[ad_1]

In September, Gautam Photo voltaic noticed the solar shine. The Delhi-based firm that makes photo voltaic panels, batteries, lights and followers, made it to the record of 34 accepted module producers, whose merchandise can be utilized in government-assisted solar energy tasks throughout the nation. Whereas it’s a coverage measure to assist native energy methods producers, the tag of being a government-approved provider opens a world of alternatives for this household enterprise. “We’re a product-oriented firm and have invested quite a bit in manufacturing. Firms like ours will have the ability to make solar energy methods which can be comparable with one of the best on the planet,” says Shubhra Mohanka, director, Gautam Photo voltaic.

The renewable power (RE) area is buzzing with pleasure. The sector is being incentivised by insurance policies that may alter the facility mixture of the nation — and make it greener and cleaner. Cash is chasing RE property which helps inexperienced energy producers add contemporary capacities yearly. Increased era has introduced down the price of RE, particularly photo voltaic, to about Rs 2.50 per unit. That is nicely under the price of thermal energy, which is over Rs 4 per unit. At present, India’s put in renewable power capability is over 147 gigawatt (GW), with photo voltaic and wind power reserving over 100 GW.

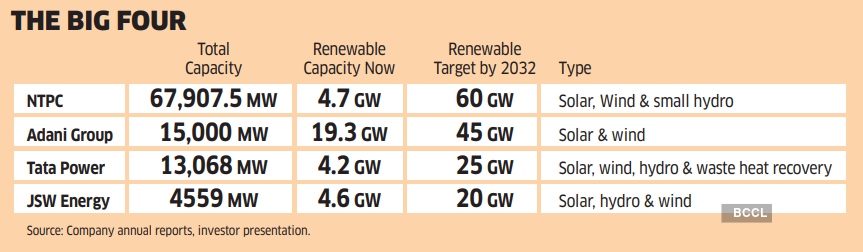

It’s not simply smaller corporations like Gautam Photo voltaic which can be taking a look at an even bigger play. Conventional energy behemoths, which centered on fossil fuel-based sources until just a few years in the past, are transitioning to RE. Legacy energy firms akin to NTPC, Tata Energy, Adani Group and JSW Power, amongst others, have concrete plans to bulk up their renewables portfolio over the following few years. Clear power commitments of the federal government, particularly on the twenty sixth UN Local weather Change Convention, or COP26, to section down coal energy are rushing the shift to wash power. At Glasgow, PM Narendra Modi mentioned India will obtain web zero emissions by 2070, and lift non-fossil power capacities to 500GW by 2030.

“There’s a powerful push in direction of RE; targets have been drawn out, and now extra investments may even stream into creating expertise and infrastructure. The core focus can be to scale back ‘seasonality points’ round RE. Storage prices are excessive in the mean time; this can be introduced down over the following few years,” says Manish Gupta, senior director, Crisil.

NTPC, India’s largest energy firm, plans to put in 60 GW of RE by 2032. The Adani Group has put aside 75% of its deliberate capex to advertise inexperienced applied sciences. On the latest Bloomberg India Financial Discussion board, Adani Group chairman Gautam Adani mentioned he hoped to personal the most important renewable firm on the planet.

“We’ve got dedicated $70 billion over the following decade to make this occur,” he mentioned. Tata Energy intends to develop its “clear and inexperienced” portfolio to 80% by FY2030. The corporate’s portfolio combine is now 69:31, favouring thermal energy.

“Local weather change is actual and we now have to safe the way forward for our planet. We try to maneuver in a short time, as a result of this decade is decisive,” says Praveer Sinha, MD & CEO, Tata Energy.

JSW Power intends to enlarge its portfolio via renewables to 10 GW by 2025 and 20 GW by 2030. “We will meet our targets a lot earlier, however we aren’t stopping at this. We’re specializing in inexperienced hydrogen, one of many cleanest types of power,” says Prashant Jain, joint MD & CEO, JSW Power.

“Comfort and viability are the 2 most crucial components for the adoption of any new expertise. These components are actually seen in RE area,” says Jain. “RE tariffs have fallen significantly over the previous two years; now incremental capacities are getting constructed throughout the nation. We’re seeing lots of technological developments, too. The concentrate on RE will solely enhance within the coming years.”

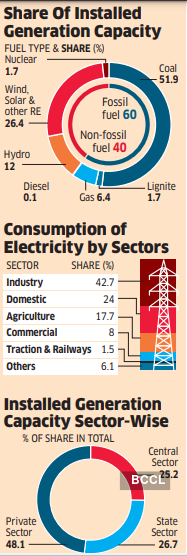

These are nonetheless early days for RE in India. Even now, fossil fuels are used to generate over 60% of our energy combine. Inside fossil fuels, coal accounts for almost 52% of put in energy capability. Gupta and Ankit Hakhu of Crisil Rankings say it might take years for India to shift its base load from coal and different fossil fuels to RE. “India consumes over 1,400 BU (billion items) of energy yearly; over 70% of that is being met by coal-fired energy crops,” says Gupta. “The transition to RE can be a gradual course of, nevertheless it has begun. Recent investments in coal-fired energy crops have stopped. The main target is to make the renewable energy pie bigger — and cut back the dependence on coal-fired energy crops,” he provides.

The per capita consumption of energy in India in 2019-20 was 1,208 kWh, means under the worldwide common of three,200 kWh. However the nation’s energy demand has been rising at 5% every year on a median over the previous 20 years.

“Coal will proceed to co-exist with RE for just a few extra years. That is crucial for the expansion of our nation,” says Jain of JSW. “But when we handle to divert incremental demand to RE, that alone can be a fantastic alternative for inexperienced energy producers.”

BLACK TO GREEN

Our dependence on coal turned starkly clear when most thermal energy producers warned of its extreme scarcity in September and October. A surge in demand for energy, leading to increased utilization of current coal inventory; incessant rains in mining areas and a provide chain breakdown; and fewer imports on account of upper worldwide costs led to this momentary scarcity, based on energy trade executives. The state of affairs has now improved, with many crucial coal crops having 11-13 days of coal inventory. “Neither coal mining firms nor energy producers foresaw a bump in demand after the second Covid wave,” says Abhineet Anand, energy sector analyst at Emkay World, a stockbroking agency. “Coal remains to be essential for the facility sector, and it might be so for a number of years. However thermal energy might not see lots of contemporary investments. Additionally, we’re seeing lots of outdated coal crops getting decommissioned yearly,” he provides.

Says Sinha of Tata Energy: “We’re solely including RE capacities now and we now have already began decommissioning outdated energy crops. We’re additionally shutting down coal-fired crops the place energy buy agreements have gotten over. We’re paying an enormous value for this transition to RE, however we now have to do it for a cleaner and inexperienced future.”

Barring just a few ongoing tasks of NTPC, conventional energy corporations are not investing in thermal energy. Overlook fairness investments, it’s troublesome to boost even debt funding to finance fossil gas tasks. “Personal energy producers having thermal energy crops are in a repair; no person will purchase these property from them now. All they will do is enhance their RE portfolio and section out thermal,” says a number one energy sector guide, on situation of anonymity.

“Many of those energy firms are owned by giant teams having different companies. They don’t need to be seen as a polluter,” the guide provides. “Many energy firms are shifting to RE as a result of they see extra progress alternatives there. Additionally, conventional energy firms get a valuation uptick if they’ve RE piece as nicely,” says Kuljit Singh, a accomplice at EY, a consulting agency. “RE is a a lot less complicated enterprise than thermal energy; there are usually not many transferring components in RE. These are brief gestation tasks and there are usually not a lot operational hassles apart from working capital points as a result of cost delays (by discoms). Additionally, in case you are in RE enterprise, you may showcase your self as local weather aware and insulate your self in opposition to cross-border carbon tax regimes that will come up sooner or later,” he provides.

NOT AN EASY BUSINESS

RE comes with its personal set of challenges. As soon as the share of thermal energy goes down, many conventional energy firms might should let go of lots of people with experience in thermal energy era.

Furthermore, almost 90% of RE energy methods are imported — and the primary provider is China. If India-China commerce ties are strained, that will impression the near-term progress of this sector. To bypass this, the federal government has introduced production-linked incentive (PLI) schemes to assist native producers. This help bundle runs to almost Rs 24,000 crore — and is generally centered on the manufacturing of photo voltaic modules and storage options (batteries).

“For RE to achieve the standing of a agency energy supply, it should work on storage options. Provided that there’s round the clock RE energy, and if costs stay decrease will individuals change to utilizing inexperienced power,” says Amit Kumar, accomplice (RE), PwC.

A number of giant Indian IT firms have begun utilizing captive inexperienced energy to take care of their net-zero standing. They’ve both put up their very own photo voltaic crops or are shopping for inexperienced power from personal producers. In the meantime, a large-scale undertaking is underway to interchange diesel pumps with solar-powered pump units in agriculture sector, which consumes over 17% of energy.

“A number of captive patrons (of energy) are shifting to inexperienced power. Many firms are creating methods to look inexperienced and environment-friendly; they could change to utilizing inexperienced energy whether it is round the clock and economically possible. The PLI scheme of the federal government will push the trade forward,” says Kumar of PwC.

For simple adoption of renewable power, energy producers may have a peaceable coexistence with patrons (distribution firms or discoms). The discoms, principally owned by states, are usually not eager on shopping for renewable energy as they should improve their transmission strains and also will incur excessive grid stabilisation and balancing prices. States like Punjab, Uttar Pradesh, Andhra Pradesh, Gujarat and Telangana try to renegotiate energy buy agreements with firms, signed at increased tariffs just a few years in the past.

“It is a disturbing pattern. These agreements had been signed at RE tariff charges that had been prevalent then. Now how do they (state discoms) count on energy firms to decrease tariffs? The producers had incurred lots of price to arrange these tasks,” says the top of a big PE fund investing in RE property.

Whereas the nation might transition to cleaner power over the following few years, it’s not going to be simple even for cash-rich energy firms.

Additionally Learn:

[ad_2]

Source link