[ad_1]

Prime business our bodies are looking for the scrapping of the Reserve Financial institution of India’s course on mortgage asset classification by non-banking finance firms (NBFCs) each day because the rule may cripple the small and medium enterprises section that’s simply limping again to normalcy after the Covid impression.

The Confederation of Indian Industries (CII) and the Related Chambers of Commerce and Business of India (Assocham) are writing to the regulator to assessment the norm which asks NFBCs to categorise loans based mostly on day by day repayments.

Of their letter to the RBI the business our bodies have argued that the strict day-to-day funds based mostly classification could be arduous to implement for the debtors serviced by them as their money flows and provides are haphazard. These debtors make lump sum funds.

“Our principal level is that we principally serve small debtors, truck drivers, gentle business autos house owners and even farmers. These folks don’t have a gradual earnings stream like salaried folks,” mentioned an individual conversant in the event. “Consequently, funds don’t usually come on or earlier than the due date, so we give them some leeway, like paying earlier than the top of the month. The strict classification on par with banks will derail this technique and will put many debtors in hassle.”

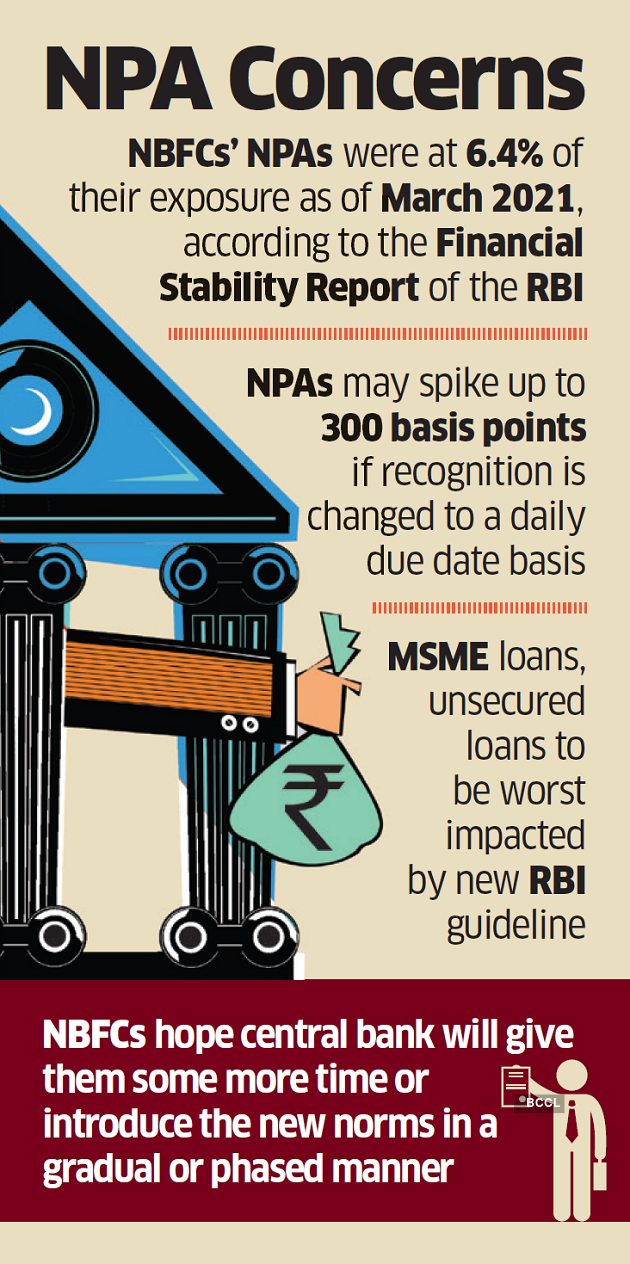

In a clarification earlier this month, RBI mentioned mortgage accounts must be categorized as NPAs except the whole arrears of curiosity and principal are paid by the borrower. NBFCs have additionally been requested to particularly point out the precise due date of mortgage accounts and the break-up of the principal in addition to curiosity. These norms have now introduced mortgage classification by NBFCs on par with banks and is one more step by the RBI to tighten laws on NBFCs though they serve a special set of shoppers. The modifications can be efficient from subsequent fiscal 12 months.

Crisil mentioned that the impression of the brand new RBI norms on unsecured mortgage NPA is predicted to be within the vary of 1.5% to three%, for MSME finance it’s anticipated to be within the vary of 1% to three%, and 1% to 2% for automobile finance.

Business leaders are hoping that the central financial institution will at the least give them some extra time or introduce the brand new norms in a gradual or phased method.

Additionally Learn:

[ad_2]

Source link