[ad_1]

The ETF recognition has been surging in India. Whereas the vast majority of ETF investments in India are nonetheless routed by the institutional path, retail traders have additionally began taking curiosity in these passive funding avenues. It is because over the previous few years, actively managed funds have been struggling to beat their benchmark and traders should pay a better fund-management charges for these funds. So, traders are discovering the simplicity and low-cost benefit of ETFs fairly interesting.

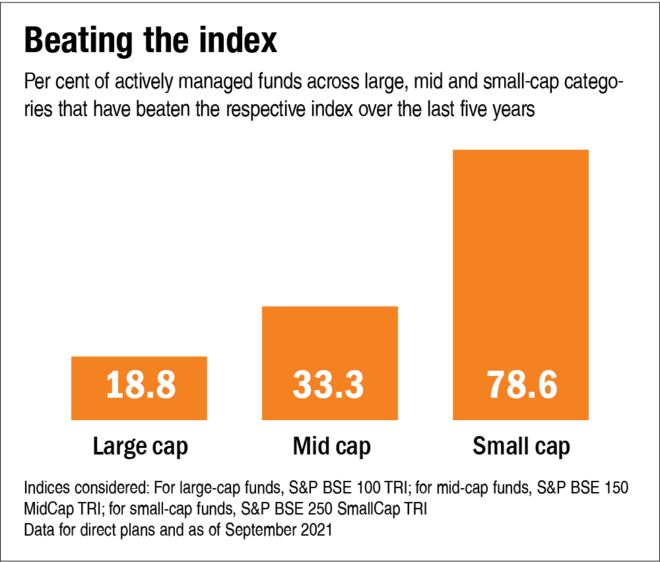

So, on this active-passive debate, are ETFs actually higher? The reply will not be as simple because it appears to be. Whereas it is true that lively funds have larger prices, their historical past of producing outperformance over the benchmarks cannot be fully missed, particularly within the mid- and small-cap segments.

The reply to the active-passive query truly would not lie on the extremes however someplace within the center. So, each lively funds and ETFs have a job to play in your portfolio, relying on what your necessities are. Listed here are just a few methods in which you’ll allocate belongings between the 2.

Allocation to the environment friendly market section

An environment friendly market section, comparable to massive caps, is one the place it’s extremely troublesome to beat the benchmark by inventory choice. Therefore, it is higher to personal the index itself by the ETF and save on prices. Nevertheless, within the mid- and small-cap segments, it is nonetheless wise to go together with actively managed fund, given the ample scope of producing outperformance. See the chart titled ‘Beating the index’.

Tactical allocation

If the core of your portfolio is made from actively managed funds, ETFs might be a great way to attain tactical allocation in your portfolio, for instance, to pick out thematic, sectoral and worldwide funds. The reverse of that is additionally doable. In case you are utilizing broad-based ETFs as a part of your core portfolio, then you may look to put money into just a few actively managed funds with a view to generate outperformance.

Publicity to smart-beta merchandise

Whereas a majority of ETFs at present accessible monitor broad-based indices, fund firms have began coming in with smart-beta ETFs, comparable to worth ETFs, equal-weight ETFs, and so on. These are based mostly on some predetermined components and lie between lively and passive variants. By way of ETFs, you can even take publicity to such revolutionary merchandise so as to add color to your portfolio.

Thus, as we will observe, it is not about whether or not you must go together with lively funds or passive ETFs. It is truly about your individual necessities. You will have to evaluate which kinds of funds finest suit your wants after which accordingly put money into them.

Disclaimer: Mutual fund investments are topic to market dangers, learn all scheme associated paperwork rigorously.

All Mutual Fund traders should undergo a one-time KYC (Know Your Buyer) course of. Buyers ought to deal solely with Registered Mutual Funds (RMF).

For additional data on KYC, RMFs and process to lodge a criticism in case of any grievance, you might refer the Information Heart part accessible on the web site of Mirae Asset Mutual Fund.

[ad_2]

Source link