[ad_1]

For the reason that Union Funds 2018, all of us who put money into fairness mutual funds are actually paying a a lot greater value for selecting the flawed funds. I suppose most of you’ll have recognised that date as the start of the (re)imposition of long-term capital good points tax on fairness funds. What buyers do not typically realise is that the ten per cent tax that the federal government costs is simply the foundation reason for your issues. The true downside is much better.

Earlier, realising {that a} fund you had invested in after which switching to a greater one was mainly cost-free, so long as at the very least a 12 months had handed. You earned rather less after which bought off and each rupee might be shifted on to the subsequent fund. Now, whenever you shift, 10 per cent (plus any surcharge) of your good points need to be paid as tax.

Over the course of a 10-15-year funding, if you find yourself shifting your cash three or 4 instances, you lose 10 per cent of your good points each single time. However that is not the one impression. The cash that you just repay as tax doesn’t get added to the subsequent funding, and doesn’t develop. That signifies that the ultimate impression of the straightforward 10 per cent tax is much better. Relying on how you turn funds, it might double that or much more.

Furthermore, due to the best way this missed alternative truly hits you, more often than not you’ll not have any concept of precisely how a lot the hit was. It requires a fancy calculation that mixes a number of tax payouts and a separate stream of compounding alternative prices. Nearly at all times, an investor would simply see every occasion as a separate hit of a nominal 10 per cent.

However that is not all. There’s one more downside that buyers are dealing with. The ten per cent tax is making the decision-making tougher. You might be invested in a fund that’s doing barely worse than many others. Earlier, when you had been satisfied of its issues, you can change instantly as soon as one 12 months was out – no second ideas required. Now, you might have a extra sophisticated if-then-else state of affairs. The fund is doing badly, however how a lot worse? Will it have extra of an impression than the ten per cent tax plus future returns from that 10 per cent? Or is it higher to proceed with an inferior fund or is it higher to take the tax hit. Possibly the fund will enhance; possibly it won’t.

There is not any method of constructing this trade-off logically as a result of the knowledge that you just want is sooner or later. There’ll at all times be a component of guesswork. Typically you’ll be proper; different instances you’ll be flawed. Once you grow to be flawed, it’s possible you’ll be tempted to make one more change after which the identical conundrum will likely be again. There is not any simple method out.

Nonetheless, what all this does imply is that it’s way more vital to speculate rigorously in funds the place there’s a excessive probability of staying for years on finish. A fast analysis based mostly on previous returns or a star ranking that you just test on Worth Analysis On-line can’t be the premise of both investing or promoting out.

The premium on being proper is way greater and one of the best ways of realising that premium is Premium (apologies for the wordplay however I could not resist it as a result of it conveys the concept completely). That is very a lot the form of downside that Worth Analysis Premium will clear up for you. There are three facets of our Premium service that may assist right here:

1. You get to make use of our algorithmic fund selector to decide on the kind of fund that’s best suited for you.

2. Inside that kind, you’ll get to select from a set of handpicked funds that I and my analyst crew have chosen for you.

3. As time passes, we are going to keep watch over how funds evolve and can sign to you the precise time when it makes most sense to modify funds.

Basically, whenever you change into a Premium member of Worth Analysis On-line, you get entry to the extremely focused and goal-oriented work that our analyst crew does. This isn’t one thing that a person can do, even with the assistance of the data-driven content material that our non-Premium members have entry to at no cost.

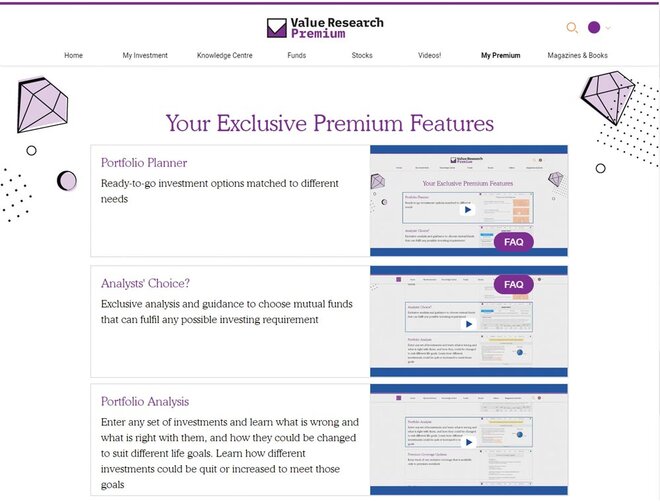

In fact, that is not all that Premium members get. This is an summary of all of the options that you just get:

The headline options

Portfolio Planner: Customized portfolios which can be prompt to you as a part of your Premium membership. The algorithm that we now have advanced takes into consideration your objectives, your earnings, your saving capability and a variety of different components.

Analyst’s Selection: Typically, buyers need to select their very own funds for some specific funding objective. As a Premium member, you should have entry to Analyst’s Selection, the place 562 complete funds are narrowed all the way down to 42 handpicked ones (as on August 9, 2021).

Portfolio Evaluation: Only some members are beginning their investing from scratch. For many of you, an enormous query is whether or not your current investments match into your objectives? You may get an analysis and a prompt fix-list based mostly on our knowledgeable groups’ inputs.

These are simply headline options. There are much more that may assist you maintain monitor of your investments, returns, diversification, taxation and virtually the whole lot else that may assist you obtain your monetary objectives.

So, head over to vro.in/premium, learn extra particulars of those options, see glimpses of what Premium has to supply, learn testimonials of our members and subscribe at a reduction of as much as 40 per cent.

[ad_2]

Source link