[ad_1]

Sudeep, a retiree, invested near Rs 20 lakh within the shuttered schemes of Franklin. Although a portion of the funding remains to be pending, he has obtained a considerably vital quantity. Pushed by a safety-first mindset, Sudeep now needs to re-invest the funds for an everyday earnings and desires to find out about numerous out there options. Right here is how he ought to go about investing in fixed-income devices.

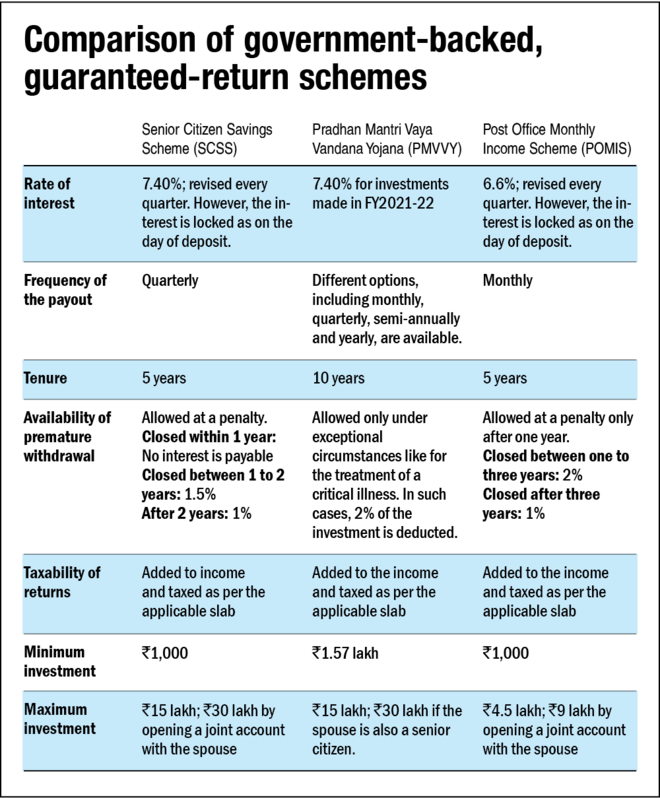

Authorities-backed guaranteed-return schemes

- Whereas investing in fixed-income avenues to generate common earnings, senior residents ought to first utilise government-backed schemes, such because the Senior Citizen Financial savings Scheme (SCSS), the Pradhan Mantri Vaya Vandana Yojana (PMVVY) and the Submit Workplace Month-to-month Earnings Scheme (POMIS).

- These schemes provide assured returns, that are normally greater than these from every other fixed-income investments like financial institution fastened deposits. Additionally, since these schemes are backed by the Authorities of India, your investments in them shall be completely protected.

Authorities and PSU bonds

- Proper now, Sudeep is seeking to make investments an quantity that’s effectively inside the most funding restrict of the schemes talked about above. Nonetheless, the excess, if any, may also be invested in bonds issued by the Authorities of India and PSU corporations.

- These bonds are comparatively protected however the interest-rate threat remains to be there. Additionally, by investing in these bonds alone, one could not be capable of diversify.

- The RBI floating fee bonds are one of many most secure fixed-income options. Their rates of interest are reset each six months and stored 35 foundation factors over and above the present return on Nationwide Financial savings Certificates (NSC). The present return fee of those bonds is 7.15 per cent and the subsequent reset will occur on January 1, 2022. Additionally, the curiosity is repaid twice a 12 months – January and July. The curiosity earned on these bonds is added to the earnings and taxed as per the relevant slabs.

- Though these bonds have a tenure of seven years, untimely withdrawals are allowed after the stipulated lock-in interval, which is determined based mostly on the age of the subscriber – six years for the age group of 60-70 years; 5 years for the age group of 70-80 years and 4 years for the age group of 80 years and above.

Company bonds and FDs

- Though company fastened deposits and bonds earn about 1-2 per cent greater than financial institution FDs, they don’t seem to be as a lot protected. It’s like lending your cash to a specific firm.

- If Sudeep is able to take a little bit of threat, investing in a great short-duration fund could be a greater concept, given the truth that his funding could be diversified amongst a number of such firm bonds and deposits.

- Cases just like the Franklin episode shouldn’t deter Sudeep from investing in debt funds altogether. Relatively, it must be handled as a studying expertise. Debt funds rating greater on liquidity, returns and taxability

choose a debt fund after the Franklin episode?

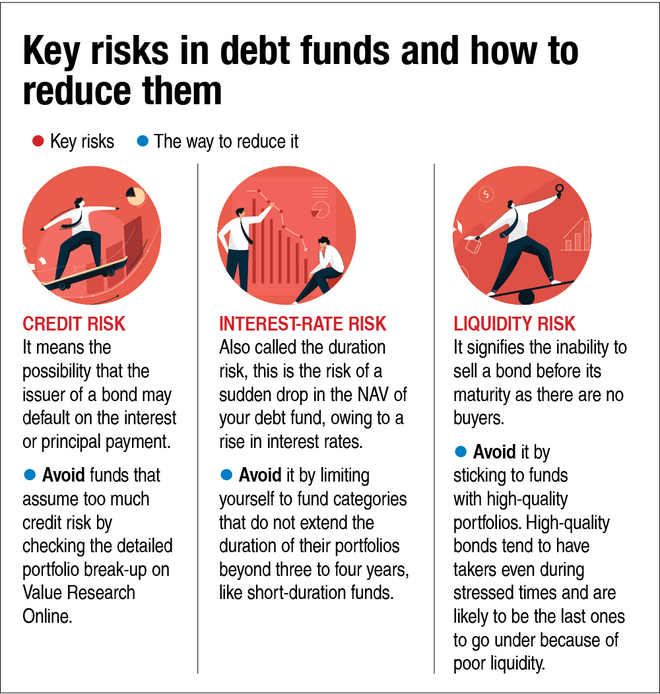

- One should perceive that dangers are there in debt funds as effectively. Due to this fact, one should take all of the precautions to cut back them.

- One ought to search for a well-diversified, prime quality portfolio. It’s higher to keep away from a fixed-income fund that’s giving extra-ordinarily excessive returns than its friends. Do do not forget that additional return comes with additional threat.

- The brand new risk-o-meter is fairly informative and efficient to evaluate the danger of a debt fund. One must also have a look at the danger grade, which is pictorially depicted and now adjustments each month with the portfolio.

Don’t shun equities fully

- Whereas it’s true that equities are risky, one should proceed to speculate a minimum of one-third of the corpus in equities even after retirement. It’ll assist one earn inflation-adjusted earnings.

- Ideally, the annual withdrawal shouldn’t exceed 4-6 per cent of the corpus.

- Relying solely on fixed-income avenues could push you in the direction of old-age poverty through the later years of retired life, owing to inflation. And in the event you make investments solely in fixed-income devices, it’s good to have a sufficiently massive corpus.

Do not ignore these

- Preserve a contingency fund equal to a minimum of six month bills in a mix of the liquid fund and sweep-in deposits.

- Have satisfactory medical health insurance for all your loved ones members. You do not want life insurance coverage until you’ve monetary dependents or sufficient internet price to financially help them in your absence.

[ad_2]

Source link