[ad_1]

Ami Organics is a speciality-chemical firm primarily based out of Gujarat. The corporate was integrated in 2007 and is among the nation’s main producers of pharma intermediaries. Its pharma intermediaries are utilized in regulated and generic APIs (Energetic Pharmaceutical Elements) of anti-cancer, antipsychotic, anti-Parkinson medicines, and plenty of extra. The corporate has 450 pharma intermediaries in 17 therapeutic areas. As of FY21, nearly 88.4 per cent of the corporate’s income comes from pharma intermediaries, and 4.8 per cent from agrochemicals, primarily via their latest acquisition of Gujarat Organics, and 6.7 per cent from different merchandise.

The corporate provides to over 150 prospects in India and 25 abroad nations like Italy, France, US, and UK, to call a couple of. Round 50 per cent of the corporate’s revenues come from exports. It has over 70 per cent market share in Trazodone, Dolutegravir, and Entacapone, that are utilized in anti-depressants, HIV/AIDS, and Parkinson’s treatment. The corporate leverages its R&D to be a number one participant within the trade.

In line with the Frost & Sullivan report, the Indian speciality chemical substances trade is ready to develop by 11-12 per cent CAGR till 2025. Low labour prices and abroad purchasers eager to diversify their provide base away from China are vital causes for India’s potential progress on this trade.

Strengths

- The corporate extremely leverages its R&D to make sure progress and be a frontrunner within the discipline. It has elevated its pharma intermediaries from 425 in 2019 to 450 in 2021 and considers its R&D an asset.

- The corporate has a major presence within the worldwide market as round 50 per cent of its income comes from exports. Each its home and worldwide buyer base is nicely diversified.

- It operates in a excessive entry barrier trade. To grow to be a longtime participant, new entrants should get main approvals and buyer validation.

- Income of the corporate grew at a CAGR of 19.5 per cent from 2019 to 2021, and revenue after tax grew at a CAGR of 52.25 per cent from 2019 to 2021.

Weaknesses

- The corporate operates in one of the vital polluting industries on this planet. Any stringent legal guidelines sooner or later might have an effect on its profitability. China has additionally been shutting down a few of its chemical vegetation to adjust to its Blue Sky coverage.

- All of its manufacturing services are in Gujarat. Any points in that individual area might limit their manufacturing and may hurt the corporate.

- The corporate doesn’t have any long-term agreements with its suppliers. Any delay in buying supplies can delay manufacturing. Round 20 per cent of uncooked materials is imported from China. Geopolitical tensions might trigger a delay in manufacturing.

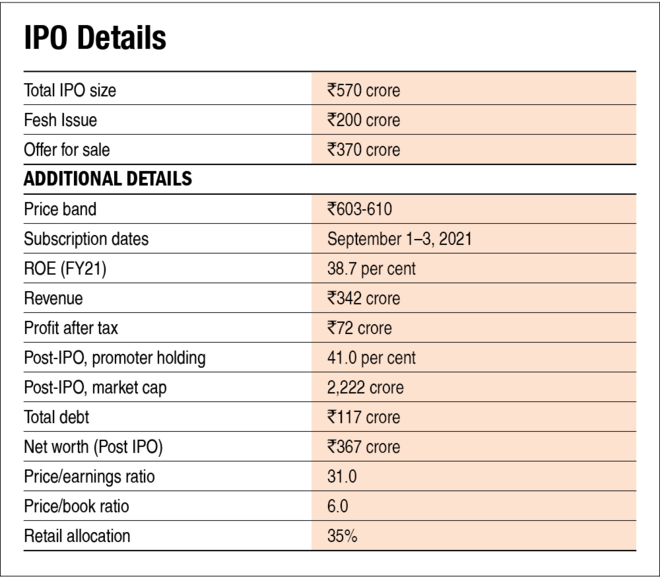

IPO questions

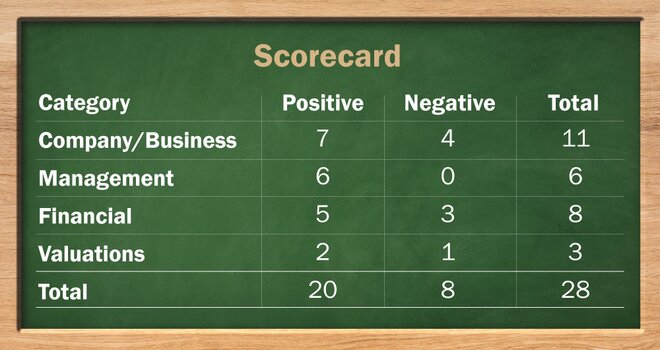

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final twelve months

Sure, the corporate’s earnings earlier than tax for FY21 is Rs 71.1 crore.

2) Will the corporate be capable to scale up its enterprise?

Sure, the corporate is a market chief in pharma intermediaries and at the moment makes use of solely 63 per cent of its capability. This, together with growing functions of speciality chemical substances throughout varied industries, will drive the demand sooner or later. The corporate additionally plans to develop organically and inorganically. It not too long ago acquired Gujarat Organics to foray into the agrochemical trade.

3) Does the corporate have recognisable model/s, actually valued by its prospects?

Sure, it has constructed good model fairness amongst pharmaceutical corporations. The corporate has 50 prospects who’ve been with the corporate for the final 5 years.

4) Does the corporate have excessive repeat buyer utilization?

Sure, 13 of its prospects have been with the corporate for the final 10 years. The highest ten prospects for FY21 have been related to the corporate for over three years.

5) Does the corporate have a reputable moat?

Sure, the corporate is among the largest producers and a market chief in some essential pharma intermediaries, giving it an edge in opposition to its opponents. Additionally, it has many giant home and worldwide pharmaceutical corporations as its purchasers, akin to Laurus Labs, Cadila Healthcare, Cipla, Organike s.r.l.a Socio Unico, and Medichem S.A., to call a couple of. The corporate has additionally obtained US FDA approval for one among its manufacturing services.

6) Is the corporate sufficiently sturdy to main regulatory or geopolitical dangers?

No, the corporate operates in an trade the place varied approvals are wanted and environmental legal guidelines are being imposed. The corporate additionally has vital publicity to worldwide markets, and it imports round 20 per cent of uncooked materials from China. Any vital geopolitical adjustments can hurt the corporate.

7) Is the enterprise of the corporate immune from simple replication by new gamers?

Sure, the trade has excessive obstacles to entry as a result of lengthy gestation interval to grow to be a provider for a shopper, notably for US and Europe-based corporations, which require excessive regulatory compliances. Additionally, the involvement of complicated chemistries in manufacturing pharma intermediates is difficult to commercialise on a big scale.

8) Is the corporate’s product in a position to stand up to being simply substituted or outdated?

Sure, the pharma intermediaries of the corporate are being utilized in drugs akin to anti-cancer, anti-psychotics, anti-parkinson’s, and plenty of extra, for which demand is growing and can’t be simply substituted.

9) Are the shoppers of the corporate devoid of serious bargaining energy?

No, the corporate generates nearly 45 per cent of its revenues from its prime 5 prospects however doesn’t have any long-term contractual preparations with its purchasers. It conducts enterprise with them primarily based on orders obtained every now and then.

10) Are the suppliers of the corporate devoid of serious bargaining energy

No, the corporate depends upon a restricted variety of suppliers, with the highest 5 accounting for 35 per cent of its complete purchases, which additionally provide to different corporations.

11) Is the extent of competitors the corporate faces comparatively low?

No, there are a number of gamers within the speciality chemical substances trade in India which have higher monetary sources and higher geographical attain.

Administration

12) Do any of the corporate’s founders nonetheless maintain no less than a 5 per cent stake within the firm? Or do promoters completely maintain greater than a 25 per cent stake within the firm?

Sure, the Govt Chairman and Managing Director, Nareshkumar R Patel, will nonetheless maintain 12.07 per cent of the shares. The promoter group will personal a 41 per cent stake within the firm publish IPO.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure, the Managing Director, Nareshkumar R Patel, has been related to the corporate since its inception.

14) Is the administration reliable? Is it clear in its disclosures, that are in keeping with Sebi tips?

Sure, we have now no purpose to imagine in any other case.

15) Is the corporate freed from litigation in court docket or with the regulator that casts doubts on the intention of the administration?

Sure, the corporate is free from any materials litigation.

16) Is the corporate’s accounting coverage secure?

Sure, we have now no purpose to imagine in any other case.

17) Is the corporate freed from promoter pledging of its shares?

Sure, the promoters haven’t pledged any of their shareholdings.

Financials

18) Did the corporate generate a present and three-year common return on fairness of greater than 15 per cent and return on capital of greater than 18 per cent?

Sure, the present 12 months ROE is 38.74 per cent, and the three-year common is 33.59 per cent. The present 12 months ROCE is 32.58 per cent, and the three-year common is 30.87 per cent.

19) Was the corporate’s working money circulate optimistic through the three years?

Sure, the corporate’s working money circulate was optimistic through the previous three years.

20) Did the corporate enhance its income by 10 per cent CAGR within the final three years?

Sure, the corporate elevated its income by 19.5 per cent CAGR over the last three years.

21) Is the corporate’s web debt-to-equity ratio lower than 1 or is its curiosity protection ratio greater than 2?

Sure. As of FY21, the corporate’s debt-to-equity ratio is 0.82, and the curiosity protection ratio is 13.77.

22) Is the corporate free from reliance on enormous working capital for day-to-day affairs?

No, the corporate wants a major quantity of working capital to conduct its enterprise. It wants to keep up adequate inventory always to fulfill manufacturing necessities. In FY21, the corporate had 117 working capital days. Additionally, its working capital days have been growing over the last three years.

23) Can the corporate run its enterprise with out counting on exterior funding within the subsequent three years?

No, the corporate requires a major quantity of working capital, and to pursue its progress plans, the corporate may have to depend on exterior funding.

24) Have the corporate’s short-term borrowings remained secure or declined (not elevated by higher than 15%)?

No, the corporate’s short-term borrowings have elevated by nearly 70 per cent between FY19 and FY21 and at the moment stand at Rs 45 crore.

25) Is the corporate free from significant contingent liabilities?

Sure, the corporate is free from any significant contingent liabilities.

Inventory/valuations

26) Does the inventory supply working earnings yield of greater than 8 per cent on its enterprise worth?

No, its inventory will supply an working earnings yield of simply 3 per cent on its enterprise worth.

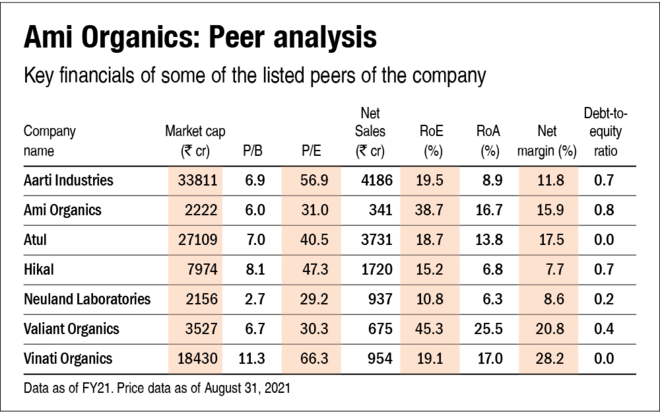

27) Is the inventory’s worth to earnings lower than its friends’ median stage?

Sure, the corporate’s inventory would commerce at a P/E of 31.0, decrease than its peer’s median stage of 43.9.

28) Is the inventory’s worth to e book worth lower than its friends’ median stage?

Sure, the corporate’s inventory would commerce at a P/B of 6.0, decrease than its peer’s median stage of seven.0.

Disclaimer: The authors could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link