[ad_1]

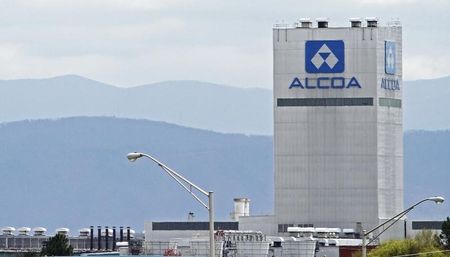

Aluminum provider Alcoa (NYSE:) surged in Friday morning buying and selling following a robust Q3 earnings report and the initiation of a dividend program for the primary time as a newly constituted firm.

The corporate reported $1.76/share in earnings, or $2.05 on an adjusted foundation, each a sequential enchancment and a reversal from shedding cash in Q32020. Its income development was pushed by a sequential improve of 13 p.c within the common realized third-party value of major aluminum, one other reminder of commodity value inflation over current months.

Alcoa’s quarter produced $352M in money movement, and the corporate additionally referred to as out its improved stability sheet, with no debt maturities till 2027.

Alcoa CEO and President, Roy Harvey, mentioned, “The strategic work we’ve been implementing throughout our Firm has helped us successfully seize the advantages from very sturdy market fundamentals and ship one other glorious quarter with file profitability. As we speak, Alcoa is stronger and higher poised for the longer term, and we plan to proceed our constructive momentum and persistently ship worth by way of the commodity cycle.”

It could possibly be with this in thoughts that the corporate instituted a dividend and buyback program. Whereas the quarterly dividend begins at $.1/share, or an annual yield of .7% on the post-earnings share value, the $500M share buyback could also be meatier, as it might cowl roughly 4.75% of the shares excellent if executed on the present value.

Extra important to buyers stands out as the firm’s feedback: “Primarily based on our view of markets and anticipated money flows, we consider these packages might be sustained by way of the commodity cycle,” Harvey mentioned. CFO William Oplinger added, ““The share repurchase program might be financed by working money flows and money available, because the stability sheet has continued to strengthen with proportional adjusted web debt is at its lowest stage because the inception of our Firm in 2016.”

Friends together with Constellium Nv (NYSE:) (+2.4%), Kaiser Aluminum (NASDAQ:) Company (2.75%), and Arconic (2.5%) are buying and selling up on the information.

[ad_2]

Source link