[ad_1]

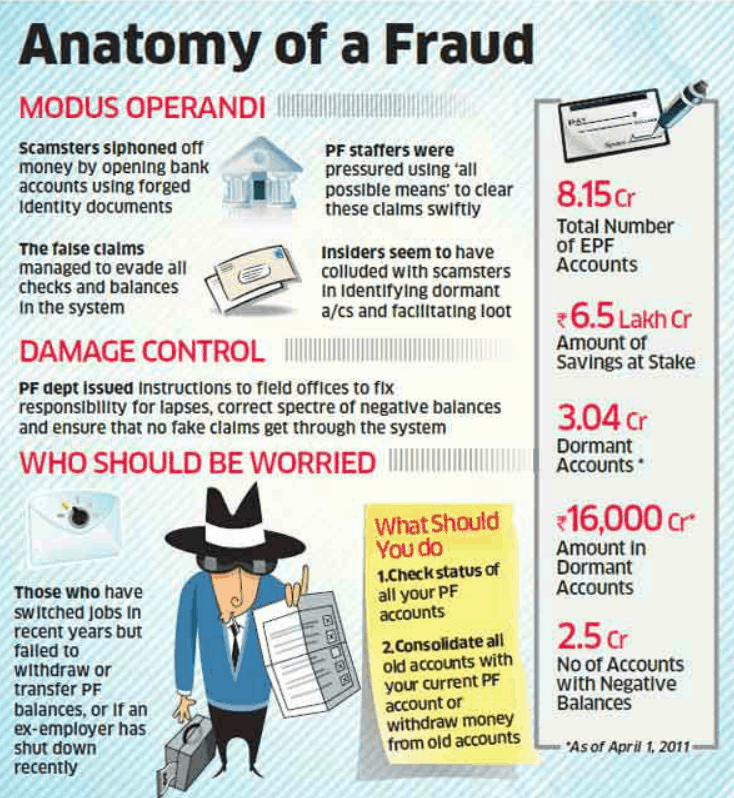

In the previous few days, there’s information that some EPFO staff have finished fraud and siphoned off Rs 21 crores from some EPF account.

How was this EPF fraud finished?

So the fraud was finished on these EPF accounts which belonged to small firms that are inactive from 2006 and there have been some checks and balances which weren’t finished for these previous accounts. One other factor they did is that they solely withdraw 2-3 lacs as a result of it doesn’t for any form of audit (it occurs above 5 lacs withdrawal).

This was finished by few staff of the Mumbai workplace and one of many clerks was the mastermind for this. Round 8 folks have been suspended already and it factors out {that a} greater fraud could also be in place. Extra investigations are occurring proper now!

I’m going to share some startling details in the present day about EPF Frauds which have just lately come to gentle and have been written about and highlighted within the press. And it’s extremely doubtless that a few of you who’re studying this text could be victims of this fraud – simply that you’re unaware of the actual fact in the mean time.

Fraud Withdrawal’s from EPF accounts

Sanjay Kumar is the Chief Vigilance Officer at EPFO and on seventh Oct 2013, a round was issued to all of the EPFO institutions of all areas within the nation with the subject- “Fraudulent withdrawal from the account of EPFO by furnished cast statutory returns”.

The letter talked about scammers making fraudulent withdrawals from varied EPF accounts by submitting cast financial institution accounts and KYC particulars/paperwork. It additionally talked about that EPF officers had colluded with these scammers and helped them withdraw cash from Provident Fund accounts – particularly ones that had been inoperative (no exercise on these accounts) and/or the place the employer not existed (closed or shutdown).

I’ve paraphrased beneath essential excerpts from the round

Level 2. The investigation has revealed that the fraud was dedicated primarily in respect of these institutions the place remittances had not been obtained for a few years, data not up to date and the institution had not submitted statutory returns. Additional no pre-coverage or post-coverage inspections had been carried out of the corporations and no claims had been obtained or settled since lengthy,” it stated.

Level 3. The investigation has revealed that the fraudsters had submitted cast/fabricated returns viz . Type 3A/6A, 9(R), Specimen Signature Playing cards and subsequently, Submitted fictitious claims within the identify of authentic members of non-members. The claims had been settled by placing stress on dealing fingers/workplace by all doable means.

You would possibly concentrate on a number of circumstances the place traders face a slew of obstacles whereas withdrawing their Worker Provident Fund cash. At instances, it takes years earlier than they get any standing of their EPF cash and even when a payout is made, cheques go lacking or are despatched to the incorrect tackle. So, it doesn’t require a lot creativeness to see how within the incorrect fingers the cheques will be cashed just by opening a faux checking account.

Right here is an incident the place an EPF investor confronted the difficulty

Preliminary investigations revealed that there had been big withdrawals and transfers of cash from the person fund accounts of plenty of faculty staff with out their consent and data,” they added. “An FIR was registered and investigations had been initiated by a particular investigation workforce. Throughout the investigation, it got here to gentle that funds had been withdrawn by the treasurer of the varsity by forging signatures of the principal and employees members,” police stated. (Supply)

Some Numbers

To place issues in context, we aren’t speaking about just a few remoted fraud circumstances or few crore rupees right here. The precise scale of the fraud is mind-boggling and can trigger you sleepless nights.

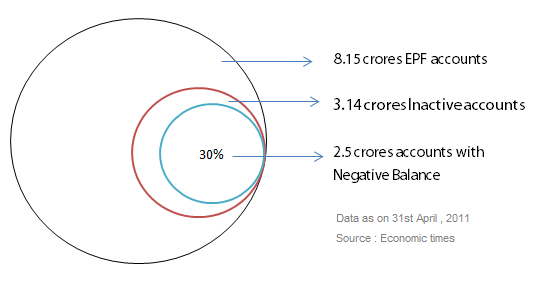

Contemplate this – as on April 2011, there have been shut to eight.15 crore EPF accounts, out of which 3.14 crores EPF accounts had been dormant with a steadiness of near 16,000 crore rupees. Of those 3.14 crore dormant accounts, 2.5 crore accounts had a adverse steadiness, which meant that they didn’t have any cash in them (cash had been completely withdrawn!).

How does EPF Fraud work?

Let’s speak in regards to the modus operandi of the fraudsters intimately, in an effort to perceive the loopholes within the EPFO system. Be aware that this entire fraud is highlighted primarily for dormant accounts, particularly these the place the employer doesn’t exist now. Nonetheless, it will not shock me if frauds began to occur even on lively accounts anytime quickly.

So listed here are the steps which can be taken by fraudsters

Step 1 – Establish a dormant EPF account

Step one is to seek out out all the small print of the dormant EPF account. When you have some cash to spend on bribes or numerous time and endurance to look the Web, you will get all the knowledge you need. The Web abounds with individuals who have given their EPF numbers, names and addresses with out realizing the chance they’re exposing themselves to.

Additionally when you’ve got the cash, you possibly can fairly simply bribe officers and get data. A dormant EPF account is one that doesn’t get any recent contributions for 36 months. At instances the employer depositing the cash within the EPF account closes operations and now the EPF account is completely orphaned and the cash is sitting idle.

The EPF holder is both in one other job ready for that good second when he’ll begin the withdrawal or switch course of or he’s working exterior India and has completely forgotten to take motion on his EPF account. It could even be that the cash within the EPF account is such a trivial quantity that he/she doesn’t trouble to do a lot about it.

Step 2 – Open a checking account with Cast particulars

The fraudster’s subsequent step is to open a checking account with cast particulars and put together a PAN card, tackle proof and so forth. In an setting, the place acquiring faux passports or utterly cast academic levels is little one’s play, it’s no stretch to imagine that it will be straightforward to get faux KYC paperwork made.

Step 3 – Apply for Withdrawal of Claims with cast identification

After all of the paperwork and identification are set, one simply has to refill a withdrawal declare whereas posing because the goal of the meant fraud. If the corporate depositing the cash within the EPF account is now non-existent, then EPFO depends on the financial institution department to verify the authenticity of the checking account (as per the Livemint article)

In any occasion, the construction of EPFO just isn’t centralized i.e. every state has its personal EPFO division and issues are managed domestically. Due to this fact there are completely different EPF account numbers for a similar particular person and completely different EPF accounts opened at completely different intervals. Even the method adopted at every step just isn’t extraordinary however moderately the identical previous rotten method of doing issues.

If there are points at some stage, it has been discovered that insiders have been influenced and helped to cross the claims (as per the EPFO round itself). There is no such thing as a surprise that bribes are given and brought and issues are bent. Right here is proof beneath

The RTI reply additionally revealed that at the very least 1,350 EPFO staff have had corruption prices towards them prior to now 5 years. Of this, 450 are from the officer grade. Most of those officers have been accused of misusing energy and colluding with firms to show a blind eye to their wrongdoings. And yearly, increasingly more such officers are coming below the scanner.

Confirming the pattern, DL Sachdeva, a member of the EPFO board, stated it will be subsequent to unattainable for any firm to siphon off cash with out the assistance of EPFO officers. (Supply)

What it is best to do now?

When you have an previous EPF account that wants consideration, it is best to make sure you withdraw the cash or switch it to your present EPF account. Make sure that you just solely have one single lively EPF account operating.

Don’t depart it unattended for prolonged durations or else be able to face disagreeable surprises sooner or later. In case you want any data or want to maneuver issues ahead, use the RTI software to the EPFO division and issues will transfer rapidly. Additionally, be sure you take normal precautions like not revealing your EPF quantity and different particulars in public and not using a sturdy cause.

Please share your views on this subject and EPFO typically within the feedback part beneath?

[ad_2]

Source link