[ad_1]

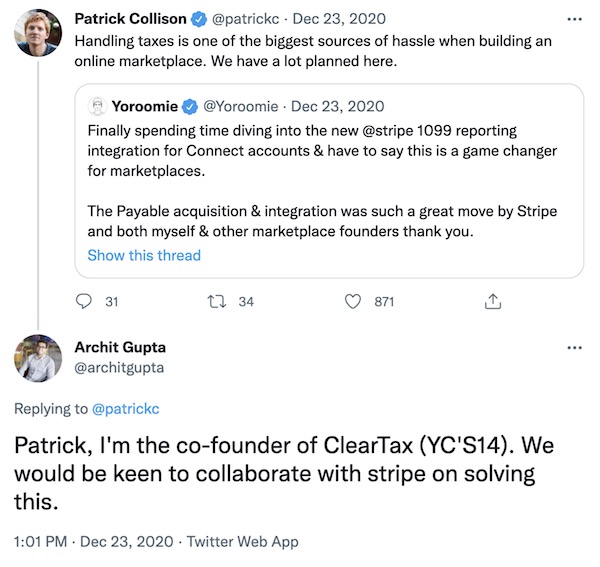

Stripe has made its second funding in India, simply days after disclosing the primary. One of many world’s most beneficial startups has backed Bangalore-based SaaS fintech agency Clear, the 2 stated Sunday night.

The ten-year-old Indian startup, previously referred to as ClearTax, stated it has raised $75 million in its Sequence C funding. The spherical was led by Kora Capital. Stripe, in addition to Alua Capital, Assume Investments and a number of other different current buyers participated within the spherical, which brings the startup’s all-time elevate to over $140 million. The brand new spherical values the Indian startup at over $700 million, in response to an individual conversant in the matter.

Clear — which counts Y Combinator, Sequoia Capital India, Founders Fund, and Elevation Capital amongst its earliest buyers — helps people and companies file their tax returns. It additionally gives wealth administration recommendation to people, and helps companies with e-invoicing and credit score.

The startup says over 6 million people, and greater than 1 million small and medium-sized companies and over 30,000 enterprises use its platform.

Previously 18 months, stated Archit Gupta, Clear founder and chief govt in an interview with TechCrunch, the startup’s SaaS platform has grown 5 occasions. Clear stated it processes over 10%, up from 3% in 2016, of India’s enterprise invoices with a GMV of $400 billion.

Clear’s marquee providing, ClearTax, began at a time when e-filing was not as fashionable in India. However the startup discovered itself in a great spot because of authorities laws within the following years. (The federal government made e-filing obligatory within the nation 5 years in the past, as an illustration.)

However the variety of folks in India, residence to 1.4 billion folks, who pay taxes remains to be pretty low. (Solely about 60 million people pay taxes in India.) That has been one of many explanation why Clear has expanded its choices to serve companies and likewise broadened to providers corresponding to credit score and wealth administration.

“We’re excited to associate with Clear as they innovate at scale within the Indian SaaS ecosystem, enabling enterprises and SMEs to automate their workflows round taxation, invoicing and a number of other different adjacencies,” stated Nitin Saigal, Kora’s founder and CIO, in an announcement.

Gupta stated the startup will deploy the recent funds to broaden its choices and can also be starting to develop abroad. Clear, which is already serving companies within the Center East, plans to develop to cater to comparable companies in Europe quickly, he stated.

“We welcome Kora, Stripe and our different incoming buyers. Kora has robust expertise in expertise gamers in rising markets and Stripe is a world expertise firm that builds financial infrastructure for the web – we’re excited to be taught from each of them,” he stated.

“India is on an enormous digitisation journey and we’re lucky to be within the excellent storm of digital invoicing, GST, UPI, low cost cellular web and fast adoption of expertise because of Covid-19. We’re doubling down on our SaaS platform to assist companies with collateral free debt and funds. This funding additionally provides us gas for our worldwide growth.”

Stripe has but to enter the Southeast Asia and India markets in a significant manner. The agency has groups at each the areas, however has but to make inroads in both. If it selected to develop to the world’s second largest web market, it could compete with YC and Sequoia Capital India-backed Razorpay, which not too long ago acquired funds from Salesforce and was final valued at $3 billion. Like Clear and Razorpay, Stripe can also be backed by Y Combinator.

Stripe has already backed a minimum of yet another Indian startup, in response to sources.

[ad_2]

Source link