[ad_1]

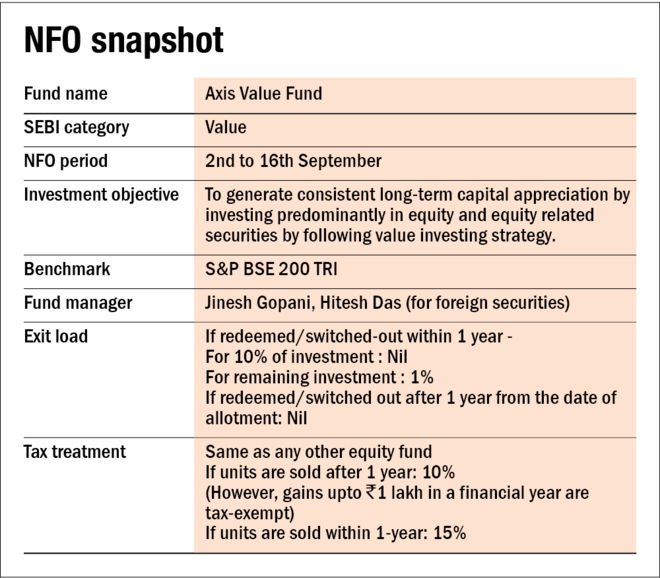

Axis Mutual Fund got here out with a brand new fund provide (NFO) on September 02, 2021 within the value-fund area. The scheme will likely be managed by Jinesh Gopani and benchmarked in opposition to the S&P BSE 200 TRI. The NFO will shut for subscription on September 16, 2021.

Listed below are the important thing particulars of the brand new fund provide:

The technique of the brand new fund

The scheme goals to supply long-term capital progress by investing in a diversified portfolio of corporations which can be chosen by way of worth investing.

The fund’s value-investing method can be to establish the shares that commerce at a valuation that’s decrease than the general market, their very own historic common valuations or relative to their basic valuations. The fund’s philosophy can be to search for the businesses which have the potential to re-rate, with the triggers for administration turnaround and sector dynamics shifts. Nonetheless, the main focus would proceed to be on corporations with sturdy fundamentals, good administration and the potential for prime earnings progress whereas avoiding the chance of entering into worth traps. As per the AMC, the fund would are inclined to have a portfolio make-up of about 50-80 per cent in massive caps and the rest can be in mid and small caps.

With an AUM of over Rs 73,600 crore, the value-oriented class accounted for about 6 per cent of the whole AUM of the open-end fairness business. The highest three funds by property alone represent greater than half of the AUM of the value-oriented class, comprising a complete of 19 funds.

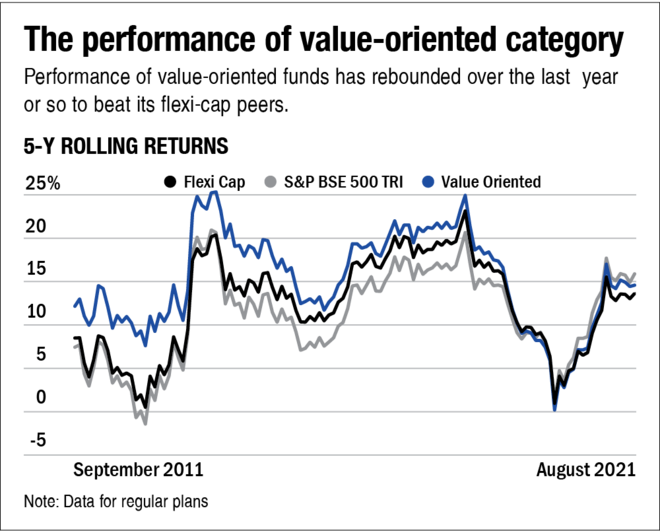

Traditionally, the typical returns of funds within the value-oriented class have been larger than their flexi-cap friends in addition to the diversified S&P BSE 500 Index (see the graph “The efficiency of value-oriented class”). Nonetheless, the class’s efficiency declined within the latter half of 2019, which has once more rebounded during the last 12 months.

In regards to the fund supervisor

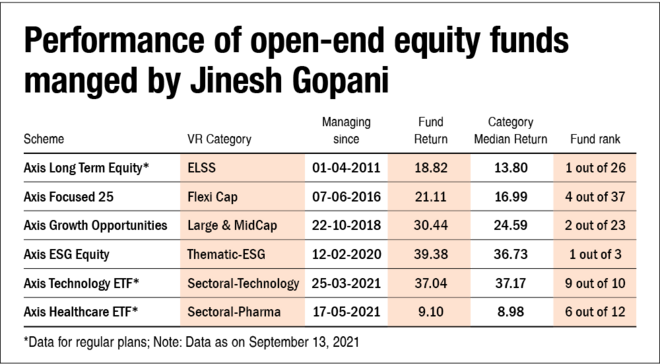

Jinesh Gopani, Head-Fairness at Axis Mutual Fund, has been appointed because the fund supervisor for the worth fund. Previous to becoming a member of Axis AMC, he labored with Birla Solar Life AMC, Voyager India Capital Pvt. Ltd., Emkay Shares & Inventory Brokers Restricted and Web Value Inventory Broking Restricted.

At present, Jinesh is managing six open-end fairness funds of Axis. The efficiency of three of those funds in ELSS, Flexi Cap and Massive & MidCap classes have been within the prime quartile since he took over their administration. Alternatively, the efficiency of the opposite three funds, that are sectoral/thematic funds, has been a blended bag until now over the brief tenure.

In regards to the AMC

Axis Mutual Fund launched its first scheme in October 2009. 75 per cent of the AMC is owned by Axis Financial institution, whereas the remaining 25 per cent is owned by Schroders plc, a UK-based asset supervisor.

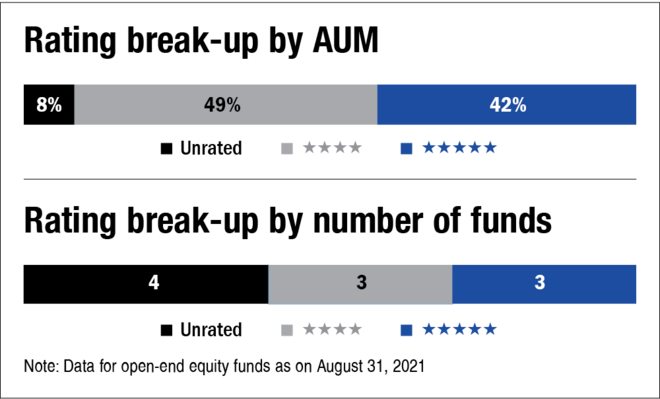

As on August 31, 2021, Axis had an AUM of over Rs 1,29,000 crore within the actively managed open-end fairness area (excluding fund of funds and index funds/ETFs), unfold throughout a basket of 11 funds. Thus, the AMC enjoys the number-one place when it comes to the actively managed open-end fairness AUM.

The AMC constructed up a stable observe document of efficiency over the previous decade and most of its fairness funds are having fun with a four- or five-star ranking, as per the ranking system of Worth Analysis. But it surely’s noteworthy that the AMC has achieved this with a powerful concentrate on the expansion fashion of investing. Due to this fact, this new fund is making a debut from the form of investing fashion the AMC has to this point practised with nice success. Time will inform whether or not it will probably obtain the identical stage of success.

Within the fund’s product doc, the AMC has talked about that worth can act as a double-edged sword however believes that its fund’s philosophy of avoiding worth traps is a key to avoiding drawdown and an vital a part of its worth technique.

[ad_2]

Source link