[ad_1]

For a railway line to be worthwhile in India, it should carry extra freight than passengers. However whereas the Konkan line shortly turned well-liked with passengers, it struggled to originate freight visitors because the Indian Railway’s design had reduce it off from industrial hubs and ports within the three states alongside its route.

Right here, within the Konkan expertise, lies a cautionary message for each the federal government and the personal sector as they embark on the just lately introduced bold nationwide monetization pipeline (NMP). To get better the ₹3,600 crore spent on the Konkan line, the Indian Railways successfully hiked the freight charges (a seemingly ‘market-oriented’ answer) by utilizing a system referred to as “chargeable distance”, which makes use of an inflated notional distance determine to calculate tariffs.

“Once I joined the KRCL in 2005, Konkan rail was the shortest bodily distance between western and south-western India,” Anurag Mishra, former managing director of KRCL, advised Mint. “However the inflated chargeable distance calculations by the Indian Railways meant we obtained zero freight visitors. As a substitute, freight nonetheless moved alongside the outdated sophisticated routes—by the south-central and south-western railway strains—as a result of that was cheaper.”

With restricted income, and annual mortgage repayments shortly outstripping operational revenue, KRCL racked up debt for a decade. “I advised the railway board that if they’d solely assure me 5 freight trains a day, we might flip a revenue,” Mishra stated. “They authorised a part of my restructuring plan—we obtained three, typically 4 freight trains a day, and half the IR loans had been transformed into choice shares. By the point I retired in 2009, KRCL was on (the) path to turning a revenue. It continued to do nicely until passenger visitors was suspended throughout India in the course of the covid lockdown.”

View Full Picture

KRCL is likely one of the many rail belongings lined up by the Niti Aayog for the NMP. The corporate is valued at ₹7,281 crore and is scheduled to be privatized in FY24. However even right this moment, its freight worth stands at 25-75% of the projections that had been made when it was designed three many years in the past.

Cash, cash, cash

KRCL is illustrative of the numerous difficulties Union finance minister Nirmala Sitharaman will face as she invitations the personal sector to navigate a posh panorama mired with built-in contradictions of competitors, authority and tacit authorities management as a part of the NMP.

The NMP needs to boost ₹6 trillion by 2025 by promoting a bunch of publicly-owned belongings throughout the infrastructure spectrum, together with roads, ports, airports, railways, energy vegetation and transmission strains, gasoline pipelines, telecom infrastructure, mines and concrete housing growth initiatives. The minister believes this train is important to maintain the nationwide infrastructure pipeline (NIP)—a programme introduced in 2019 to construct ₹111 trillion of infrastructure initiatives by 2025—alive.

India’s monitor report on privatizing publicly held belongings has been patchy at finest. Successive governments have invited the personal sector into public initiatives reminiscent of roads, energy transmission, mining and telecom with various levels of success. However each authorities has additionally, as a matter in fact, routinely missed its annual disinvestment targets. The Air India sale is at the moment in its third iteration; stake gross sales in Life Insurance coverage Company of India, Container Company of India Ltd, Transport Company of India and Bharat Petroleum Corp. Ltd are all working delayed.

However the Narendra Modi authorities stays assured that the NMP will succeed, and confidence is one thing it’s pressured to venture, because the pandemic has taken a wrecking ball to authorities funds. State governments usually spend twice as a lot because the Union authorities in a given yr on infrastructure spending. Nevertheless, with most states realizing decrease revenues than they budgeted for in 2020-21, they’ve drastically reduce their capex (capital expenditure) outlays this fiscal.

With tightening fiscal constraints at each the Centre and state stage, the federal government wants a win on the NMP. Whereas its fund-raising goal of ₹6 trillion is barely a fraction of the ₹111 trillion wanted for the NIP, success right here would shore up its credibility amongst abroad buyers, lenders and establishments such because the World Financial institution. That’s at the least the assumption that’s driving the present push.

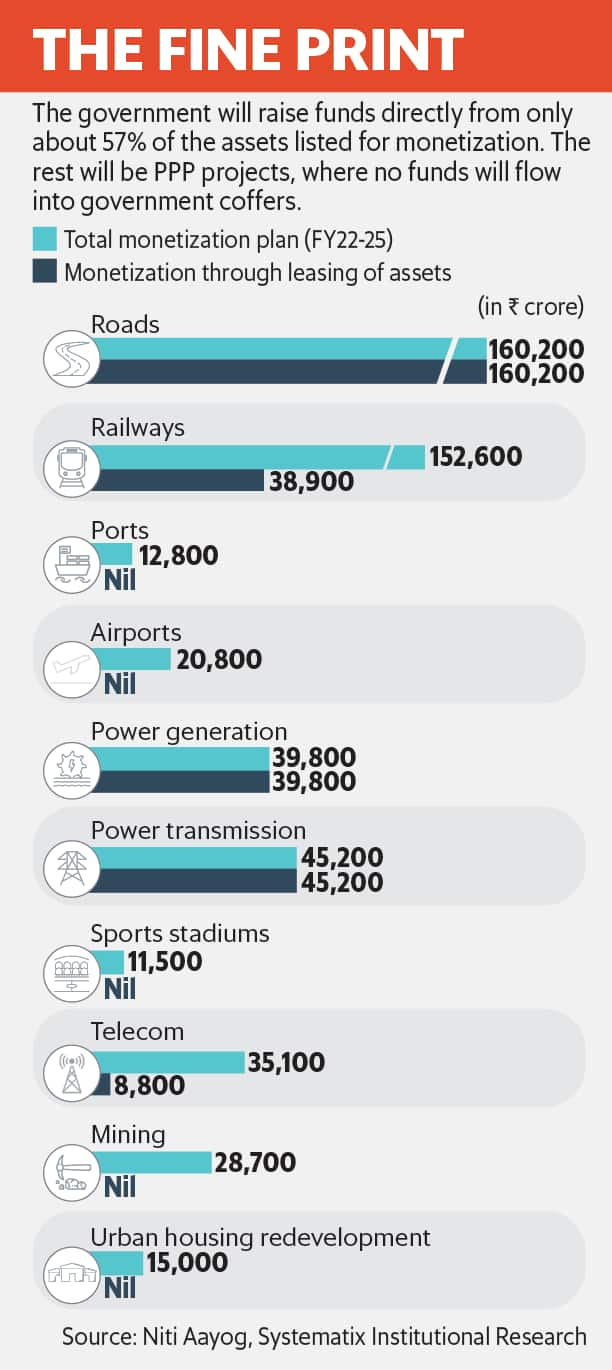

Whereas the Niti Aayog has listed belongings price ₹6 trillion for the NMP, by its personal estimate, it may well solely elevate about ₹3.4 trillion in long-term asset leases. The remaining belongings on the record are to be developed through public-private partnerships, the place the personal associate solely invests within the asset. No cost accrues to the federal government (see Chart).

A 6 September report by Systematix Institutional Equities notes that the NMP is “aggressive” and “over-ambitious” in comparison with the tempo of privatization that India has thus far been in a position to forge.

“Previously three years, a complete of 1,408km of roads have been monetized and now 586km will likely be privatized by the infrastructure funding belief. Towards this, the NMP needs to monetize 26,700km of roads by FY22-25—a 20x soar over 4 years,” the report stated. “This August, the Indian Railways witnessed an entire failure of its plans to award 109 routes for personal passenger practice operations. The important thing purpose cited was (the) lack of an impartial regulator,” it added. Roads and railways account for a 3rd of all initiatives below the NMP.

Within the energy transmission sector, the regulated tariff initiatives, a part of the stability sheet of Energy Grid Company of India Ltd, should be de-merged first earlier than being privatized, and will pose related transaction overheads such because the continuation of the tax vacation on belongings. The clear vitality belongings on sale are 3.5 gigawatts of vegetation owned by public sector models. The problem right here will likely be to promote belongings at guide worth at a time when newer vegetation are being constructed at ever-falling tariffs.

Bouquet of alternatives

Regardless of these complexities, at the least a piece of the personal sector is happy with the preliminary promise of the NMP. Kishore Desai, a part of Hyderabad-based Megha Engineering and Infrastructures Ltd’s company technique group, stated that corporations like his are excited by the NMP and NIP. “The 2 programmes supply a bouquet of alternatives to fulfill our bold plans to step up our investments in India’s infrastructure sector. Most of the belongings listed are additionally marquee initiatives.”

Dhaval Monani, resident fellow at IDFC Institute, is optimistic that the personal sector can tease out positive aspects from under-utilized authorities belongings. “In fact, the headline variety of ₹6 trillion is deceptive, but when the federal government can pull off even a part of this, it would get upfront return on its belongings,” Monani stated. “The federal government has to additionally ring fence the funds raised, in order that they return into infra creation and never the consolidated fund.”

He says fears that the NMP might result in furthering crony capitalism are unfounded. “Have a look at the bids for inexpensive housing initiatives below the Pradhan Mantri Awas Yojana. It’s principally native builders within the respective districts profitable initiatives,” Monani stated. “They’re even in a position to undercut giant corporates like Larsen and Toubro on such bids. I believe if the federal government can maintain asset sizes bite-sized, it may well broaden the investor base to keep away from asset hoarding by just a few personal teams.”

The federal government can also be eager to contain personal buyers from the get-go this time. “The NMP took place after intensive stakeholder engagements that ran by March and April,” stated a senior authorities official who was a part of these discussions, however didn’t want to be named. “We’ve taken views on concession agreements, their size and construction; the asset sizes that must be monetized; what ranges of leverage to permit—all of those components are being codified and dealing teams are being fashioned.”

Cautious banks

Home lenders, nevertheless, have conspicuously stayed silent because the NMP’s announcement—with good purpose too. On the peak of the unhealthy mortgage disaster in 2017 that introduced banks to their knees, the infrastructure sector accounted for 1 / 4 of all non-performing belongings. Central financial institution governor Shaktikanta Das indicated final yr that business needed to cease counting on banks for infra lending and should discover different funding avenues.

“Even when the personal sector is within the NMP, I doubt banks will willingly assist these initiatives,” a managing director at a big personal sector financial institution advised Mint on the situation of anonymity. “Provided that our previous expertise remains to be contemporary in our recollections, we is not going to contact any infrastructure venture the place the federal government is a counter-party.”

“Nitin Gadkari, because the Union minister for roads, has made public statements saying authorities officers ought to litigate much less towards personal builders. However his ministry continues to file instances towards builders. There’s no change on the bottom. We (additionally) nonetheless see energy buy agreements routinely getting re-negotiated by states,” the banker added.

In the end, each banks and personal corporations would need credible ensures from the federal government, a steady coverage panorama, and impartial regulation and dispute decision for the NMP to succeed.

Moreover, not each public asset listed within the NMP might require an answer within the type of privatization. Mishra, the previous managing director of Konkan Rail, says it’s troublesome to see any case in favour of privatizing the KRCL.

“I don’t suppose the present administration has been consulted on this resolution. A personal investor will want two assurances to take a position—a minimal visitors assure from the railways and capex to double the present line. If Indian Railways provides these concessions, KRCL gained’t must privatize to extend earnings. And even then, the Konkan line is so deeply interlinked with the Indian Railways that there will likely be little operational independence for a personal investor and restricted freedom to set fares.”

Maybe, the federal government’s actual intention is to not hand over all of the listed belongings and even to boost the said ₹6 trillion by 2025.

“The NMP will rely as a hit even when we don’t obtain 100% of what’s laid out,” the federal government officer quoted earlier stated.

“If the federal government is ready to set up processes that set a blueprint for privatization, it’s a win for us. For those who don’t set an bold goal, no venture positive aspects the eyeballs and political opinions essential to make (the) plans occur. The NMP is grabbing public consideration and political assist. Senior bureaucrats are concerned. The machine is shifting. That’s a win.”

By no means miss a narrative! Keep linked and knowledgeable with Mint.

Obtain

our App Now!!

[ad_2]

Source link