[ad_1]

India on Tuesday introduced that it’s going to launch 5 million barrels of crude oil from its strategic petroleum reserves in session with different massive world oil shoppers such because the US, China, Japan, and the Republic of Korea. Mint takes a take a look at the implications:

What triggered the strategic oil launch?

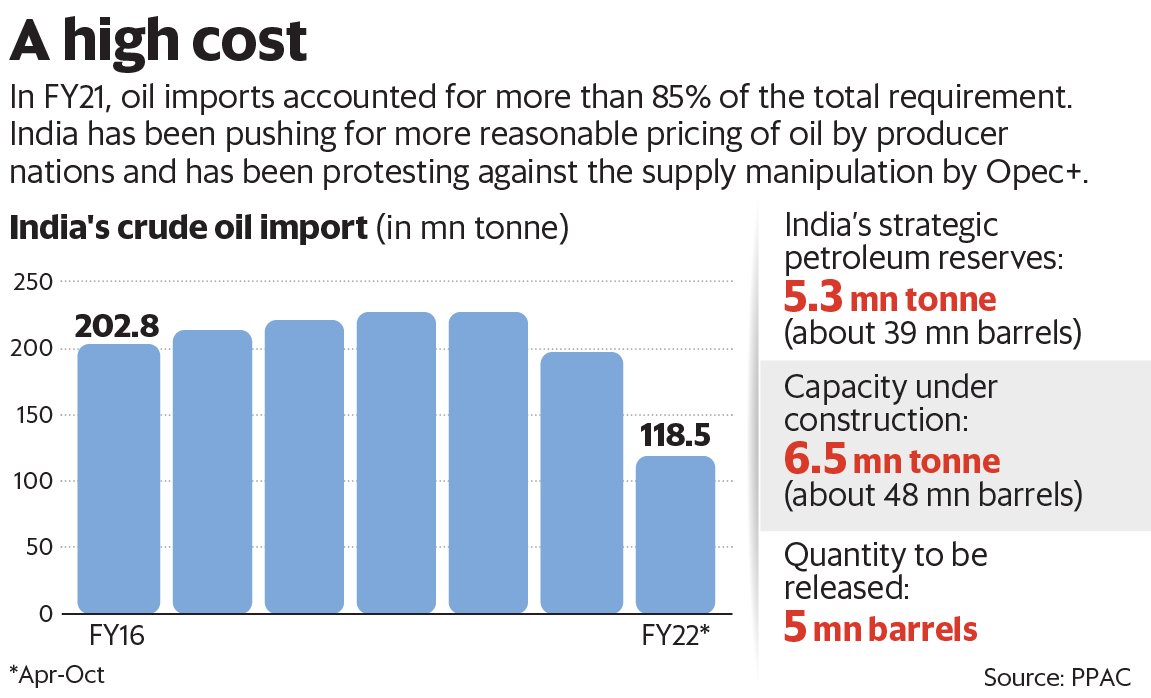

India is closely reliant on oil imports. In FY21, oil imports accounted for greater than 85% of the whole requirement. India has been pushing for extra affordable pricing of oil by producer nations and has been protesting towards the provision manipulation by the Group of the Petroleum Exporting Nations and its allies, identified as Opec+, aimed at propping up costs. Excessive oil costs impression uncooked materials prices for companies and have an effect on competitiveness as some petrochemicals refined from crude oil are the essential constructing blocks in a number of industries. Apart from, increased costs compelled the federal government to chop taxes on petrol and diesel.

Will it result in decline in oil value?

For the discharge of oil from strategic reserves to have a significant impression, all taking part nations ought to announce the extent of the discharge and take coordinated motion. The 50 million barrels that the US would launch from its reserves is over the “subsequent a number of months”. Indian authorities are awaiting concrete plans from different nations. Japan too has confirmed that it’s going to launch “just a few hundred thousand kilolitres” of oil from its nationwide reserve, however the timing is but to be determined. The transfer sends a transparent sign to producing nations about massive consumers coming collectively, an individual aware of discussions within the authorities stated.

View Full Picture

What’s India doing to tame oil value?

Ethanol mixing is vital to lowering dependence on oil. The goal is to realize 20% ethanol mixing of petrol by 2025. Additionally, a powerful coverage backing is given to facilitate transition from fossil fuel-based transportation to electrical mobility. State-owned oil refiners are at all times on the look-out for contracts with new suppliers. Coverage-makers are additionally eying hydrogen as a gas.

Is India on a collision course with Opec?

India’s efforts to affect oil pricing with its standing of a bulk purchaser has seen little end result until now due to cartelization. It has given clear indicators of diversifying sources of crude oil, elevating purchases from the US, and strongly backing transition to electrical mobility. Provides from Center East nations have fallen in FY21 to 63.5% of India’s complete imports from 69% in FY20, due to manufacturing cuts by Opec+. However India doesn’t count on the discharge of oil to have an effect on diplomatic ties with the Center East.

How does low-cost vitality assist the authorities?

The federal government led by Prime Minister Narendra Modi has benefited from low oil costs prior to now, giving it the chance to boost taxes and discover sources for varied welfare schemes. The Modi authorities has additionally phased out a lot of the petroleum subsidies, cleansing up the federal government stability sheet, making oil costs go by means of to shoppers. Excessive oil costs compelled the federal government to chop taxes making it more durable for it to stability budgets. Greater vitality prices are additionally seen by consultants as a deterrent to consumption.

By no means miss a narrative! Keep related and knowledgeable with Mint.

Obtain

our App Now!!

[ad_2]

Source link