[ad_1]

As we noticed within the earlier article of this collection, an ETF, or exchange-traded fund, is a reasonably easy product which simply tracks an index. So, by investing in an ETF, you’re successfully investing in its underlying index. Your returns may even doubtless be index-like. For example, in the event you invested in a Sensex or a Nifty ETF, you’d get related returns as these from these indices.

A have a look at your accessible ETF choices reveals that there are 31 fairness ETFs monitoring the Sensex or Nifty indices. It’s possible you’ll ask, what is the distinction between them? If all of them observe the identical index, should not you simply decide one randomly? Nicely, not likely, as a result of there are variations even among the many ETFs that observe the identical index. Listed here are the assorted parameters that it’s best to take into accout whereas selecting an ETF.

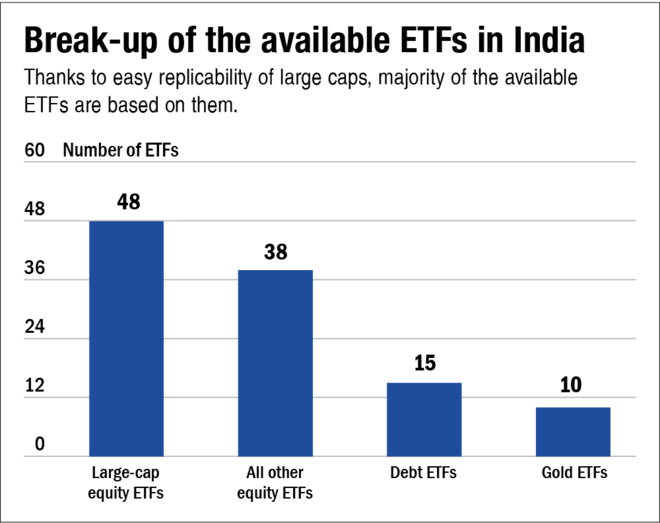

Underlying index: An ETF tracks an index, so first resolve which index you want to put money into. Sensex and Nifty comprise large-cap shares. So, by investing in ETFs that observe them, you’re investing in massive caps. There are ETFs monitoring mid and small caps as nicely. Then there are people who observe worldwide indices. The chart ‘Break-up of the accessible ETFs in India’ exhibits the variety of ETFs by way of their underlying.

As one can see, the ETF universe is extremely skewed in direction of ETFs monitoring large-cap indices, such because the Nifty and the Sensex. That is due to the convenience of replicability. Giant-cap indices represent most liquid shares and therefore it is easy for the fund supervisor to imitate them. Quite the opposite, ETFs monitoring mid and small caps must battle more durable to duplicate their underlying, provided that these segments are typically much less liquid.

Liquidity: Whereas investing in an ETF, you will need to guarantee which you can purchase and promote its items with ease. Thus, you will need to select an ETF that trades with a reasonably excessive buying and selling quantity. That is just like investing in a liquid or an illiquid inventory. A liquid inventory gives you a easy shopping for and promoting expertise. However with an illiquid inventory, your order could stay unexecuted for a very long time.

Entities referred to as authorised members (APs) play an necessary function in sustaining the liquidity of ETFs. An AP is a big monetary establishment, resembling an funding financial institution, that purchases or sells shares required to create a unit of ETF primarily based in the marketplace demand. When the demand of ETFs is excessive, the AP purchases extra shares and helps create extra items of the ETF. Equally, when the demand of the ETF is low, the AP removes ETF items from the market.

Distinction between the value and NAV: The value of an ETF ought to transfer in tandem with its internet asset worth (NAV). Since an ETF is a mutual fund that trades, the NAV is the precise worth of its unit. If the value is greater than the NAV, you’re truly getting the ETF costly. The vice versa can also be true. So, a great ETF will replicate an orderly motion of its worth and NAV. Now and again, nonetheless, because of supply-demand dynamics, this sync could get disturbed. Therefore, all the time see the price-NAV distinction on the time of investing in an ETF.

Monitoring error: The monitoring error signifies how nicely an ETF tracks its underlying index. The decrease the error, the higher.

Bills: Whereas selecting a fund, bills are an necessary consideration. Within the case of actively managed funds, an investor could give desire to efficiency over bills however within the case of ETFs, the place the returns are virtually sure to be just like the underlying index, it could make sense to go for the most affordable ETF. For 2 ETFs that observe the identical index, go for the cheaper one, supplied that the remainder of the determinants are the identical.

Disclaimer: Mutual fund investments are topic to market dangers, learn all scheme associated paperwork fastidiously.

All Mutual Fund traders must undergo a one-time KYC (Know Your Buyer) course of. Traders ought to deal solely with Registered Mutual Funds (RMF).

For additional info on KYC, RMFs and process to lodge a criticism in case of any grievance, it’s possible you’ll refer the Data Heart part accessible on the web site of Mirae Asset Mutual Fund.

[ad_2]

Source link