[ad_1]

By Anjani Trivedi

International automakers are slashing manufacturing forecasts, which can value the world a whole lot of 1000’s of vehicles within the coming months. But any worries about this consequence belie the underlying issues of an business marred by slowing gross sales and brimming output earlier than the pandemic. In actuality, the newest cuts will solely assist a much-needed (even when painful) rebalancing of the sector.

The cutbacks have come exhausting and quick: The world’s largest automaker, Toyota Motor Corp., this month revised down its manufacturing forecast for the yr. Different Japanese producers akin to Nissan Motor Co. and Honda Motor Co. have finished the identical, bringing the mixed determine to over 1 million vehicles.

Within the U.Okay., output fell sharply in July, marking the worst efficiency in that month since 1956. Within the U.S., provide was 50% beneath final yr’s degree and 70% beneath 2019 at finish of August, in line with Cox Automotive. In the meantime manufacturing could possibly be lowered by greater than 450,000 autos in North America within the second half of the yr – and 1.5 million items for the entire yr.

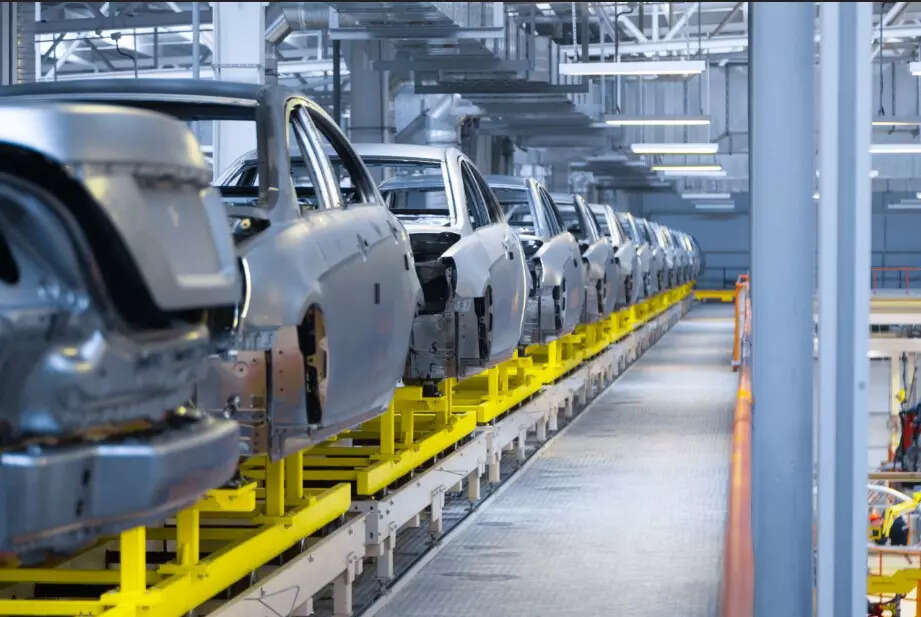

The prospect of fewer vehicles rolling off manufacturing traces could also be troubling. Nevertheless, that is what was speculated to occur, even earlier than the shock of the pandemic. “Peak automotive” was imminent, if not already realized. In that context, having fewer autos isn’t essentially a nasty factor — and, maybe, must be thought-about the brand new regular.

Check out what was taking place earlier than Covid-19. The market was inundated with autos – patrons have been being lured into showrooms with incentives, value cuts and techie options. Automakers have been dealing with powerful emissions rules, the specter of expertise and commerce frictions that have been elevating the price of vehicles.

In early 2020, Volkmar Denner, CEO of Robert Bosch GmbH, one of many world’s largest automotive components suppliers mentioned: “It might effectively be that we’ve handed the height of automotive manufacturing,” as his firm introduced job cuts and a drop in revenue. International automotive output was anticipated to fall for a 3rd consecutive yr as demand cratered and stayed flat in 2020.

All of the whereas, carmakers’ earnings have been barely rising, margins have been thinning and controlling prices was the most important problem. But manufacturing continued to chug alongside as a result of firms noticed no different means out of the morass. So intense was the concern of what would come from the waning world auto business that even the Worldwide Financial Fund sounded the alarm. In its World Financial Outlook report in October 2019, the group famous that the sector accounts for five.7% of worldwide financial output and about 8% of worldwide items exports.

The huge manufacturing cuts might now paint a stark image of what might lie forward for the worldwide financial system. However that’s provided that firms hold doing what they’ve all the time finished. The coronavirus outbreak — and accompanying provide chain shortages and shutdowns — has now pressured automakers into what they’d beforehand been unwilling to do. That is an excellent factor. With all the newest clear air targets, who actually wants so many vehicles, anyway? Particularly as they hold getting dearer.

Certain, there could also be pissed off potential patrons who can’t get their arms on a brand new automotive instantly, or firms not making as a lot as they might have. However the pullback ought to drive a deeper rethink of enterprise fashions, particularly as automakers now have the protection of revenue buffers and hefty working margins, because of the demand-supply imbalance. Corporations may even go a step past changing fuel autos with electrical ones, and contemplate making fewer, higher, greener vehicles.

Any impulse to disregard this chance and return to business-as-usual, churning out heaps of autos carmakers assume shoppers need, could be misguided – and finally way more painful.

[ad_2]

Source link