[ad_1]

For those who’ve ever needed to take out a mortgage, you understand simply what number of paperwork are concerned within the approval course of.

It’s quite a bit.

The method is tedious and time-consuming, and in lots of extra circumstances than you’d count on — nonetheless guide.

Ocrolus is a startup that’s hoping to vary that with an automation platform that it says analyzes monetary paperwork with over 99% accuracy. To that finish, the New York-based firm at the moment has introduced that it has raised $80 million in Collection C funding towards its mission of serving to lenders automate the underwriting course of.

Fin VC led the financing, which values New York-based Ocrolus at “north of $500 million” and brings its complete funding raised since its 2014 inception to over $100 million. Thomvest Ventures, Mubadala Ventures, Oak HC/FT, FinTech Collective, QED Traders, Bullpen Capital, ValueStream Ventures, Laconia, RiverPark Ventures, Stage II Capital and Cross River Financial institution additionally participated within the newest spherical.

The corporate is one that’s refreshingly clear about its financials. From the primary quarter of 2018 to the second quarter of 2021, Ocrolus has grown its income from $1 million to $20 million in annual recurring income (ARR), in line with co-founder and CEO Sam Bobley. It has managed to land quite a lot of high-profile fintech clients, together with Brex, Enova, LendingClub, PayPal, Plaid and SoFi.

And it’s performed that by spending roughly $10 million in complete gross sales and advertising bills, Bobley stated.

Now it’s able to go after extra conventional monetary establishments too. With its new capital, the startup plans to “extra aggressively” construct merchandise for the mortgage lending and banking industries and increase its U.S. operations.

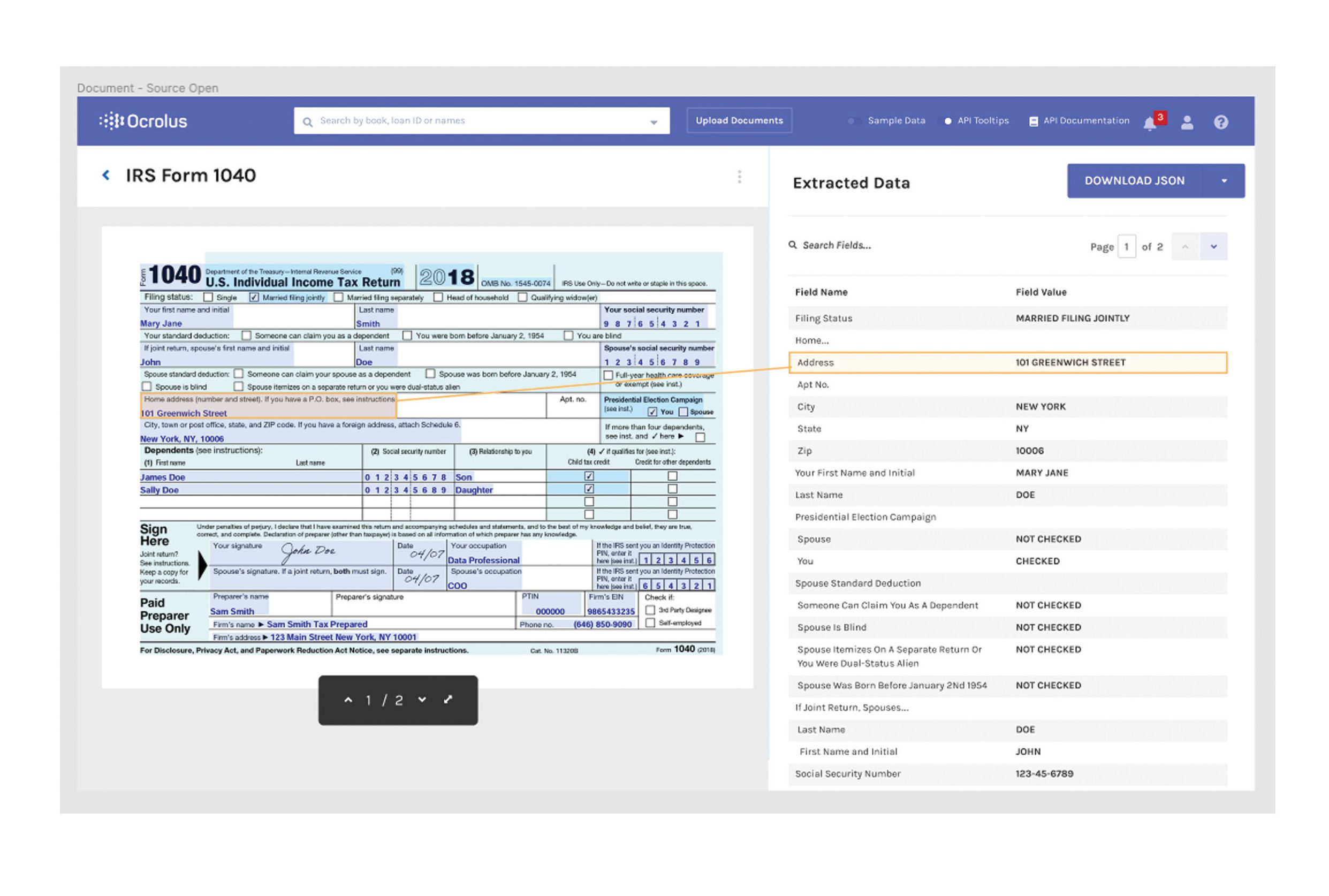

Ocrolus makes use of a mix of know-how, together with OCR (optical character recognition), machine studying/AI and large knowledge to investigate monetary paperwork. However what units it aside, says Bobley, is the Human-in-the-Loop (HITL) element additionally utilized in doc processing to additional guarantee accuracy.

In a nutshell, the corporate goals to assist lenders make “quicker, data-driven selections.” Its know-how can classify monetary paperwork, seize key knowledge fields, detect fraud and analyze money flows, in line with Bobley. It’s clear that the COVID-19 pandemic has led to a digital acceleration in lots of industries, with monetary providers being among the many most affected. Previous to the pandemic, lower than 1% of loans on the earth had been made on-line, notes Bobley. However because the COVID-19 outbreak, demand for digital lending know-how amongst conventional monetary providers corporations has “accelerated dramatically.”

“Now, as COVID-19 has pressured monetary establishments to evolve, each lender and financial institution has no selection however to supply on-line choices to clients,” he stated.

Fin VC managing common associate and founder Logan Allin agrees, stating that fintechs and banks alike nonetheless battle with “mountains” of digital and paper paperwork in extracting the monetary knowledge they should course of and analyze through the mortgage utility course of.

“Ocrolus has emerged as one of many pillars of the fintech ecosystem and is fixing for these challenges utilizing OCR, AI/ML, and large knowledge/analytics,” he wrote through electronic mail. “We consider that Ocrolus is simply getting began when it comes to the use circumstances and scope of their platform and we’re enthusiastic about this unconstrained TAM.”

Ocrolus will not be the one participant within the area, however what’s serving to drive its progress and set it aside, Allin believes, is its fraud detection and compliance overlay capabilities, in addition to its tailor-made analytics and benchmarking capabilities for its buyer base.

Apparently, Ocrolus began with the intent to automate the long-term care Medicaid utility course of. It discovered that “well-paid professionals” had been spending their time combing via paperwork web page by web page, line by line.

“So we began to analysis the issue and what we discovered is that present know-how out there merely was not correct sufficient to be helpful,” Bobley instructed TechCrunch. Tech giants akin to Microsoft, Amazon and Google provide OCR merchandise, however many battle at studying textual content off of PDFs and pictures, notably when the paperwork are semi-structured or unstructured, Bobley stated. It’s additionally troublesome for machines to make sense of all of the various codecs.

“We wished to create a brand new method of doing this. And what we did was we constructed a machine learning-based platform that additionally incorporates people,” he stated. “The objective was that it doesn’t matter what the doc that was submitted seems like — if it’s a clear doc from Chase, or a blurry cellular phone picture from a group financial institution in Kansas — we’ll be capable to course of it with good accuracy.”

Regardless of the resolution can’t do mechanically, it slices into smaller duties and routes to its personal group of analysts and high quality management specialists to carry out knowledge verification. The corporate then makes use of a collection of algorithm checks to verify its staff did the work accurately.

“Lengthy story quick, we ship again completely correct structured digital knowledge for each single file we course of,” Bobley stated.

Picture Credit: Ocrolus

A few yr or so into the corporate’s life, the group realized that “lending was a a lot larger and extra enticing market alternative” than Medicaid.

“We actually entered the fintech lending area on the proper place on the proper time,” Bobley instructed TechCrunch.

By 2016, the corporate had launched its official product and was producing income.

“One of many advantages of our software program is that it has actually helped fintech lenders scale,” Bobley stated. “Our product, frankly, is 10x higher than doing it manually. As soon as we processed the loans immediately or in a matter of minutes, when all people else was taking hours or days, individuals began to return to us — together with massive fintech lenders — with out us even having a gross sales pressure.”

And for Bobley, the startup is extra than simply about rushing up the mortgage course of. It is usually about monetary inclusion.

“Our platform helps lenders automate underwriting and intelligently leverage money movement and revenue knowledge for credit score scoring” Bobley stated. “By enabling lenders to extra rapidly analyze various sources of economic knowledge, Ocrolus ranges the taking part in area for each borrower, offering expanded entry to credit score at a decrease value.”

The corporate plans to additionally use its new capital to proceed to rent, with a concentrate on its machine studying and knowledge science groups. It’s additionally planning to open a new knowledge high quality management facility in Florida to accommodate monetary establishments and authorities entities with onshore knowledge necessities.

[ad_2]

Source link