[ad_1]

An acrid scent hangs within the air at Trenton Forging Co. on the outskirts of Detroit as a 4,500 pound hammer slams a bar of crimson sizzling metal with sufficient drive to shake the constructing.

A employee makes use of tongs to place the piece, heated to 2,200 levels, below the hammer, then onto a conveyor belt. The method is repeated 7,000 occasions a day on the 90-employee plant, leading to gasoline rails that feed gasoline to injectors.

However the days of forging gasoline rails is numbered. They’re amongst lots of of elements in inner combustion engines that received’t be wanted when the nation transitions to electrical automobiles, a incontrovertible fact that isn’t misplaced on Dane Moxlow, the vice chairman of Trenton Forging, whose grandfather began the enterprise in 1967.

“This would possibly go away utterly,” Moxlow, 33, mentioned as a pair of employees behind him inspected a freshly made rail. “Is it one thing we fear about? Yeah. But it surely’s additionally one thing we plan for.”

Throughout the nation, 1000’s of firms reminiscent of Trenton Forging are warily eyeing a future of electrical automobiles that comprise a fraction of the elements of their gasoline-powered counterparts and require much less servicing and no fossil fuels or corn-based ethanol. It’s a transition that might be felt effectively past Detroit, as thousands and thousands of employees at restore outlets, gasoline stations, oil fields and farms discover their jobs affected by an financial dislocation of historic proportions.

“Anyone who thinks this transition goes to go easily is fooling themselves,” mentioned Michael Robinet, government director of automotive advisory companies for consulting agency IHS Markit.

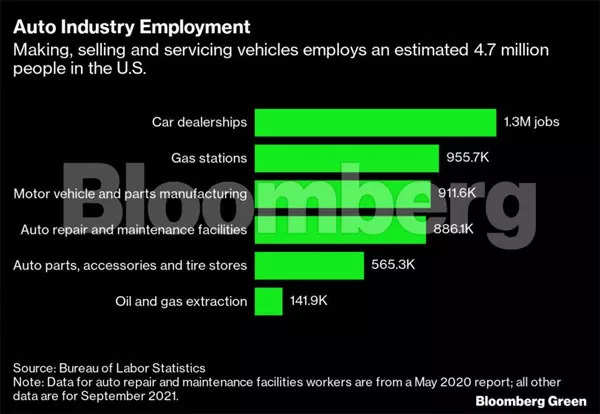

Making, promoting and servicing automobiles make use of an estimated 4.7 million folks within the U.S., based on the Bureau of Labor Statistics. Among the jobs received’t go away, after all — there’ll nonetheless be a necessity for dealerships and tire outlets.

Making the large batteries that line the underside of electrical vehicles guarantees to make use of 1000’s. However the place a traditional automotive’s engine and transmission have lots of of elements, some electric-vehicle powertrains have as few as 17, based on the Congressional Analysis Service. That doesn’t take note of the radiators, gasoline tanks or exhaust programs that electrical automobiles don’t want. As soon as working, an electrical automotive has no spark plugs or oil that want altering or mufflers that put on out. And with so few shifting elements, service stations might be relegated to altering tires and windshield wipers.

Typical vehicles will most likely stay on the street for years, softening the blow for restore outlets and different affiliated industries. However with a median lifespan of 12 years, the pattern traces for gasoline-powered automobiles might be heading down.

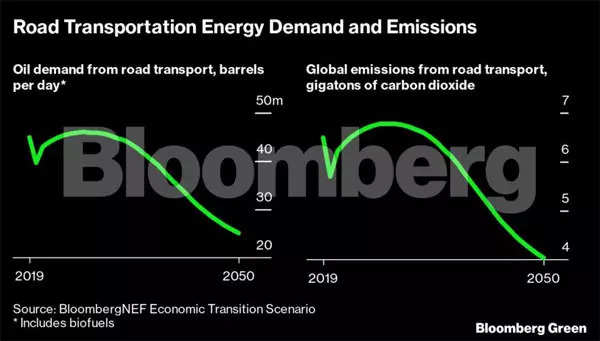

The shift will scale back demand for oil almost by 4.7 million barrels a day by 2040 within the U.S. alone, based on projections by BloombergNEF. That’s about 26% of U.S. consumption, roughly equal to the quantity that Germany and Brazil mixed consumed each day in 2020. Much less gasoline being offered additionally means the necessity for ethanol, which is mixed into motor fuels and consumes a 3rd of the U.S. corn crop, will even fall.

If the story of U.S. financial historical past is one in every of fixed inventive destruction — as gasoline engines displaced steam, aircraft journey trumped trains, plastic ate into metal demand, imported items idled U.S. factories — the approaching shift continues to be exceptional in its scope.

“It’s a disruption that folks can not recognize,” mentioned Paul Eichenberg, managing director of Paul Eichenberg Strategic Consulting. “Really the engine and transmission turns into the buggy whip of the twenty first century. However in the event you take a look at the opposite industries, it’ll have a huge effect.”

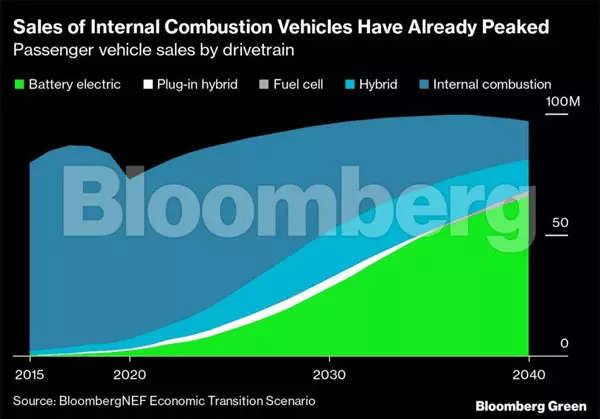

That future is quick approaching. Common Motors Co. has vowed to promote solely zero-emissions fashions by 2035. Ford Motor Co. mentioned it expects 40% of its world car gross sales quantity to be electrical by 2030 and Stellantis NV, the successor to Fiat Chrysler, has mentioned it’s concentrating on over 70% of gross sales in Europe and over 40% within the U.S. to be “low emission automobiles,” which means both electrical or hybrid, by 2030.

The Biden administration is enthusiastically encouraging the transition, which it sees as a key to combating local weather change. It’s proposing an array of incentives and has ordered the federal authorities to affect its fleet. Transportation is accountable for a few third of the greenhouse-gas emissions within the U.S., making it the biggest single sector, based on the Environmental Safety Company.

“The way forward for the American auto trade is electrical,” President Joe Biden mentioned in entrance of a financial institution of electrical automobiles on the White Home garden in August. He then signed an government order setting a objective of getting half of all automobiles offered within the U.S. be emission-free by the top of the last decade. China, he mentioned, is profitable the race to make electrical automobiles and the U.S. should catch up.

In some ways, the U.S., the place solely 2% of automobiles offered are electrical, is a laggard. France plans to ban inner combustion engines in 2030, and China and Britain will accomplish that by 2040. India says it’s setting an “aspirational goal” of all-electric gross sales by 2030.

The United Auto Staff union, seeing the handwriting on the wall, is gearing up for a combat over who will get to make the batteries that energy the automobiles, mentioned Bernie Ricke, the silver-haired president of Native 600, which represents employees on the Ford plant the place the F-150 pickup truck is made.

“You’ll be able to prefer it or not prefer it — it’s coming,” mentioned Ricke, throughout an interview from his workplace within the shadow of Ford’s large 1,100-acre plant, the place a conventionally powered pickup truck rolls off the meeting line each 53 seconds.

Close by, a nondescript white warehouse with blue bay doorways is being outfitted to make the Lightning, as the electrical F-150 might be identified.

On the occasion on the White Home garden in August, Ricke launched Biden and burdened the necessity to shield union jobs.

“We all know that President Biden understands that, as we transfer ahead, our employees is not going to be left behind,” he mentioned, pointedly. “We all know that President Biden has our again.”

The UAW, which has estimated the shift to electrical may consequence within the lack of 35,000 union jobs, says it’s taking a practical strategy and is pushing for protections for employees. That features commitments that jobs be positioned within the U.S. at comparable wages and advantages.

“We’re not operating from and combating expertise that everybody sees is coming,” mentioned Jeff Dokho, director of analysis on the union’s headquarters. “We’re saying in the event you’re going to take taxpayer cash, it’s essential to have the gold-standard jobs like constructing powertrains. We’re pushing for ‘In the event you’re going to take authorities cash, the opposite facet is there have to be good jobs in these communities.’ Our focus has been to attempt to connect labor provisions wherever we will.”

“Similar to in China and Europe, for all this to work, there must be an enormous public funding,” Dokho mentioned. “We really feel like within the present setting, we should always have strings connected.”

From his Metropolis Corridor workplace throughout the road from from GM’s World Technical Heart, Mayor Jim Fouts of Warren, Michigan, ticked off a listing of advantages and investments that electrical automobiles had introduced. Chrysler is planning to re-open a plant on the town to provide an electrical model of the Jeep Wagoneer and with it 6,000 jobs, Fouts mentioned.

“A lot of the improvement happening in Warren is said to electrical automobiles and batteries,” mentioned Fouts, a bespectacled 78 year-old, whose age is belied by a twice-a-day operating behavior. “There’s a higher realization by increasingly folks that the time is now to enter one thing that won’t hurt the setting which is what fossil fuels are doing.”

Nonetheless, Fouts mentioned, a few of Warren’s 134,000 residents have been fearful concerning the future.

“There may be quite a lot of reticence about whether or not automation and electrical automobiles will substitute their jobs,” Fouts mentioned. “I believe with coaching they are going to be OK.”

Dan Turke, a 50-year-old millwright for Stellantis, takes a philosopical view.

“Electrical automobiles are nice,” mentioned Turke, carrying security goggles and carrying a thermos as he ready to start out his shift on the firm’s 3.31 million square-foot Warren Truck Meeting Plant. “Any person’s nonetheless received to construct them.”

However the jobs created received’t essentially resemble those misplaced, mentioned Eichenberg, the guide, who’s a former government for auto half provider Magna Worldwide Inc. Elements reminiscent of transistors and capacitors and high-voltage battery packs are manufactured in a lot alternative ways — which means a employee on an engine manufacturing line can’t merely swap to creating batteries.

“It’s like evaluating apples and oranges,” Eichenberg mentioned. “They’re chemical firms, they’re supplies firms and, as you’ve gotten this variation, there’s only a basic distinction.”

The Motor & Tools Producers Affiliation, which represents elements suppliers reminiscent of Valeo North America and Robert Bosch LLC, estimates that the U.S. auto elements trade may lose as a lot as 30% of its workforce or almost 300,000 jobs when the transition is full.

“Suppliers, the UAW, plenty of people are proper to be involved,” mentioned Ann Wilson, a senior vice chairman on the affiliation. “The fact is the transition goes to happen whether or not they’re involved or not.”

The approaching change might be likened to the electrification of America within the early a part of the twentieth century, when the nation started switching from the steam energy to electrical energy, mentioned Theodore DeWitt, College of Massachusetts Boston professor of administration.

That change required factories that now not wanted large steam engines in the midst of their vegetation to retool, nevertheless it additionally created new jobs, together with ones that didn’t exist earlier than, reminiscent of electrician. For a time, that grew to become largest occupation within the nation, DeWitt mentioned.

“I don’t assume there’s a case for industrial transformation the place we haven’t misplaced jobs and created others,” DeWitt mentioned. “There might be jobs that didn’t exist earlier than.”

The transition is already creating alternatives. GM and South Korean-based battery maker LG Power Resolution introduced in April they’d construct a $2.3 billion battery plant in Tennessee to produce the automaker’s electrical car. Invoice Lee, the state’s Republican governor, mentioned it was the “largest single funding of financial exercise within the state’s historical past.”

The plant will make use of 1,300 folks when it begins manufacturing, and it represents the second three way partnership for the 2 firms. GM and LG Power already are setting up their first vehicle-battery plant in Lordstown, Ohio. That plant will make use of greater than 1,000 employees and provide batteries to Manufacturing unit Zero, an electric-truck manufacturing unit close to Detroit. Stellantis and Korean battery-maker Samsung SDI on Thursday introduced plans to construct a manufacturing unit within the U.S., including to the automaker’s battery tasks in North America.

“That is internet job creator for whoever captures the race for world clear transportation,” mentioned Joe Britton, government director of the Zero Emission Transportation Affiliation, which represents electrical car makers reminiscent of Tesla Inc. and Lordstown Motors Corp. “We now have an enormous alternative to take a position properly and that’s what our international rivals are doing.”

But the transition will lead to winners and losers. Metallic forging is within the latter class. Totally 1 / 4 of the a $90 billion the trade generates annually comes from car elements reminiscent of rods, crankshafts, gears and drive shafts.

For Joseph Schwegman, president of High quality Metal Merchandise in Milford, Michigan, meaning discovering new merchandise to switch the torque converter hubs, a disc-like transmission part, they now make. They received’t be wanted in an electrical car.

The 40-person forging firm is contemplating making hand instruments like pliers and can be analyzing whether or not current elements they make, like D-rings, can be utilized to carry car batteries.

“We’re going to be much more aggressive in different alternatives,” Schwegman mentioned, as sparks from a metallic grinder showered the manufacturing unit flooring behind him. “We need to proceed to diversify.”

[ad_2]

Source link