[ad_1]

A brand new research claims that Amazon makes way more from charges on its Market platform than even the money cow referred to as AWS. The report says that Amazon’s charges for taking part successfully on its retailer have grown to the purpose the place sellers now give the corporate about 34% of their earnings — and this has currently turn into Amazon’s major income stream. The corporate disputes the report’s findings.

The report, “Amazon’s Toll Street,” by the Institute for Native Self-Reliance, makes two major claims. First, the ILSR’s researchers say that in 2021 Amazon will herald some $121 billion from sellers within the type of charges and promoting funds, about 34% of these sellers’ complete income. That’s twice the estimated $60 billion from 2019, which on the time was 31% of vendor income, in keeping with the report.

Founder Jeff Bezos himself tried to counter this narrative when he instructed Congress that the growing sum of money going from sellers to Amazon is one thing of an optical phantasm, because of extra of them selecting to pay for add-on providers like higher placement on key phrase searches and utilizing Amazon’s personal delivery and warehouse infrastructure.

In an announcement to TechCrunch, Amazon referred to as the ILSR report “inaccurate,” saying it “conflates Amazon’s promoting charges with our non-compulsory add-on providers” and that its promoting charges are aggressive with different on-line retailers — and positively the report does mix these numbers.

However as its writer, Stacy Mitchell, factors out, the add-ons have gone from non-compulsory to must-have as Amazon has given benefit after benefit to sellers that use them. Experiences over the previous few years present that the variety of advertisements and sponsored listings on frequent product searches have elevated dramatically. And Amazon provides a rating bonus to sellers utilizing the “Fulfilled By Amazon” service, which contributes strongly as to whether a product will get sure coveted spots within the listings. And that is with out contemplating the shady enterprise of duplicating profitable merchandise.

Amazon didn’t handle the declare that sellers are spending 4-5 instances as a lot on advertisements and placement right this moment as they did in 2016, contributing to the large improve in revenue. The corporate merely stated there’s a vary of advert varieties and processes, and that it’s “a good way for sellers to assist improve the visibility of their merchandise.” It denied that it favors FBA customers in search outcomes, although because the hyperlink above reveals, it appears to take action by oblique means.

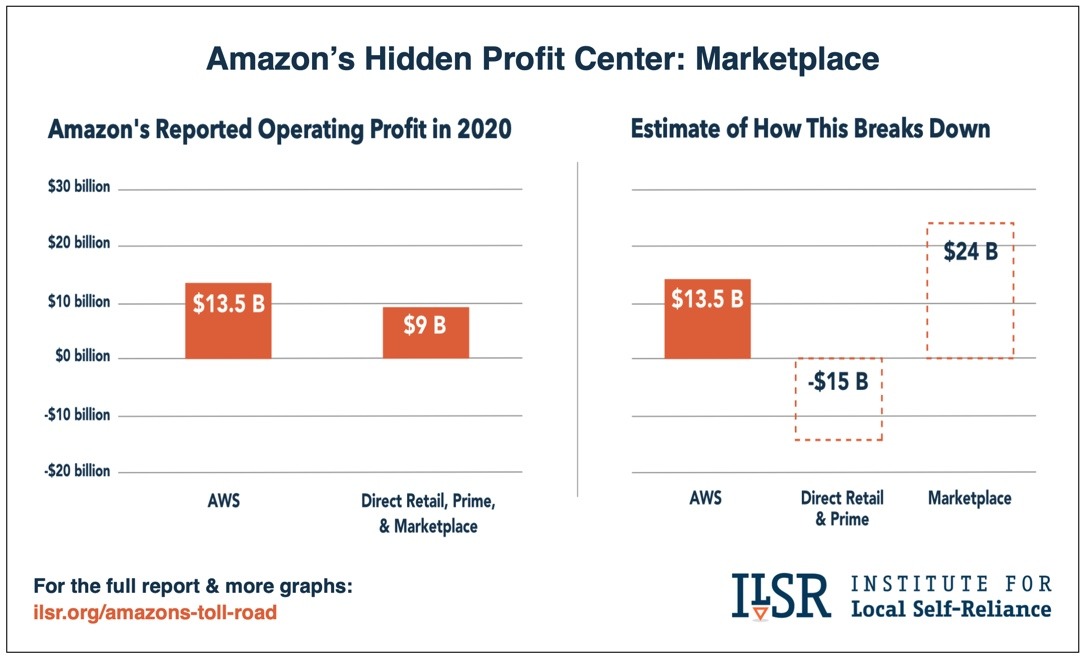

The opposite declare made by the report is that Amazon is utilizing artistic accounting to masks the large revenues generated by vendor charges, grouping the large income of the Market division with monumental losses incurred in constructing out their delivery infrastructure. Certain, they’re associated — but it surely’s hardly forthcoming to current an combination of two wildly completely different numbers and declare it represents the enterprise precisely. This isn’t a brand new allegation, however Mitchell places particular numbers on it for 2020, making it greater than a common concept.

Picture Credit: ILSR

“We conclude that vendor charges probably generate extra revenue than AWS. This contradicts standard knowledge concerning the firm; information tales generally describe AWS because the supply of most of Amazon’s earnings,” writes Mitchell within the abstract. “Drawing on analysts’ estimates of the margins Amazon probably earns on vendor promoting and different vendor charges, we discover that Market could have generated working income of $24 billion in 2020 — considerably greater than the $13.5 billion in revenue that Amazon reported for AWS. AWS has lengthy been seen as Amazon’s money cow. However this report finds that the tech big has a second money cow, which it retains quietly out of view.”

Amazon instructed me that it “can’t speculate” on 2021 income numbers in the course of the 12 months, however didn’t reply to a follow-up query asking whether or not the earlier years’ numbers within the ILSR report had been correct.

A few of these practices are below scrutiny by numerous authorities powers, together with an FTC led by maybe now the world’s most well-known questioner of Amazon’s enterprise practices, Lina Khan. The ILSR report is merely informative and Amazon can wave it away, but when an FTC job power is wanting into related questions and drawing related conclusions, the corporate could have cause to start out sweating.

[ad_2]

Source link