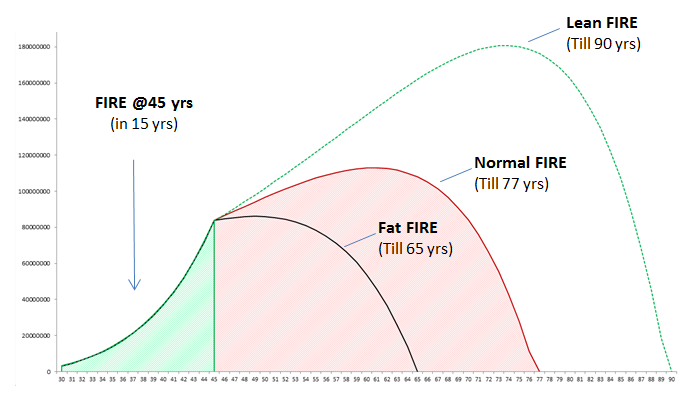

Regular FIRE

Regular FIRE is if you need to create sufficient wealth which may maintain your present way of life and wishes for all of your life. Word the phrase “Present way of life”, which signifies that going ahead your bills, your holidays, your spendings, your outings, your wishes might be maintained at roughly the identical degree. This I believe is the default mindset and one thing which most individuals will prefer to pursue.

A really high-level thumb rule says that if a forty five yr outdated has achieved approx 35X corpus (35 occasions of their yearly bills), you could have achieved regular FIRE

Lean FIRE

Lean FIRE is an idea the place you’re able to compromise in your bills and way of life, and able to reside decrease bills. Plenty of occasions it will not be doable for an individual to realize regular FIRE. By which case you may say – “I’m able to reside with simply 75% of my present bills, however I need to FIRE quicker.. I can’t wait”.

This is sort of a little compromised model of regular FIRE.. however hey, it’s nonetheless some sort of FIRE!

A really high-level thumb rule says that if a forty five yr outdated has achieved approx 25-28X corpus (25 occasions of their yearly bills), you could have achieved Lean FIRE (Dwelling with 75-80% of your bills)

Fats FIRE

Fats FIRE is precisely the other of Lean FIRE, right here you need to spend your life like a king and need to need to freely spend cash after FIRE. You don’t need to prohibit your self and take costly holidays and so on. By which case clearly, you want a a lot larger corpus to final all of your life.

A really high-level thumb rule says that if a forty five yr outdated has achieved approx 45-50X corpus (25 occasions of their yearly bills), you could have achieved Lean FIRE (Dwelling with 125-140% of your bills)

What’s COAST FIRE?

There may be yet another idea referred to as Coast FIRE, which is one thing a lot of you’ll have already achieved.

An individual is alleged to have achieved Coast FIRE when he/she has sufficient corpus already which is able to develop to FIRE corpus sooner or later with out the necessity for any new investments. This merely means reaching a degree, the place you simply need to earn cash equal to your month-to-month necessities and anticipate 5-10-15 yrs to realize the precise FIRE

Instance of Coast FIRE

Let’s say a 30 yrs outdated particular person is incomes Rs 2 lacs a month. As a way to obtain FIRE at age 50, he has to create a corpus of Rs. 6crore. The particular person aggressively invests his 60% earnings (ie Rs 1.2 lacs) and begins his wealth creation journey.. Within the subsequent 10 yrs, when he turns 40 yrs outdated he has already created a corpus of two.5 crores.

At this level, his earnings is let say 4 lacs a month and he’s nonetheless saving 2 lacs out of that (his bills are 2 lacs a month). Nonetheless now, if he desires to achieve his authentic goal of 6 crores within the subsequent 10 yrs, he doesn’t have to put in any new investments. His 2.5 crores will in any case develop to six crores in 10 yrs @10% returns.

So his path and pace is already set in such a means that he can attain his goal with out placing in any additional effort. If he desires, at this stage of life, he doesn’t have to create an earnings of 4 lacs.. If he desires he can transfer to a different low-stress job or one thing else which he needs which pays much less. All he wants is to create an earnings that may maintain his bills for an additional 10 yrs and let his current corpus develop with out touching.

I’m positive a lot of you who’re studying this have already achieved Coast FIRE in your life and you’re unaware of it. Attempt to do the calculations

Which class of FIRE you Are Pursuing?

So, which class of FIRE are you pursuing?

I can’t touch upon which class of FIRE is best for you as a result of solely you may outline how sort of life you need to pursue going ahead. What cash means for you and what degree of consolation you need, nevertheless, I believe Lean FIRE just isn’t for everybody. Lean FIRE is definitely some degree of compromise and there may be nearly no margin of security there. If a couple of issues go fallacious, your FIRE objective can go for a toss.

Therefore I believe one shall goal regular FIRE because it’s extra life like and sensible. Nonetheless having mentioned that, one shall attempt to first attain Lean FIRE and goal regular FIRE 5-6 yrs after that.

If you’re fairly fortunate and have sufficient curiosity left to earn and make investments extra money, you may attempt shifting in direction of Fats FIRE too..

Vital Disclaimer

FIRE is an idea and primarily based on mathematical calculations. A small distinction in inflation or returns assumption can change the goal quantity or goal yr by an enormous margin, therefore have a look at the discussions above as simply an instance. You want fairly a superb degree of calculations and discussions with a superb monetary planner to mission your calculations. Additionally, these are all sophisticated matters in actuality, however for dialogue’s sake, these factors look easy.

To offer you a easy instance, in case your calculation says that you just achieved FIRE and your cash will final until age 90 yrs. It’s extra of simply arithmetic. Now if you happen to enhance the inflation by 1% and reduce the return by 1%, this may increasingly inform you that now your cash will final solely until 73 yrs (a discount of 17 yrs) which tells you that these calculations are very dynamic and delicate to assumptions.

So please take precautions which doing any sort of calculations. This dialogue above is only for fundamental data.

I might like to know what you are feeling about FIRE and what are your ideas about it?

[ad_2]

Source link