[ad_1]

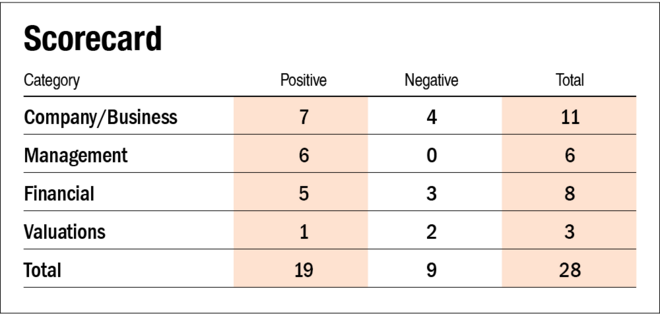

In our story, Tega Industries IPO: Data evaluation, we make clear the important thing particulars of the IPO, together with necessary details about the corporate. Right here we’ll reply some questions on Tega Industries and consider it on parameters like administration, financials, valuations, and so forth.

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

Sure. In FY21, the corporate’s earnings earlier than tax stood at Rs 181.2 crore.

2) Will the corporate have the ability to scale up its enterprise?

Sure. Its total capability utilisation for FY21 was round 58 per cent, leaving numerous room for progress. A rise in demand as a result of declining ore grades, coupled with the corporate’s plan to extend its penetration and market share by means of its direct gross sales mannequin and powerful analysis and improvement capabilities, would assist it sooner or later.

3) Does the corporate have recognisable manufacturers really valued by its clients?

No. The corporate is concerned within the B2B provide of mill consumables.

4) Does the corporate have excessive repeat buyer utilization?

Sure. Its income from repeat orders of gross sales as a share of the gross sales of services and products averaged 76.5 per cent throughout FY19-21.

5) Does the corporate have a reputable moat?

No. Whereas the corporate operates in a market construction that’s dominated by a handful of firms, the corporate would not appear to have a reputable moat.

6) Is the corporate sufficiently strong to main regulatory or geopolitical dangers?

Sure. The corporate is sufficiently strong to main regulatory or geopolitical dangers.

7) Is the enterprise of the corporate immune from simple replication by new gamers?

Sure. The business presents vital entry boundaries within the types of capital depth, buyer validation and approvals, expectation from clients with regard to product innovation, high-quality requirements and stringent specs. Furthermore, mineral-processing websites don’t have a tendency to modify to cheaper suppliers instantly, owing to excessive switching prices.

8) Is the corporate’s product capable of stand up to being simply substituted or outdated?

Sure. The corporate’s merchandise play a crucial function in any mines’ processing operations.

9) Are the purchasers of the corporate devoid of great bargaining energy?

Sure. The shoppers of the corporate are devoid of great bargaining energy, because the merchandise, as a result of their crucial nature, have excessive switching prices. The corporate is ready to make long-term contracts and go the rise in enter prices to the client.

10) Are the suppliers of the corporate devoid of great bargaining energy?

No. The corporate’s predominant uncooked materials is rubber of various sorts. As the corporate depends on a number of key suppliers for its uncooked supplies, the corporate is a worth taker.

11) Is the extent of competitors the corporate faces comparatively low?

No. The corporate faces competitors in India in addition to abroad. The business is dominated by a number of gamers globally. As an illustration, within the mill-liner product phase, the highest 5 gamers accounted for 49 per cent of the market within the calendar yr 2020. Furthermore, Tega Industries compete with world gamers which are bigger enterprises with larger monetary sources.

Administration

12) Do any of the corporate’s founders nonetheless maintain at the least a 5 per cent stake within the firm? Or do promoters maintain greater than a 25 per cent stake within the firm?

Sure. Publish-IPO, the promoter and promoter group will maintain a couple of 79.2 per cent stake within the firm.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure. Chairman and government director Madan Mohan Mohanka (one of many promoters) has been related to the corporate since its incorporation in 1976.

14) Is the administration reliable? Is it clear in its disclosures, that are according to SEBI tips?

Sure, now we have no motive to consider in any other case.

15) Is the corporate freed from litigation in court docket or with the regulator that casts doubts on the administration’s intention?

Sure, the corporate is free from any materials litigation.

16) Is the corporate’s accounting coverage secure?

Sure. As per the auditors’ report, the accounting coverage is secure.

17) Is the corporate freed from promoter pledging of its shares?

Sure. The corporate’s shares are freed from any pledging.

Financials

18) Did the corporate generate a present and three-year common return on fairness of greater than 15 per cent and return on capital employed of greater than 18 per cent?

No, the corporate managed to generate a three-year (FY19-21) common return on fairness of 14.8 per cent and a return on capital employed of 15.7 per cent. For FY21, the corporate generated a return on fairness of twenty-two.2 per cent and a return on capital employed of 24.8 per cent.

19) Was the corporate’s working money circulation constructive over the last three years?

Sure, the corporate has reported constructive working money circulation over the last three years.

20) Did the corporate enhance its income by 10 per cent CAGR within the final three years?

Sure. The corporate’s income elevated from Rs 633.8 crore in FY19 to Rs 805.5 crore in FY21 at a CAGR of 12.7 per cent.

21) Is the corporate’s internet debt-to-equity ratio lower than one or is its interest-coverage ratio greater than two?

Sure. The corporate’s internet debt-to-equity ratio stood at 0.19 as on June 30, 2021 and its interest-coverage ratio was 10.75 for FY21.

22) Is the corporate free from reliance on big working capital for day-to-day affairs?

No. A big quantity of working capital is required to buy supplies and manufacture the completed merchandise earlier than the cost is acquired from clients. The corporate had a working-capital cycle of 120 days in FY21.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

No. The corporate plans to broaden its manufacturing capability in India and abroad and discover inorganic progress alternatives. These are extremely capital-intensive actions and subsequently, the corporate could need to depend on exterior funding.

24) Have the corporate’s short-term borrowings remained secure or declined (not elevated by larger than 15 per cent)?

Sure. Quick-term borrowings decreased from Rs 153 crore in FY19 to Rs 103 crore on June 30, 2021.

25) Is the corporate free from significant contingent liabilities?

Sure, the corporate doesn’t have any significant contingent liabilities.

Inventory/valuations

26) Does the inventory provide an operating-earnings yield of greater than 8 per cent on its enterprise worth?

No, the inventory will solely provide an operating-earnings yield of 4.7 per cent on its enterprise worth.

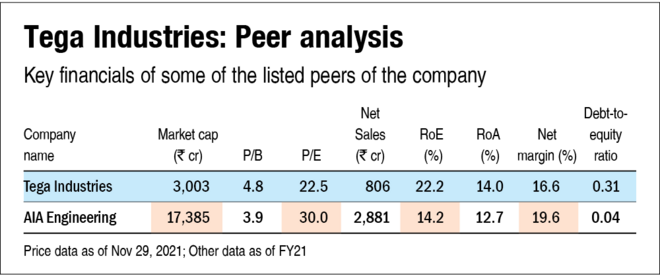

27) Is the inventory’s price-to-earnings lower than its friends’ median stage?

Sure. There is just one listed peer. Publish-IPO, the corporate’s inventory will commerce at a P/E of round 22.5, which is lower than its peer’s P/E of 30.0.

28) Is the inventory’s price-to-book worth lower than its friends’ common stage?

No. There is just one listed peer. Publish-IPO, the corporate’s inventory will commerce at a P/B of round 4.8, which is lower than its peer’s P/B of three.9.

Additionally examine Tega Industries IPO: Data evaluation to study key IPO particulars and necessary details about the corporate.

Disclaimer: The authors could also be an applicant on this Preliminary Public Providing

[ad_2]

Source link