[ad_1]

Since April 2020, after the March crash, the markets have rallied spectacularly. Numerous causes are being given for this improbable rise within the markets: a liquidity rush to combat the pandemic, a receding pandemic, an financial rebound, good revenue numbers of listed firms, and so forth.

Up to now so good. Nevertheless, for the intense inventory investor, maybe the most important problem is the place to put money into a bull run. With shares and their valuations rising wings, your finest funding concepts appear to be out of attain.

On this collection of articles, we deliver to you shares which have given higher returns than the Sensex over the past one yr however are nonetheless out there at a reduction to their historic valuations.

With a purpose to arrive at these shares, we utilized the next filters:

- Market cap greater than Rs 1,000 cr

- EPS progress of greater than 15% pa over the past 5 years

- Present and five-year common ROE & ROCE greater than 15% (for finance firms, solely ROE)

- Constructive money flows over the past 5 years (not relevant for finance firms)

- Buying and selling at a reduction or a premium of lower than 10% from 5Y median P/E (P/B for finance firms)

From the checklist of shares that we so obtained, listed below are two giant ones.

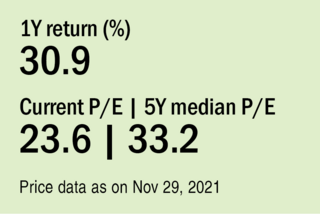

Supreme Industries: The piping grasp

A number one producer of plastic merchandise in India with 25 manufacturing services, the corporate provides a variety of merchandise throughout varied classes, together with plastic-piping methods, product packaging, moulded furnishings, storage and material-handling merchandise, packaging movies, to call a number of. The corporate enjoys a big market share throughout all its enterprise verticals. In FY21, it generated a majority of its income from plastic-piping methods, which contributed 65 per cent to its complete revenues, whereas industrial merchandise, packaging merchandise and client merchandise accounted for 12 per cent, 17 per cent and 6 per cent, respectively.

Though FY21 was largely affected by the pandemic, the corporate nonetheless managed to extend its income by greater than 15 per cent, owing to an increase within the value of PVC. Nevertheless, its gross sales amount contracted by simply 1 per cent. Regardless of pandemic-led restrictions, the corporate exported items price $18.35 million as in opposition to $18.29 million in FY20.

Its future outlook seems brilliant with the re-opening of the development sector and varied authorities initiatives like ‘Jal Jeevan Mission’ and ‘Nal se Jal’ scheme, which act as a catalyst for the home plastic-piping trade over the long run. Regardless of a lacklustre FY21, the administration is optimistic in regards to the future and is continuous with its capex plans of Rs 850 crore within the subsequent two years. Supreme Industries is a robust participant in India’s rising housing and client market and is properly positioned within the plastic-piping phase, given its robust product portfolio and a wholesome steadiness sheet.

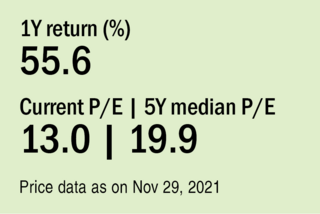

Finolex Industries: Constructing a brilliant future

Finolex Industries is the most important and solely backwards-integrated PVC pipes and fittings producer in India, with a manufacturing capability of three,70,000 million tonnes (MT) every year. It’s the second-largest producer of PVC resin in India, with a manufacturing capability of two,72,000 MT every year. Boasting a variety of merchandise, the corporate has an in depth community of over 900 sellers and 21,000 retail touchpoints.

In FY21, its complete income elevated by 16 per cent and its working revenue (as measured by earnings earlier than curiosity, taxes, depreciation and amortisation) greater than doubled to Rs 989 crore – the best ever since its inception. Working money flows of Rs 941 crore have been virtually equal to the earlier 4 years put collectively. This phenomenal efficiency was pushed by a number of components, reminiscent of a rise in PVC costs, increased realisation, decrease prices and a big enchancment in all working parameters.

The federal government’s initiatives within the affordable-housing phase, the irrigation sector and varied initiatives associated to rural piped-water provide are anticipated to behave as catalysts for the PVC pipe trade. Given this, the corporate has determined to extend its presence within the plumbing and sanitation segments whereas sustaining regular progress within the agriculture phase. Finolex, being well-placed to profit from a slew of things reminiscent of a shift from metallic to plastic pipes, the rising demand for infrastructure, an elevated share of value-added merchandise and consolidation, continues to have a brilliant future.

[ad_2]

Source link