[ad_1]

Integrated in 2012, FSN E-commerce Ventures, the guardian firm of Nykaa, is a local consumer-technology firm concerned in promoting magnificence, wellness, personal-care and vogue merchandise. Moreover having a various portfolio of merchandise, it sells its personal model merchandise beneath two verticals – magnificence and private care and attire and equipment. Whereas the corporate’s enterprise is primarily on-line, it additionally has 80 retail shops throughout 40 main cities in India. As of August 2021, the corporate provided round 3.1 million stock-keeping models (SKUs) from 4,078 nationwide and worldwide manufacturers. Whereas the sweetness and personal-care division affords 2,56,149 SKUs from 2,644 manufacturers primarily throughout make-up, skincare, haircare and perfume, the style division affords round 2.8 million SKUs from 1,434 manufacturers throughout numerous classes.

With the corporate striving to be extra technologically centered than retail-based, it derives round 90 per cent of its income from the net enterprise. And out of this income, 90 per cent comes from its app and the remaining from different on-line platforms and stores. Regardless of that, it’s nonetheless opening a number of stores to compete with unorganised gamers. The corporate will get 40 per cent of its income from tier-1 cities, whereas the remaining 60 per cent from tier-2 and tier-3 cities. As reported by the corporate, its consumer metrics for the 5 months ended August FY22 stood at 14.7 million month-to-month common distinctive guests and 1.2 million common transacting customers – a major rise from the year-ago interval.

India has been witnessing a rise within the buy of magnificence and vogue merchandise, owing to the nation’s younger professionals. In keeping with a RedSeer report, the Indian magnificence and personal-care market is predicted to develop at 12 per cent CAGR, whereas the style market is predicted to develop at 18 per cent CAGR till 2025. With the low penetration within the Indian magnificence area and some organised gamers, Nykaa is predicted to realize from this booming market.

Strengths

1) For the reason that firm derives round 80 per cent of its income from its cell software, it’s self-reliant.

2) It’s certainly one of India’s main magnificence and personal-care corporations within the organised area and enjoys sturdy model consciousness amongst younger prospects.

3) It has sturdy supply-chain capabilities with round 20 warehouses all through the nation and may ship round 94 per cent of orders inside 5 days.

4) Other than promoting its personal manufacturers, the corporate has partnerships with numerous nationwide and worldwide manufacturers, reminiscent of Armani Magnificence, Huda Magnificence and lots of extra.

5) For the reason that firm has a presence each on-line and offline, it affords an omnichannel expertise to its prospects and offers numerous incentives reminiscent of loyalty packages, reward playing cards and so forth.

Weak point

1) A good portion of the corporate’s income comes from its prime distributors – Elca Cosmetics, Hindustan Unilever, Honasa Shopper Merchandise, Huda Magnificence and Loreal India. As of August 2021, they contributed 21.5 per cent to the corporate’s complete income. Any change of their partnership phrases will lead to a lower in income.

2) The corporate depends closely on advertising, particularly on social media and partnered with 3,055 influencers as on August 31, 2021. Any sort of detrimental publicity can drastically have an effect on its income.

3) Though the corporate is a frontrunner within the organised market, the unorganised portion of magnificence and personal-care merchandise nonetheless holds a market share of round 72 per cent. Nykaa is immediately competing with these native distributors who’ve a bonus as a consequence of low pricing.

4) The corporate closely depends on know-how, because it derives 90 per cent of income from its on-line enterprise. Any delay in processing or different points in its technical infrastructure could not solely have an effect on its income but additionally its relationships with prospects.

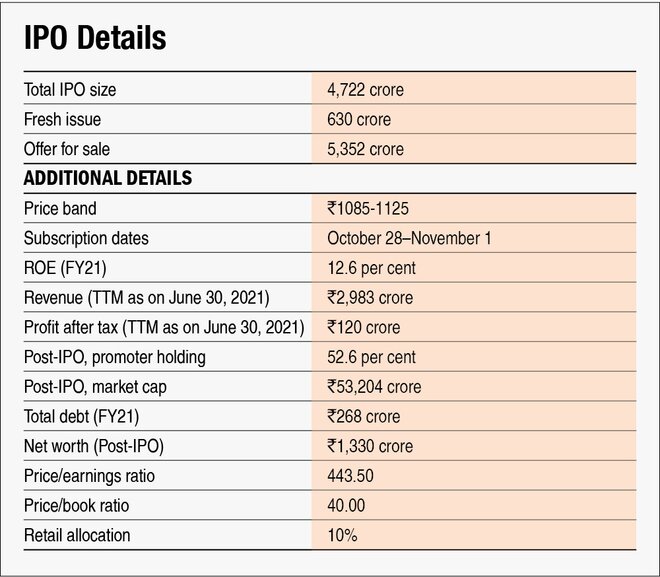

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

Sure, the corporate’s earnings earlier than tax for FY21 was Rs 75.3 crore.

2) Will the corporate be capable of scale up its enterprise?

Sure, the corporate has a comparatively asset-light enterprise. With important spending on advertising to draw new customers and subsidiaries to open new retail shops, it is going to be in a position to scale up its enterprise.

3) Does the corporate have recognisable model/s, really valued by its prospects?

Sure, Nykaa is a number one speciality magnificence and personal-care firm and affords numerous merchandise with growing energetic customers on its on-line platform.

4) Does the corporate have excessive repeat buyer utilization?

Sure. In FY21, the corporate derived round 70 per cent of its income from its current prospects. Additionally, its customer-retention capability is excessive.

5) Does the corporate have a reputable moat?

No. Though the corporate is a frontrunner within the organised magnificence area, it doesn’t provide something distinctive.

6) Is the corporate sufficiently sturdy to main regulatory or geopolitical dangers?

Sure, the corporate doesn’t have main publicity to the worldwide market and it has additionally adhered to all of the regulatory necessities to this point.

7) Is the enterprise of the corporate immune from straightforward replication by new gamers?

No, the corporate just isn’t resistant to new entrants. With adequate expenditure on advertising and know-how, new entrants can simply replicate Nykaa’s enterprise.

8) Is the corporate’s product in a position to stand up to being simply substituted or outdated?

No. As the corporate is in a aggressive area the place numerous different manufacturers provide related merchandise, the corporate’s merchandise may be simply substituted by them.

9) Are the purchasers of the corporate devoid of serious bargaining energy?

Sure, as its prospects are people, nobody has important bargaining energy over the corporate.

10) Are the suppliers of the corporate devoid of serious bargaining energy?

No, the corporate derives a good portion of its income from just a few main distributors. Though Nykaa solely acts as a mediator right here, a fallout by way of the contract would imply a lower in income.

11) Is the extent of competitors the corporate faces comparatively low?

No, the corporate competes with each organised and unorganised gamers, with unorganised gamers having an higher hand proper now with a big market share.

Administration

12) Do any of the corporate’s founders nonetheless maintain at the least a 5 per cent stake within the firm? Or do promoters completely maintain greater than a 25 per cent stake within the firm?

Sure, the founder group Falguni Nayar Household Belief will proceed to carry a 22 per cent stake put up challenge and the promoters as a complete would proceed to carry 52.6 per cent put up challenge.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure, its CEO Mrs Falguni Nayar has been with the corporate since its inception and Mr Manoj Jaiswal, Chief Provide Chain Officer, has been related to the corporate since 2013.

14) Is the administration reliable? Is it clear in its disclosures, that are per SEBI pointers?

Sure, we now have no motive to consider in any other case.

15) Is the corporate freed from litigation in court docket or with the regulator that casts doubts on the intention of the administration?

Sure, though the corporate has 12 circumstances concerning tax claims in opposition to it, it doesn’t solid any doubt on the administration’s intention.

16) Is the corporate’s accounting coverage steady?

Sure, we now have no motive to consider in any other case.

17) Is the corporate freed from promoter pledging of its shares?

Sure, the promoter’s shares are freed from pledging.

Financials

18) Did the corporate generate a present and three-year common return on fairness of greater than 15 per cent and a return on capital of greater than 18 per cent?

No, the corporate incurred losses in FY19 and FY20. Its present ROE and ROCE stand at 12.6 per cent and 15.6per cent, respectively.

19) Was the corporate’s working money move constructive in the course of the three years?

No, the corporate reported detrimental money move from operations in FY19.

20) Did the corporate enhance its income by 10 per cent CAGR within the final three years?

Sure, the corporate’s income grew at a charge of 48.2 per cent from FY19 to FY21.

21) Is the corporate’s internet debt-to-equity ratio lower than one or is its interest-coverage ratio greater than two?

Sure, the corporate is net-debt free as on June 30, 2021.

22) Is the corporate free from reliance on big working capital for day-to-day affairs?

Sure, the corporate has a constructive working capital and a working-capital cycle of round 30 days inside which, the corporate converts its gross sales into money.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

Sure, the corporate has an inventory-based enterprise mannequin the place it purchases merchandise immediately from producers. As the corporate has deliberate to utilise part of its proceeds to arrange warehouses and spend money on different subsidiaries, it is not going to want any exterior funding.

24) Have the corporate’s short-term borrowings remained steady or declined (not elevated by better than 15 per cent)?

No, the corporate’s short-term borrowings stood at Rs 266 crore as on June 30, 2021, up from Rs 225 crore in FY19.

25) Is the corporate free from significant contingent liabilities?

Sure, the corporate has contingent liabilities of Rs 13.2 crore, which is 1.8 per cent of its fairness as on June 30, 2021.

Inventory/valuations

26) Does the inventory provide an operating-earnings yield of greater than 8 per cent on its enterprise worth?

No, the corporate’s inventory will provide an operating-earnings yield of 0.2 per cent on its enterprise worth.

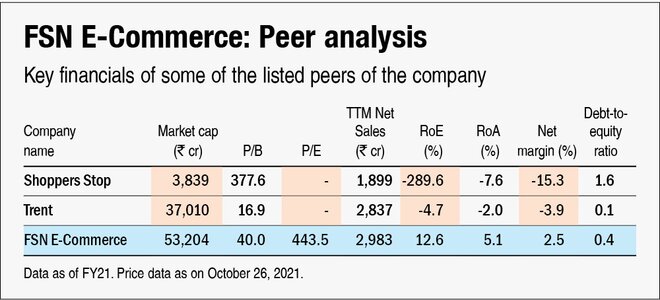

27) Is the inventory’s price-to-earnings lower than its friends’ median degree?

Not relevant. Though no different listed firm is engaged in an identical e-commerce enterprise, Consumers Cease and Trent are some large offline retail gamers. Each these corporations incurred losses in FY21.

28) Is the inventory’s price-to-book worth lower than its friends’ median degree?

Not relevant. Submit-IPO, the corporate’s inventory will commerce at a P/B of round 40.0, whereas Consumers Cease and Trent commerce at a P/B of 377.6 and 16.9, respectively.

Disclaimer: The authors could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link