[ad_1]

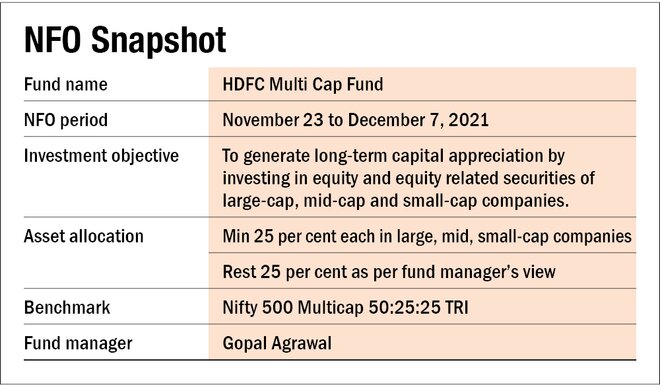

HDFC Mutual Fund lately launched a multi-cap fund. The fund will make investments throughout the large-, mid- and small-cap corporations. The scheme will shut for subscription on December 7, 2021 and will probably be managed by Gopal Agrawal. It will likely be benchmarked in opposition to the Nifty 500 Multicap 50:25:25 TRI.

In line with the AMC’s NFO presentation, the fund will observe a mixture of top-down and bottom-up method to inventory choice as a part of its funding technique. Additionally, the fund will make investments with no type bias and purpose to seize alternatives throughout worth, development, and turnaround corporations.

Commenting on HDFC Multi Cap Fund, Gopal Agrawal, supervisor of the fund, mentioned, “We now have noticed that totally different market cap segments carry out otherwise at totally different time limits. HDFC Multi Cap Fund is a one-stop resolution for traders searching for publicity to totally different market caps, by means of one fund in a disciplined method, to realize higher risk-adjusted returns. We imagine that long-term fundamentals, efficient diversification and inventory choice are vital in a always altering setting. Going ahead, the structural development drivers and supportive exterior setting bode effectively for India’s secular development story. Additional, sturdy earnings development outlook and beneficial macroeconomic setting bode effectively for equities over medium to long run.”

In regards to the technique

The multi-cap class is a reasonably new one created by SEBI in September 2020. As of October 2021, this class has about 12 funds managing property price over Rs 32,000 crore.

Mandated to speculate at the least 25 per cent of their cash every in large-, mid- and small-cap shares, these funds are comparatively just like their flexi-cap counterparts when it comes to investing throughout market caps. Nonetheless, the latter does not have any restrictions relating to the minimal allocation that should be made to any market-cap section. Thus, these funds get pleasure from a higher diploma of flexibility and exactly that’s the reason at Worth Analysis, we desire flexi-cap funds over multi-cap ones.

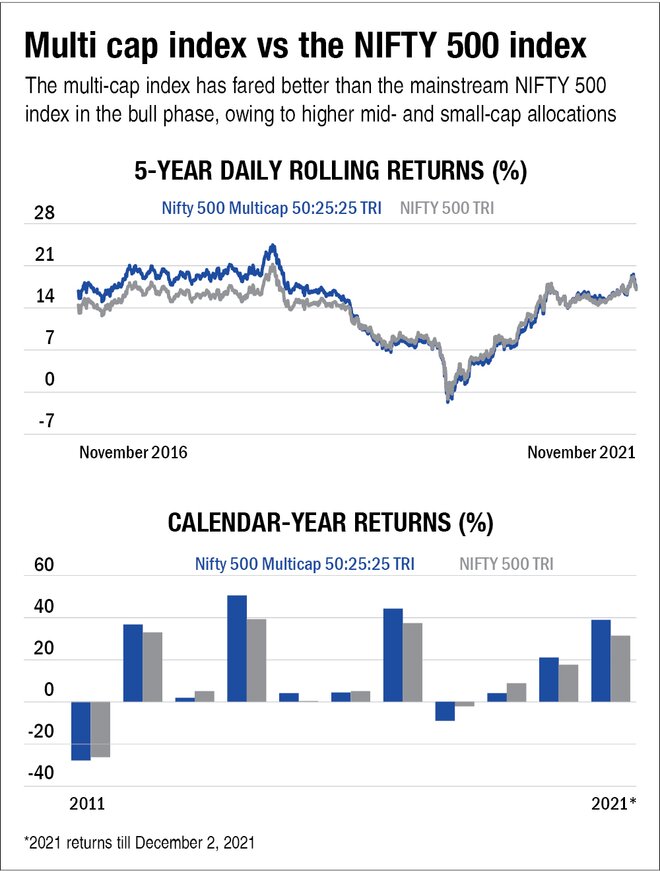

Typically talking, most flexi-cap funds are likely to have a decrease allocation to mid- and small-cap shares than that of multi-cap funds. Owing to this issue, the latter tends to be a bit extra aggressive in relative phrases.

The efficiency historical past of multi-cap funds may be very quick, as the present avatar of the class got here into being nearly a 12 months in the past. However a comparability between the efficiency of the multi-cap index (NIFTY 500 Multicap 50:25:25 TRI) and the extra mainstream Nifty 500 TRI reveals that the previous was an outperformer on a five-year rolling return foundation until concerning the center of 2019, due to its increased mid- and small-cap allocation. Of late, although, each have been neck and neck. However this efficiency has additionally come at the price of excessive volatility and larger drawdowns in the course of the down markets, which once more reveals the upper mid- and small-cap publicity of the multi-cap technique.

In regards to the fund supervisor

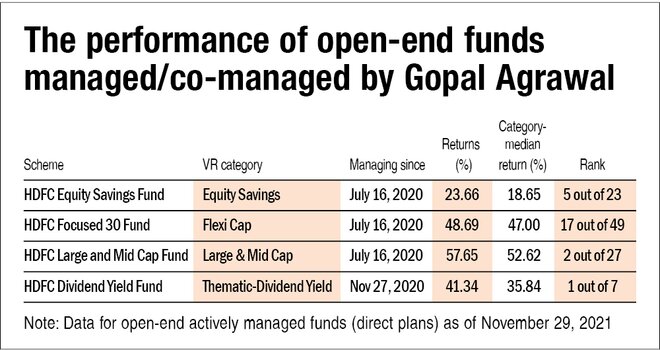

Gopal Agrawal, senior fund supervisor at HDFC AMC Ltd., has over 16 years of expertise in fund administration and a pair of years in fairness analysis. Previous to becoming a member of HDFC Asset Administration Firm Restricted, he has labored with DSP Funding Managers Personal Restricted, TATA Asset Administration Firm Restricted and Mirae Asset World Investments (India) Pvt. Ltd.

He’s at present managing HDFC’s targeted 30, massive and mid cap and dividend yield fund and co-managing the fairness financial savings fund. Though it is solely been about one-and-a-half years since he took over the reins, his general efficiency throughout funds to date has been fairly good. The desk under offers a glimpse since he began managing/co-managing these funds.

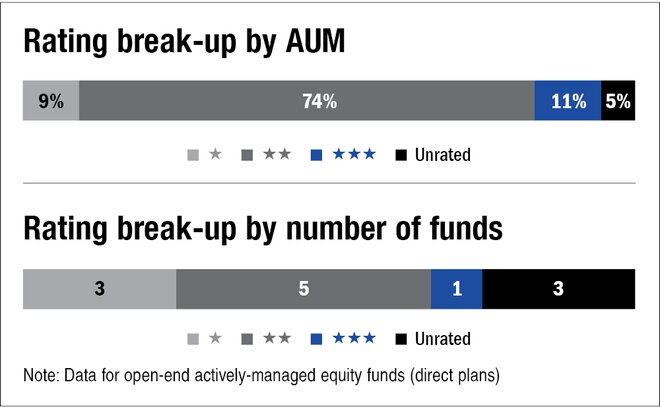

In regards to the AMC

HDFC AMC Ltd. has a diversified asset class combine throughout fairness, fastened revenue and hybrid funds. As of October 2021, it ranks third within the trade, managing a complete of Rs 4.39 lakh crore of traders’ cash throughout 45 open-end fairness, debt and hybrid schemes. Of this, Rs 1.20 lakh crore is in 12 open-end actively-managed fairness funds. Listed here are Worth Analysis’s star scores on the AMC’s open-end fairness funds.

[ad_2]

Source link