[ad_1]

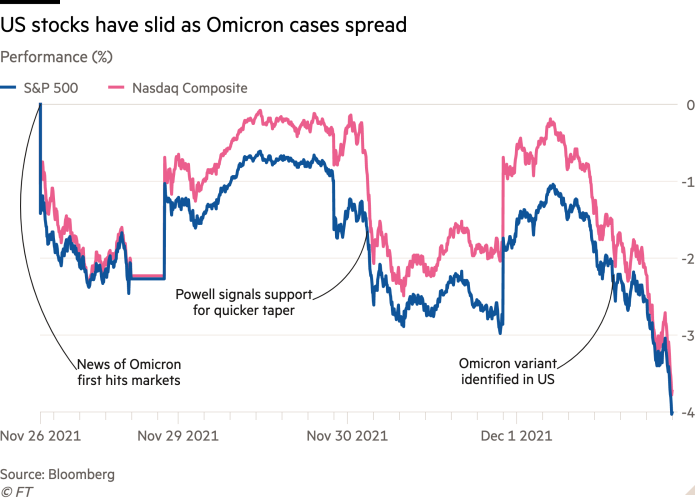

US equities and oil costs slid on Wednesday as considerations concerning the Omicron coronavirus variant and hawkish feedback from the Federal Reserve chair weighed on world monetary markets.

Wall Avenue’s S&P 500 fairness gauge closed 1.2 per cent decrease in New York, erasing a acquire of 1.9 per cent earlier within the session. The decline marked the benchmark’s largest intraday swing since March and adopted a punishing session on Tuesday, which left the index virtually 2 per cent decrease.

The technology-focused Nasdaq slipped 1.8 per cent, with losses accelerating simply earlier than the shut.

Buyers raced to hedge themselves as markets lurched decrease, with buying and selling volumes of put choices — derivatives that supply safety if the worth of a safety declines — hitting the best degree in 17 months, based on Bloomberg information. The surge in purchases of places accompanies the worst two-day sell-off within the S&P 500 since October 2020.

In Asia, markets had been blended following the sell-off on Wall Avenue, with Japan’s benchmark Topix index down 0.4 per cent and Hong Kong’s Cling Seng up 0.3 per cent. Brent crude, the worldwide benchmark, rose virtually 1 per cent to $69.51 a barrel in Asia buying and selling, as buyers anticipated the results of the Opec+ assembly of the producer group and its allies this week.

The knock to shares got here on information that the primary Omicron variant had been recognized in a vaccinated particular person in California, in addition to figures that confirmed one other surge of coronavirus instances in South Africa.

On high of Omicron fears, buyers continued to weigh feedback from Jay Powell, Fed chair, who this week instructed Congress that the chance of upper inflation had elevated. He has additionally signalled his help for a faster discount of stimulus measures the US central financial institution had put in place on the onset of the pandemic. That stimulus has been central to the inventory market’s restoration since early 2020.

However Powell additionally characterised the economic system as “very robust” forward of jobs information on Friday that economists polled by Reuters anticipate to point out American employers added greater than half one million new hires final month.

“Markets clearly bought fairly involved concerning the emergence of Omicron however we stay in uncharted territory, nobody actually is aware of,” mentioned Aneeka Gupta, analysis director at ETF supplier WisdomTree. “Powell’s vote of confidence within the economic system has helped to deliver again some threat urge for food.”

Kasper Elmgreen, head of equities on the European fund supervisor Amundi, warned that such confidence would stay fragile as markets swung between optimism about financial development and the “humbling reminder that the pandemic stays with us”.

Market measures of volatility continued to rise on Wednesday, with the Cboe’s Vix index rising above 30 for the primary time since March. That’s above its long-run common of 20 and a sign of the uneven strikes in markets.

Markets, Elmgreen added, “may keep on this tug of struggle for a while, as actually there isn’t a clear path”.

The chief government of the vaccine maker Moderna predicted in an interview with the Monetary Instances on Tuesday that present jabs can be a lot much less efficient at tackling Omicron than earlier strains of coronavirus. Later, the College of Oxford and BioNTech predicted that presently obtainable vaccines would proceed to stop extreme illness.

In authorities debt markets, the yield on the benchmark 10-year US Treasury word declined 0.02 share factors on the day to 1.42 per cent. The 30-year yield, which strikes with development and inflation expectations, late within the day fell to 1.75 per cent, its lowest degree since January.

The 2-year Treasury yield, which carefully tracks rate of interest expectations fell 0.01 share level to 0.56 per cent.

The Stoxx 600 index ended the European session up 1.7 per cent, marking its strongest closing efficiency in virtually seven months, with broad-based good points on Wednesday led by tech firms, oil producers and banks amongst different sectors.

Unhedged — Markets, finance and robust opinion

Robert Armstrong dissects an important market tendencies and discusses how Wall Avenue’s greatest minds reply to them. Enroll right here to get the publication despatched straight to your inbox each weekday

[ad_2]

Source link