[ad_1]

For lots of buyers, the step after studying – the precise doing – finally ends up being the issue. When you begin studying books and articles about profitable entrepreneurs beginning and rising a enterprise, you typically come throughout phrases like ‘execution is all the things’, or ‘execution trumps all the things’. What these sayings imply is straightforward: concepts are value nothing except applied properly.

As an investor, you should be typically conscious of the enterprise setting – companies that begin, people who succeed and people who fail. Suppose again over the previous couple of years and make a psychological checklist of companies which have failed in the identical line of exercise whereas others have succeeded. I do not imply simply the ‘web start-up’ form of companies however all companies. Take a look at the mutual fund trade. There are a handful of fund corporations which have succeeded whereas most simply wrestle on and plenty of get offered off. Take a look at the airline enterprise. Take a look at overseas corporations which have come to India to get into the automobiles enterprise. Take a look at e-commerce. Take a look at inventory brokerages. It is the identical story all over the place. In truth, when you go searching in your neighbourhood, you’ll certainly discover many examples amongst small retailers and eating places.

On the one hand, we’ve these examples of some companies failing at the very same exercise that others succeed. Then again, we’ve this enormous tradition of worshipping ‘The Large Thought’. There are individuals who won’t let you know what their new enterprise will do with out signing a non-disclosure settlement. Why? As a result of they really feel that the thought is all the things. Anybody who has that concept can succeed and compete with them.

What vs how in investing

Sadly, the funding world can also be one thing like this. We are likely to really feel that what issues extra is ‘what’ you will, and never ‘how’ you will do it. In my expertise, the reality could be very totally different. There are not any good concepts which might be secret. The fundamentals of investing success – diversification, asset allocation, value averaging, specializing in fundamentals, and many others., – can be found to everybody. Furthermore, they’re additionally out there simply and at both zero or very low value. There are not any limitations to concepts. You possibly can have all the great concepts in investing, delivered to the gadget in your pocket, at any second that you just select.

And but, identical to in enterprise, and identical to in lots of different elements of life, it is the execution that issues. Some buyers appear to choose up the nice concepts and simply run with them and succeed however many don’t. Nonetheless, the issue is definitely a bit bit deeper than enterprise. In contrast to enterprise, this isn’t about competence, however reasonably what the primary exercise of your life is. In spite of everything, investing just isn’t the primary enterprise of your life. You can’t spend all of your time studying the nitty gritty of the particular implementation of the very best concepts. In contrast to enterprise, you can not even rent somebody skilled to handle issues for you…or are you able to?

It seems which you can, and that’s what you might be doing right here with Worth Analysis.

Take a look at a number of of our articles about asset allocation, rebalancing and utilizing debt funds in probably the most helpful manner. These are good concepts in investing. In truth, they’re indispensable concepts and should type the core of any investing technique. The remainder of the method wants a extra guided course of.

And the way are we going to do this? That is the place Worth Analysis Premium is available in.

This can be a course of that has 4 components to it:

- Present a manner so that you can articulate your objectives clearly.

- Counsel a set of investments and a sample of investments for these objectives.

- Confirm that your present investments match the objectives, and counsel modifications if they don’t.

- Constantly monitor your investments to verify they’re heading in your objectives; counsel modifications, if any are required.

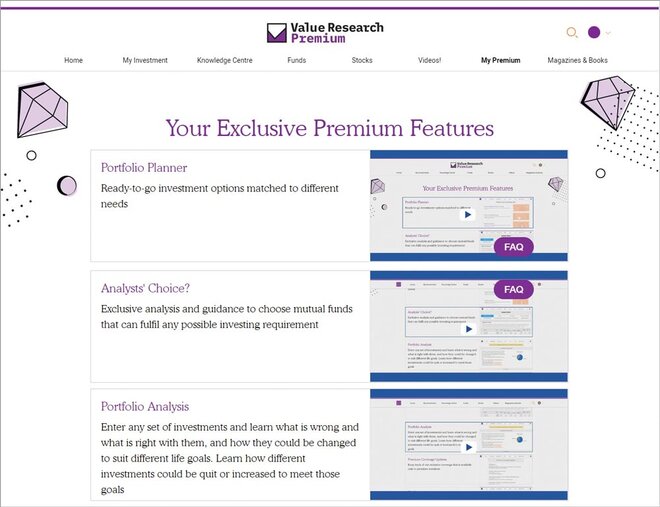

All these could be applied by options that we’ve built-in into Premium which is on the web site. This is an outline of these which immediately work in direction of assembly your monetary objectives.

Portfolio Planner: These are customized portfolios which might be steered to you as a part of your Premium membership. The algorithm that we’ve developed takes under consideration your objectives, your earnings, your saving capability and plenty of different components.

Analyst’s Alternative: Typically, buyers need to select their very own funds for some specific funding function. There are about 1,600 out there to you and even with the assistance of our score system, it is loads of work to zoom in to the suitable set. Nonetheless, that will not be an issue for you as a result of as a Premium member, you should have entry to Analyst’s Alternative. As an alternative of the 37 official varieties of funds, we’ve created eight investor-oriented classes which match exactly with precise monetary objectives that you’ve. In every of those, my workforce of analysts and I’ve fastidiously chosen a handful of funds that may serve you with the very best outcomes.

Portfolio Evaluation: Only some members are beginning their investing from scratch. For many of you, a giant query is whether or not your present investments match into your objectives? That is typically a tough query to reply as a result of there are loads of implications of switching outdated investments, not the least of which is taxation. Within the Premium system, you may get an analysis and a steered fix-list, based mostly on our skilled groups’ inputs.

Much more

In fact, these are simply headline options. There are much more that may assist you to preserve observe of your investments, returns, diversification, taxation and virtually all the things else that may assist you to obtain your monetary objectives. Check out http://vro.in/premium for the total particulars.

[ad_2]

Source link