[ad_1]

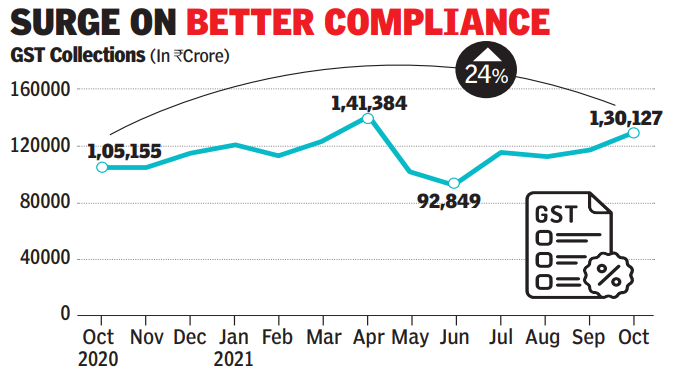

Information launched by the finance ministry on Monday confirmed GST receipts in October have been 24% increased than the revenues in the identical month final 12 months, and 36% over 2019-20. Revenues from import of products was 39% increased, and revenues from home transactions (together with import of companies) have been 19% greater than the revenues from these sources throughout October 2020, the finance ministry mentioned in an announcement. That is the fourth straight month of receipts crossing Rs 1 lakh crore. The best assortment up to now was in April this 12 months.

“That is very a lot according to the development in financial restoration. That is additionally evident from the development within the e-way payments generated each month for the reason that second wave,” the finance ministry mentioned. “The revenues would have nonetheless been increased if the gross sales of vehicles and different merchandise had not been affected on account of disruption in provide of semiconductors.”

Because the lifting of curbs after the second Covid-19 wave, revenues have been strong, due to the financial rebound. The ministry mentioned the mop-up has additionally been aided by the efforts of the state and central tax administration, leading to elevated compliance over earlier months.

It mentioned that along with motion towards particular person tax evaders, this has been a results of the multipronged strategy adopted by the GST Council. Measures taken to ease compliance embody nil submitting by textual content messages, enabling the quarterly return month-to-month fee (QRMP) system and auto-population of returns. “General, the affect of those efforts has ensured elevated compliance and better revenues… extra steps to limit pretend ITC (enter tax credit score) are into consideration of the GST Council,” the ministry’s assertion mentioned.

Up to now 12 months, GSTN — the IT spine — has augmented the system capability significantly to enhance person expertise. The council has additionally taken varied steps to discourage non-compliant behaviour, like blocking of e-way payments for non-filing of returns, system-based suspension of registration of taxpayers who’ve did not file six returns in a row and blocking of credit score for return defaulters.

Economists anticipate the wholesome development to persist within the months forward. “The six-month excessive GST collections of October 2021 are a mirrored image of the wholesome pickup in GST e-way payments in September 2021, led by pre-festive season stocking, in addition to improved compliance,” mentioned Aditi Nayar, chief economist at rankings company ICRA. “With the October 2021 GST e-way payments anticipated to exceed the extent seen within the earlier month, the headline GST collections are slated to stay wholesome in a variety of Rs 1.25-1.35 trillion in November 2021. General, we anticipate CGST collections to exceed the federal government FY2022 funds estimate of Rs 5.3 trillion by as much as Rs 500 billion.

“Though the provision points associated to semiconductor availability might proceed to constrain the efficiency of GST compensation cess, we don’t anticipate the funds estimate of Rs 1 trillion to be missed, with Rs 0.6 trillion already raised within the first seven months of this fiscal,” mentioned Nayar.

[ad_2]

Source link