[ad_1]

The distinction in returns between the direct and the common plans of the identical mutual funds has now develop into so giant that it is unattainable to disregard. Besides, after all, for buyers who nonetheless have no idea something about direct plans in any respect. For educated buyers, i.e., most of those that might be studying this web page, it’s inexplicable that there’s, even now, any cash in any respect in common plans.

How might there be any mutual fund buyers nonetheless on the market who do not know that there’s a easy method to improve their earnings from any fairness fund by 10% or so by simply selecting a special plan? And but it is true. Direct funds account for almost 22% of the whole cash that’s being held in Indian fairness funds. The remaining remains to be held in common plans and people buyers are nonetheless leaving cash mendacity on the desk for others to select up. The proportion is far greater in debt funds however these are principally utilized by skilled company buyers, so the story is completely different.

The factor that the educated direct fund buyers don’t realise is that except you exit and search for it, there isn’t a manner that you’ll come throughout details about direct funds by your self. I imply you will notice references to the phrase ‘direct’ right here and there however the precise monetary implications are nearly completely secret. For individuals who have been snug in the best way they make investments, by way of a distributor giant or small, and who maybe google funds on occasion and even go to fund corporations’ web sites, there isn’t a method to uncover the precise nature and quantum of the returns benefit that you’re going to get by way of direct funds.

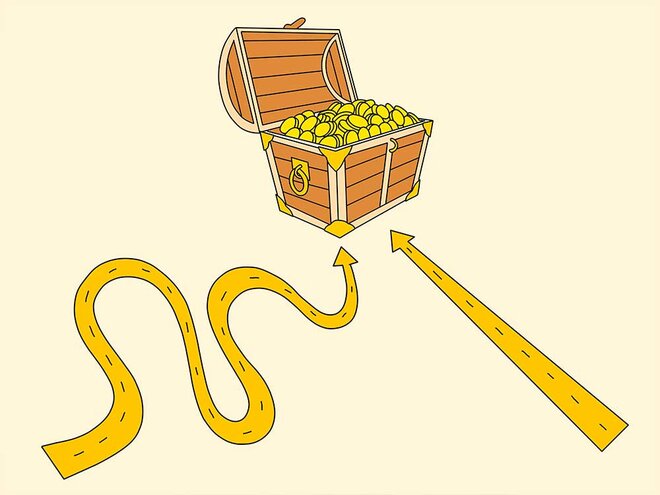

Aside from a few of the new fintech platforms, or investor-oriented sources like Worth Analysis On-line, the benefit of direct funds is a secret. How a lot of a secret? This is a bit style. I will take the instance of 1 typical middle-of-the-road large-cap fairness fund that I picked on Worth Analysis On-line. In case you had invested Rs 10 lakh on this fund’s common plan seven years in the past (the longest interval for this fund), it could have grown to Rs 23.2 lakh. The identical funding within the direct plan would have grown to Rs 25 lakh. The achieve of Rs 15 lakh is 13.6% greater than the achieve of Rs 13.2 lakh. Identical fund, similar portfolio, only a completely different plan. Clearly, over longer durations, the differential can solely develop – that is a mathematical certainty.

Clearly, direct plan followers are justified in being puzzled that most individuals refuse to take this cash. In fact, a straight comparability between direct and common plans is considerably unjustified in some elements. Direct and common plans are suited to completely different sorts of buyers. At Worth Analysis On-line too, we fee them in separate units although you should use our free instruments to match them with one another.

Newbie buyers want easy comfort companies to facilitate the transactions. Much more than that, newbie buyers want somebody to get them began. Not like a set deposit in a financial institution, a mutual fund funding is just not merely an automated extension of some companies you’re already getting. Being too focussed on the final sliver of value might imply that you just by no means truly get began.

So what sort of an investor could be suited to direct investments? That must be somebody who understands what sort of mutual funds are wanted for various sorts of funding wants, is able to researching these independently and provide you with a listing of funds to put money into, after which undergo the method of really investing with out the assistance of an middleman. After one begins investing, every time the markets fall and funding values come below strain, an exterior supply of recommendation may help one keep the course. Basically, it’s important to do for your self every thing that an advisor is meant to do.

There isn’t any common right alternative – every investor has to determine what they’ll do, and what they want another person to do for them, and determine it out.

[ad_2]

Source link