[ad_1]

India’s transfer to slash automotive-fuel costs final week will seemingly help the central financial institution’s efforts to normalize liquidity flows and restrain inflation, pushing again the timeline for a rise in charges and offering adequate development impetus to an economic system clambering out of the Covid sinkhole.

As pump costs of transport fuels are lowered, there’s a probability of decrease items prices, probably giving the Reserve Financial institution of India (RBI) adequate elbow room on liquidity tapering and but retraining bond yields from spiking as expectations of a change within the price trajectory are pushed again past the latter half of 2022.

Moreover, the US Federal Reserve transfer final week to taper its bond-buying program might additionally affect yields globally.

“Native yields are prone to stabilize and pattern a tad decrease this week as markets resume after the festivities,” mentioned Mahendra Jajoo, CIO- mounted earnings at Mirae Asset Administration. “Mumbai would take in the muted response in world markets to the fed taper and the Diwali present of decrease gas costs over the prolonged weekend. It’s advantageous for the RBI, which has been doing a balanced job of liquidity normalisation.”

New Delhi final week lowered the excise duties on petrol by Rs 5 a litre and diesel by Rs 10 a litre.

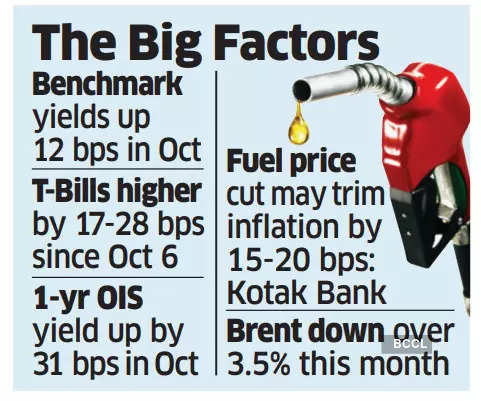

Given the larger discount in diesel costs, the better influence can be on logistics prices, decreasing the tempo of improve in the price of consumed items and probably trimming inflation by round 15-20 foundation factors, in keeping with Kotak Mahindra Financial institution. One foundation level is 0.01%.

“The latest pushback to expectations from main central banks and excise obligation cuts on petrol and diesel in India ought to assist realign rate-hike expectations,” mentioned Suyash Choudhary, head-fixed earnings, IDFC Mutual Fund.

On November 3, the US Federal Reserves determined to reduce the bond-purchase programme from this month. The $120-billion-a-month asset buy programme can be wound up by June subsequent 12 months steadily.

An anticipated unwinding calendar didn’t set off any violent response barring a drop in US sovereign yields.

The benchmark US Treasury yields plunged 15 foundation factors in simply two successive buying and selling classes – Thursday and Friday, each public holidays in India.

The Financial institution of England, too, held its charges defying standard expectation that it will increase the benchmark.

Again dwelling, the benchmark bond yield elevated by about 12 foundation factors since October with the central financial institution sucking up extra money via Variable Reverse Repo Fee (VRRR), a devoted window.

Treasury Payments, or shorter period sovereign securities, yielded about 17-28 foundation factors greater till now since October 6, two days earlier than the RBI introduced its bi-monthly coverage. T Payments supply a benchmark gauge for brief time period company borrowings.

“The markets have introduced ahead expectations of coverage normalisation in lots of main markets over the previous couple of months,” mentioned Choudhary. “With the latest sharp rise in yields, swaps are actually pricing in a hike in efficient in a single day price in every coverage assembly for the following 12 months.”

The one-year In a single day Listed Swap (OIS) yield shot up by 31 foundation factors in October, present information from Monetary Benchmarks India.

If world oil costs don’t considerably change, elevated market charges are anticipated to dip now for now, sellers mentioned.

Brent crude oil costs fell over 3.5 p.c this month after touching a seven-year excessive at 85.82 per barrel on October 20.

[ad_2]

Source link