[ad_1]

DSP Mutual Fund has rolled out a brand new fund provide (NFO) on October 18, 2021, within the good beta-index-fund house. It would shut for subscription on October 29, after which it may be bought and offered on the inventory exchanges.

Sensible beta is a fusion of energetic and passive investing methods whereby an index is altered by deleting or knocking off one thing primarily based on a number of elementary, technical or different filters. Globally, smart-beta merchandise have been round for a reasonably very long time however they’ve just lately began to catch Indian traders’ consideration. This mode of investing is also called ‘issue investing’ as a result of it depends on figuring out the important thing elements after which utilizing them to construct portfolios.

“DSP has been the primary mover in launching passive funds utilizing the Equal Weight Technique in India and we’re excited to launch the primary ETF monitoring Nifty 50 Equal Weight index within the nation,” mentioned Kalpen Parekh, MD & CEO, DSP Funding Managers.

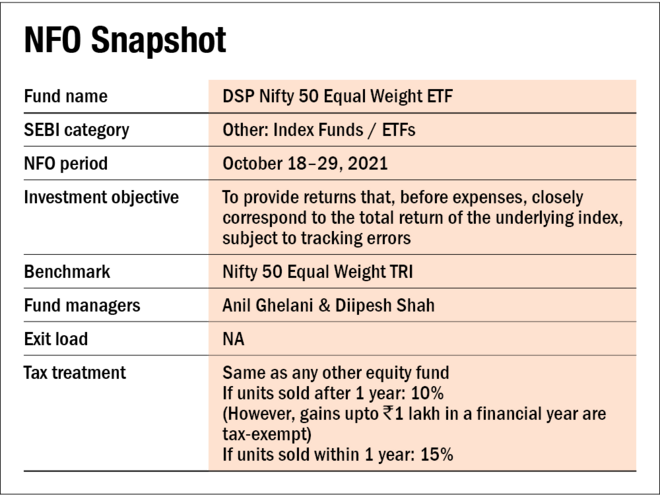

Listed below are the important thing particulars of the brand new fund provide:

In regards to the technique

The newly-launched fund is an exchange-traded fund (ETF) that may mimic the ‘Nifty 50 Equal Weight TRI’. The latter contains Nifty 50 shares however with totally different weighting methodology. Right here, every inventory would have an equal allocation of two per cent within the portfolio somewhat than the normal market-cap weights of constituent shares within the Nifty 50.

In consequence, the brand new fund would provide extra stock-level and sector-level diversification than bellwether indices akin to Nifty 50. This may be clearly articulated from a comparability of prime shares and prime sector allocation between the 2. The AMC has highlighted in its investor presentation that within the Nifty 50 Index, the load of the highest inventory, i.e., Reliance (10.7%), is roughly equal to the load of the underside 17 shares as of September 30. In distinction, the underlying index of the brand new fund offers each inventory an equal potential to contribute to the efficiency. Additional, the highest 5 sectors within the Nifty 50 index make up roughly 83 per cent whereas it is just round 65 per cent for its equal weight variant.

The fund home had beforehand launched an index fund on the identical theme in 2017. With this NFO, the AMC seeks to cater to these traders who may favor the inventory alternate route of investing by way of their demat account, as one can see from the rising ETFs reputation.

Since you’ll get a large-cap-heavy portfolio with this fund, replicability of the index shouldn’t be an issue. That is additional validated by the truth that the same themed index fund – DSP Equal Nifty 50 Fund has a low one-year monitoring error of 0.07 per cent in opposition to the 1Y common monitoring error of 0.15 per cent in large-cap funds as on September 30, 2021. Other than this, two different funds observe the index into consideration, one by Aditya Birla and the opposite by HDFC AMC. Being launched in June- and August 2021, respectively, each are new and can’t be meaningfully analysed.

In regards to the efficiency

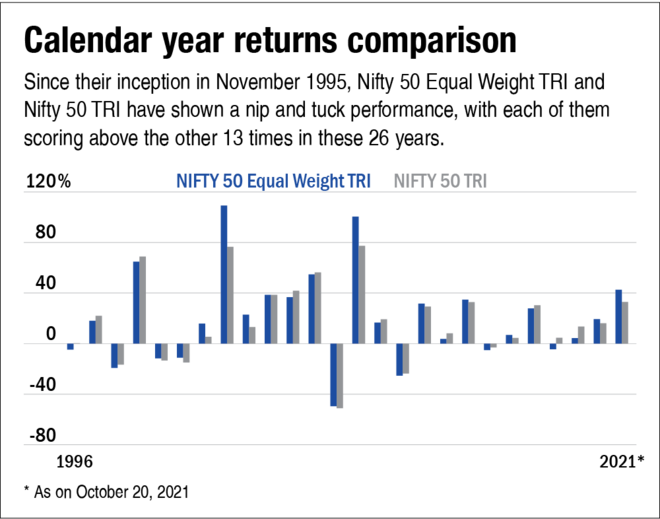

We in contrast the calendar 12 months returns of Nifty 50 Equal Weight TRI and Nifty 50 TRI since their inception in November 1995. What we discovered was certainly a nip and tuck struggle between the 2, with every of them scoring above the opposite 13 occasions in these 26 years (together with YTD 2021).

We additionally in contrast the five-year rolling returns to get a greater long-term image of fairness investing. The consequence exhibits that the underlying index of the brand new fund has constantly overwhelmed the broader index by fairly a large margin until mid-2008. Nonetheless, the next efficiency has been broadly neck-to-neck between the 2. However traders ought to be aware that these are historic traits and can’t be extrapolated into the long run.

In regards to the AMC

Managing complete belongings of round Rs 1.07 lakh crore, DSP ranks among the many prime 10 AMCs in India (as per knowledge of open-end funds as on September 30, 2021). Out of this, Rs 59,000 crore pertains to fairness funds unfold throughout 21 schemes.

Nonetheless, in relation to passive fairness (index funds/ETFs), the fund home at the moment manages a meager Rs 528 crore. Other than the fund investing within the Nifty 50 Equal Weight index as mentioned above, the opposite two fairness index funds run by the AMC observe Nifty 50 and Nifty Subsequent 50 indices. Each of them have a decrease expense ratio and one-year monitoring error in comparison with the common of all different index funds monitoring the identical index.

[ad_2]

Source link