[ad_1]

Each time any investor is requested questions on their investing, they have a tendency to focus completely on what they’ve invested in. That appears like fairly the pure factor to do, and I personally do it on a regular basis. Is not that the query, you would possibly ask? If I am requested about my investing; naturally, I’ll reply with what I’ve invested in.

Truly, after I rigorously study my private investments, I realise that there’s a way more helpful and fascinating reply to the query: why I did what I did, and the way I went about doing it. In the event you actually wish to learn about my investing course of, then only a checklist of what I’m invested in would not lower it. The journey I undertook, the route I selected and why I selected it are simply as necessary because the vacation spot I reached.

The rationale it is necessary is that the way you do one thing is definitely extra necessary than what you do. As an instance that I advised you that I maintain Rs 1 crore value of X fairness mutual fund and that that is about 20 per cent of my complete monetary property. That is advantageous, you say, and set off to emulate that. You too go off, liquidate some investments and put 20 per cent of your monetary asset base into fairness fund X. You and I are actually at par so far as this fund is worried, proper?

Clearly not. Once I advised you that I had Rs 1 crore in fund X, I might have invested all of it two days earlier than that or it might have been constructed up over 10 years with month-to-month SIPs or it might have been invested a very long time in the past after which simply left alone. I may very well be planning to carry it for a lot of extra years, or I’ll have already filed for a redemption. How I acquired to the present state of affairs, why I made a decision to take action and the place I am going – all these are way more necessary and helpful items of knowledge than simply the place I stand at the moment.

What vs why and the way

We are inclined to really feel that what issues extra is what you will do, and never how you will do it. In my expertise, the reality may be very totally different. There aren’t any good concepts which can be secret. The fundamentals of investing success: diversification, asset allocation, value averaging, specializing in fundamentals, and so on., can be found to everybody. Furthermore, it is also accessible simply and at both zero or very low value. There aren’t any boundaries to concepts. You possibly can have all the nice concepts in investing, delivered to the machine in your pocket at any second that you just select.

And but, similar to in enterprise, and similar to in lots of different features of life, it is the execution that issues. Some buyers appear to select up the good concepts and simply run with them and succeed however many don’t. Nevertheless, the issue is definitely just a little bit deeper than enterprise. In contrast to enterprise, this isn’t about competence, however relatively what the principle exercise of your life is. In any case, investing will not be the principle enterprise of your life. You can not spend all of your time studying the nitty gritty of the particular implementation of the perfect concepts. In contrast to enterprise, you can not even rent somebody skilled to handle issues for you…or are you able to?

It seems which you could, and that’s what you’re right here with Worth Analysis. And the way are we going to try this? That is the place Worth Analysis Premium is available in. It is a course of that has 4 elements to it:

- Present a means so that you can articulate your objectives clearly.

- Recommend a set of investments and a sample of investments for these objectives.

- Confirm that your current investments match the objectives, and counsel modifications if they don’t.

- Constantly monitor your investments to verify they’re heading on your objectives; counsel modifications if any are required.

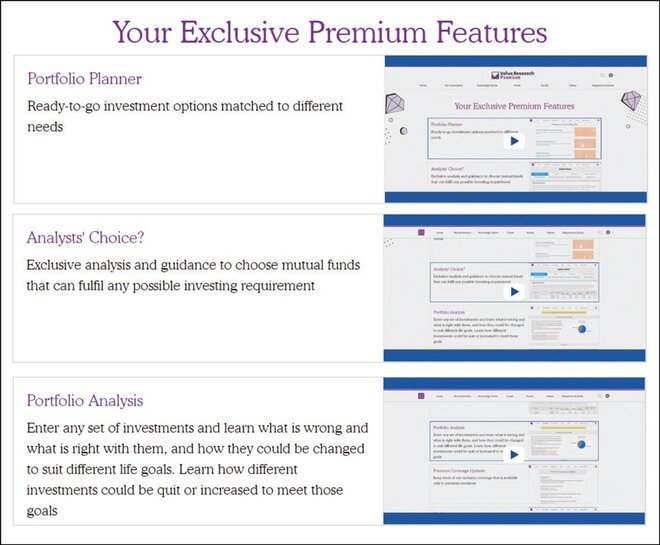

All these could be applied by options that we’ve got built-in into Premium. Here is an outline of these which immediately work in direction of assembly your monetary objectives:

Portfolio Planner: These are customized portfolios which can be urged to you as a part of your Premium membership. The algorithm that we’ve got developed takes into consideration your objectives, your earnings, your saving capability and quite a lot of different elements.

Analyst’s Alternative: Usually, buyers wish to select their very own funds for some explicit funding goal. There are about 1,600 accessible to you and even with the assistance of our score system, it is a variety of work to zoom in to the correct set. Nevertheless, that will not be an issue for you as a result of as a Premium member, you’ll have entry to Analyst’s Alternative. As an alternative of the 37 official forms of funds, we’ve got created eight investor-oriented classes which match exactly with precise monetary objectives that you’ve got. In every of those, my staff of analysts and I’ve rigorously chosen a handful of funds that may serve you with the perfect outcomes.

Portfolio Evaluation: Only some members are beginning their investing from scratch. For many of you, an enormous query is whether or not your current investments match into your objectives? That is typically a tough query to reply as a result of there are a variety of implications of switching outdated investments, not the least of which is taxation. Within the Premium system, you may get an analysis and a urged fix-list based mostly on our knowledgeable groups’ inputs.

And much more

In fact, these are simply headline options. There are much more that may assist you to maintain observe of your investments, returns, diversification, taxation and virtually every thing else that may assist you to obtain your monetary objectives. Check out Worth Analysis Premium for the complete particulars.

[ad_2]

Source link