[ad_1]

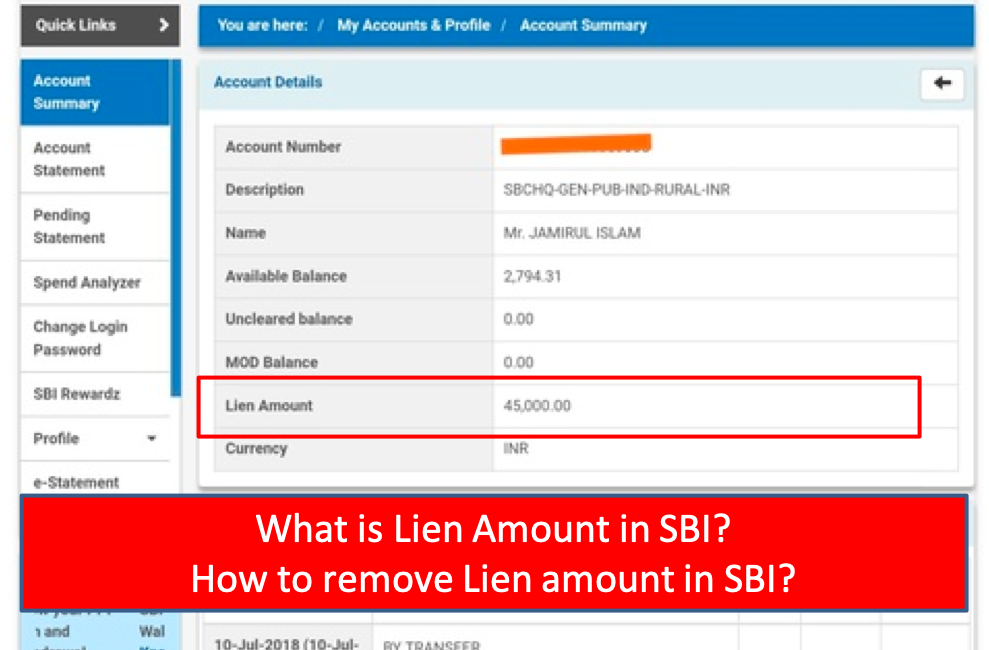

Are you nervous and confused about Lien quantity in SBI? Effectively you aren’t alone. Typically, this shouldn’t be cause to fret. On this put up we cowl about following:

- What’s Lien Quantity?

- Causes for having Lien Quantity in SBI?

- How are you going to take away Lien in SBI on-line & Offline?

What’s Lien Quantity in SBI?

Lien quantity in SBI or another financial institution is obstructing specified quantity in your checking account which you can not withdraw or use with out the approval of the financial institution or involved authority. The lien could also be imposed by the financial institution itself or could also be by way of an authority reminiscent of courtroom or tribunals.

The correct of lien might be charged within the following methods:

• Proper to explicit lien

• Proper to a basic lien

• Proper to lien

Nevertheless, liens typically will not be a cause to fret. Within the subsequent part we talk about what are varied causes for liens in SBI.

Easy methods to generate Common Month-to-month Revenue?

There might be a number of conditions once we search for common earnings. That is very true for individuals after retirement with none pension. Additionally there could be new entrepreneurs who want common earnings till their start-up stabilises. We inform you 13 investments which might generate common earnings for you together with their professionals and cons.

Causes for Lien Quantity in SBI

Your financial institution can put lean in your checking account because of a number of causes. We begin with the most typical first.

When you utilized for IPO by way of your SBI checking account: SEBI had modified the way in which you may apply for IPO a number of years in the past. You may apply to IPOs solely by way of your banks account utilizing ASBA or Software Supported by Blocked Account. On this case the cash doesn’t go away your account till you get confirmed allotment. The cash in your account is placed on Lien (or blocked) from the time you apply for the IPO to the time precise allotment is completed. In case you get the allotment, the required cash is handed on the corporate. In case you don’t get allotment, the lien is eliminated robotically. The good thing about this course of is there isn’t a ready for the cash in case you didn’t get allotment and the cash within the account nonetheless earns curiosity.

Use of Digital Playing cards: SBI and plenty of different banks have the power to create Digital Debit playing cards. These digital playing cards present an additional layer of safety for on-line transactions. These digital playing cards are similar to bodily playing cards – with the one distinction being that it may be used just for on-line transactions and are lively for a short while body. Everytime you create a digital card of certain quantity, that quantity is placed on Lien by SBI. The quantity is barely debited when you really make a transaction by way of your digital card. In case you don’t use the cardboard till its expiry (which is usually 48 hours), the lien is faraway from the account robotically. In case you created the digital card or don’t want it anymore, you may merely “cancel Digital Card” and the lien could be launched instantly.

Fail to pay Financial institution Service Expenses: Financial institution could put a lien in case you did not pay the costs for financial institution’s companies. This will likely embody fees for non-maintenance of minimal steadiness or tons of of different fees that the banks have.

Do you Find out about Hidden Expenses in Banks?

Are you aware you pay a number of thousand rupees yearly to hidden fees of banks. This might vary from extra recognized fines for not sustaining minimal steadiness quantity to lesser know POSDEC cost of ICICI Financial institution. There might be fees for ATM utilization, department visits, cheque books and so forth. Do learn our article on Hidden Expenses in Banks and what you are able to do about it?

Bank cards backed by Fastened Deposits: In case you could have poor credit score historical past, you may get bank card towards fastened deposit. It is a win-win for each the client and the financial institution. When the financial institution points this bank card, it marks lien in your fastened deposit as much as the credit score restrict of the cardboard.

Non-Fee of Credit score Card Dues: The banks can mark Lien in your checking account in case you have not paid your bank card dues from the identical financial institution.

Missed EMIs on Loans: In case you could have mortgage and checking account in the identical financial institution, the financial institution could also be of their authorized rights to mark Lien in your checking account in case you have missed your EMI funds.

Lien because of Court docket or Tribunal Orders: There might be lien in your account because of courtroom orders.

Lien by Tax Division: The tax division can put a lien in your checking account if it has cause to imagine that you’ve got tax due. The division has to observe sure authorized course of to get the lien.

Lien because of suspicious actions or any difficulty because of difficulty of cheque or draft

Technical Error: You may get a lien in your account because of some technical error both by the underlying software program or because of handbook error accomplished by particular person dealing with it. On this case it’s worthwhile to communicate to the client care or the department supervisor to get the lien eliminated.

Easy methods to take away Lien Quantity in SBI On-line & Offline?

It’s vital to grasp the explanation for Lien Quantity in SBI as it could assist us to plan the subsequent step on take away lien quantity in SBI?

In case your account is on lien because of ASBA and also you need the lien to be eliminated instantly, you must ship a withdrawal request with the difficulty to the registrar of the IPO. When you can wait, the lien could be eliminated if you don’t get allotment of the IPO. With the impact of this, they’ll cancel your bid and instruct the SCSB (Self-certifies Syndicate Financial institution) to unblock your cash.

If the lien is because of digital card, you may cancel the cardboard and the lien is eliminated instantly. The cardboard expires in 48 hours and the lien is eliminated robotically.

For lien in your Fastened Deposit on your bank card, it’s possible you’ll both negotiate the phrases with the financial institution or cancel the cardboard.

For all different conditions, the place the lien is because of non-payment of taxes, charges, excellent loans, and so on, you would wish to pay them again with penalty and take away the lien.

After finishing the required accomplishment financial institution will take away the lien out of your checking account.

If unsure, you may contact your financial institution and the financial institution will present the explanation because of which they put a lien in your checking account and provide the method to resolve it if relevant.

Lien Quantity in SBI FAQs

Do I get financial institution curiosity on the lien quantity in SBI?

Sure, Financial institution gives curiosity on the entire quantity together with the lien quantity. You may withdraw the curiosity however not the lien quantity.

Easy methods to withdraw the lien quantity in SBI?

It is possible for you to to withdraw the quantity marked because the lien quantity when you resolve the difficulty associated to it. You may contact the financial institution for the verification of the explanation and know the process to resolve the difficulty.

Is the lien on my checking account is taken into account as dangerous?

Lien might be voluntary and non-voluntary as properly. Whether it is voluntary to your checking account then there isn’t a drawback.

However, if the financial institution places lien from themselves it represents a adverse picture of the account holder and in addition impacts his credit score rating.

What’s the basic instance of lien?

Contemplate you could have bought a automobile by taking a mortgage. You aren’t capable of pay your EMI even after discover from the financial institution. Financial institution can put a lien in your automobile in addition to the steadiness of your checking account for cost of EMI.

How lengthy does a SBI lien final?

The interval of lien in checking account would rely on the explanation of the lien. It may be as brief as 48 hours if the lien was towards creation of digital playing cards. In case of IPO by way of ASBA, it could be for 10 days – till the allotment is finalised. For courtroom orders and non -payment of dues the lien lasts till the underlying drawback is resolved.

[ad_2]

Source link