[ad_1]

When Australian doctor Weng Yee Chin and her husband got here to purchase a Manhattan condo in 2019 earlier than shifting from Hong Kong, they had been “traumatised” by the expertise and rented as an alternative. Armed with pandemic financial savings, they began wanting once more at first of the yr. They might have been enthused by the decrease costs — however that didn’t make the method simple, precisely.

“I really feel that there was loads of worth, in comparison with 2019,” says Chin. The couple made three totally different gives at first of 2021. However all of them failed.

“There have been loads of bargains available for those who had been fortunate and for those who moved on it on the proper time and [were] prepared to compromise,” she says. However competitors was hotting up. By the point they discovered the condo they purchased on the Higher East Facet, the market had clearly shifted, and so they had been compelled to extend their price range. In the long run, the pair paid $3.7m for a three-bedroom rental on the thirtieth ground of a constructing on East ninetieth Road, with loads of room for his or her two daughters and two canine.

However Chin is “holding a really shut eye” in the marketplace lately, she says, questioning: “how a lot did I overpay?”

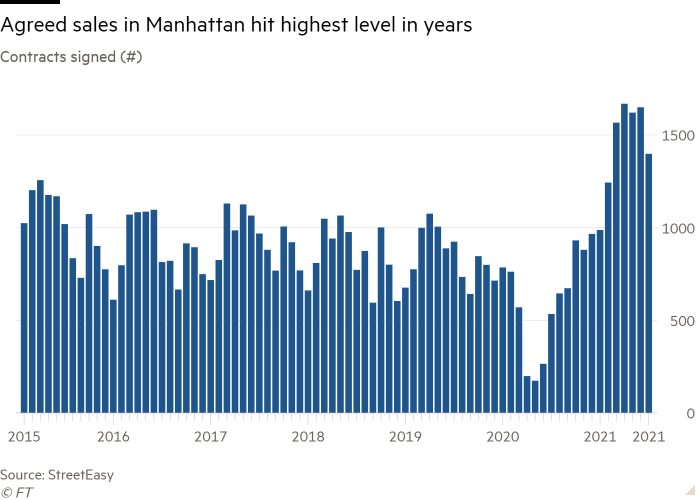

For the previous few months, the Manhattan property market has seen a rebound that few anticipated so rapidly given how abandoned the island felt at first of the pandemic. Property portal StreetEasy reported 4,997 gross sales within the second quarter of 2021, the best since its information began in 2010.

“Since April, I don’t assume we’ve ever achieved this many transactions in such a decent time period,” says Jeff Adler, a dealer with Douglas Elliman.

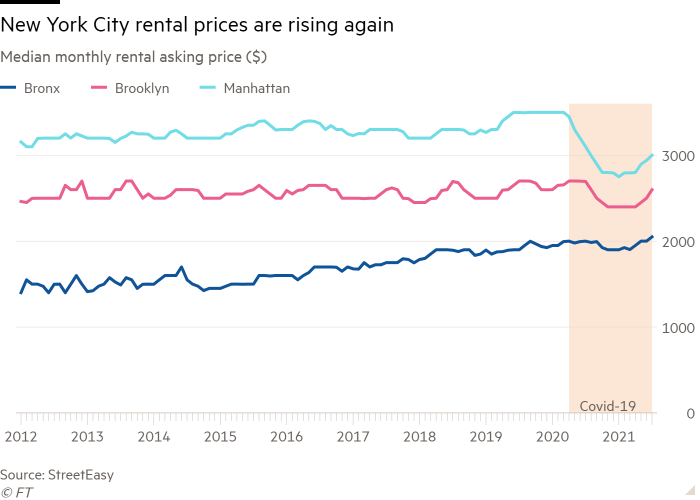

Demand within the rental sector is up, too. “July [2021] was after we actually began to see rents begin to return to virtually pre-pandemic ranges for a number of neighbourhoods,” says Nancy Wu, an economist at StreetEasy.

Olivia Anne, who declined to provide her surname, and her companion, decamped to upstate New York for a lot of the pandemic, letting the lease on their one-bedroom condo in Chelsea lapse in February. When the couple seemed to return to the town this yr, they had been hoping to discover a discount. In the summertime, they put their condo search on maintain till the rental market cools down.

“It was slightly below $4,000 [per month] that we had been paying in the long run. Now I feel the one-bedroom in [our old] constructing is over $5,000,” she says.

Douglas Elliman dealer Marie Espinal says that a few of her prospects are renters opting to purchase relatively than pay such excessive rents.

Within the gross sales market, Wu says the present rebound is a transparent distinction from what was occurring pre-pandemic, when costs had been falling month after month since 2018. In keeping with Douglas Elliman, the median property worth in Manhattan within the second quarter of 2021 was $1.13m, the best degree in eight quarters, and up 5 per cent on the primary quarter.

Wu cites the town’s reopening, low mortgage charges, and a better certainty about the place folks will likely be working from because the “excellent storm” fuelling this new demand, notably for these “who’ve been window searching for the previous yr throughout the pandemic”.

General, dwelling costs have skyrocketed throughout the nation as Individuals have scooped up houses in suburban areas and smaller cities resembling Austin and Phoenix. In Might, property costs within the US had been up practically 17 per cent on the yr earlier than, in line with the S&P CoreLogic Case-Shiller index — the most important leap in additional than 30 years of knowledge. Costs have risen extra slowly in Manhattan, says Wu, due to a surplus of houses in the marketplace.

Regardless of latest rises, the median worth in Manhattan remains to be under the degrees seen 4 years in the past, says Garrett Derderian, director of market intelligence at Serhant. Within the second quarter of 2017, the median gross sales worth peaked at $1.2m, he provides.

All through the market, so-called “Covid reductions” are slowly disappearing. Chase Landow, a Serhant dealer, says a purchaser bought condo 62B at 157 West 57th Road — in any other case referred to as “Billionaires’ Row” — for $16.5m in February 2021, under the condo’s remaining asking worth of $19.9m. A month later, condo 66B went into contract at $19m.

Because the starting of June, 12 residences on the constructing have bought, whereas the previous 12 took six months to promote, in line with StreetEasy.

Deanna Kory, a dealer with Corcoran Group, represented the proprietor of an condo at 115 Central Park West that was listed previous to the pandemic for $12.95m however didn’t promote. It was relisted in April 2021 for $10.95m and closed on August 4 for $13.11m after competitors amongst potential patrons.

“I’ve by no means misplaced out on extra bidding wars in my complete profession as I’ve within the final six months,” Landow says.

One space of Manhattan that continues to be depressed is Midtown East, says Serhant dealer Donna Strugatz. The neighbourhood, which is dwelling to loads of business buildings and luxurious condos, may proceed to lag behind the remainder of the island as extra firms delay their return to workplace on account of the Covid-19 Delta variant.

Like patrons throughout the nation, many New Yorkers are looking for more room, notably for a house workplace.

Douglas Elliman dealer Jacqueline Teplitzky stated her purchasers are even listening to kitchens, lengthy uncared for by New Yorkers, as they pursue newfound passions for cooking. “Covid actually advised us this condo isn’t large enough, not when each [my husband and I] had been working at dwelling and my son was working at dwelling,” says Jennifer Tsao, who closed two weeks in the past on a three-bedroom condo on West Finish Avenue for $2.65m — $100,000 lower than its asking worth. Tsao nonetheless felt stress from the market although, she says, shifting rapidly so nobody else would swoop in and provide extra.

“If this one hadn’t come up, I don’t know if we’d nonetheless be wanting,” she says.

“I feel the rebound we’ve been seeing for the reason that starting of the yr is closely correlated with vaccine adoption,” says Jonathan Miller, chief government of actual property appraisal firm Miller Samuel.

Whereas the third quarter may outpace the second, he provides, the proliferation of the Delta variant may delay some patrons’ plans.

What you should buy for

$600,000 A one-bedroom, co-op condo on MacDougal St in SoHo. Upkeep is $796 per thirty days. Obtainable by Sotheby’s Worldwide Realty.

$3.01m A two-bedroom rental condo on East thirtieth Road in NoMad, Midtown Manhattan. The condo, which measures 1,371 sq ft, has month-to-month upkeep charges of $1,914. Obtainable by Douglas Elliman.

$13.1m A five-bedroom rental condo in Tribeca in Decrease Manhattan. The property, which measures $3,708 sq ft, is out there by Compass.

Steff Chavez is a reporter for Monetary Occasions Specialist publication MandateWire. She is predicated in Chicago and New York

Observe @FTProperty on Twitter or @ft_houseandhome on Instagram to search out out about our newest tales first

[ad_2]

Source link