[ad_1]

Are you aware that there’s a chance that your grandparents or another person in household may need some checking account or some coverage which you aren’t privy to until immediately and the cash is mendacity unclaimed for many years?

Sure, that may occur!!

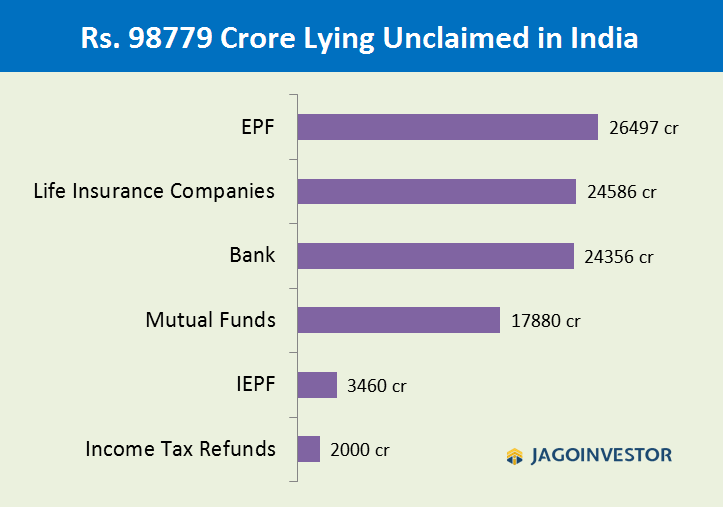

Are you able to imagine {that a} whopping Rs 98,779 crore is mendacity in numerous funding merchandise in India like banks, EPF, PPF, Mutual funds, LIC, and plenty of different entities!!

In final 18 months, so many individuals misplaced their lives and their households had no thought of the investments made by them, or if that they had any life insurance coverage coverage or not. A number of them nonetheless don’t know and can by no means come to know most likely.

What occurs to that cash? How will relations get entry to them? How will they declare it?

They WON’T!

Right here is the breakup of how a lot cash is mendacity unclaimed at numerous locations in India, take a look!

Let’s discuss of those

Rs 24,356 in Banks

As per RBI report, Rs 24356 crore is mendacity unclaimed in round 8.1 crore financial institution accounts as on December 31, 2020. This seems to be near Rs 3,000 on a median per checking account. The largest share on this unclaimed cash is in SBI financial institution after which different non-public sector banks.

Rs 26,497 crores in EPF

That is the amount of cash mendacity unclaimed in EPF accounts throughout the nation. A few of this cash could also be of these folks, who haven’t withdrawn the cash after altering or leaving jobs, however a much bigger chunk is mendacity there from years and years and plenty of of them might by no means be claimed because the households should not conscious of those investments

Rs 17,880 crores in Mutual Funds

An enormous chunk of cash can be mendacity in inactive folios which is near Rs 17,880 crores. A number of traders have invested in mutual funds in bodily format a long time again and plenty of of relations is probably not conscious of those investments after their demise. This unclaimed quantity is near little lower than 1% of complete AUM of mutual funds.

Rs 24,586 crore with Insurance coverage Firms

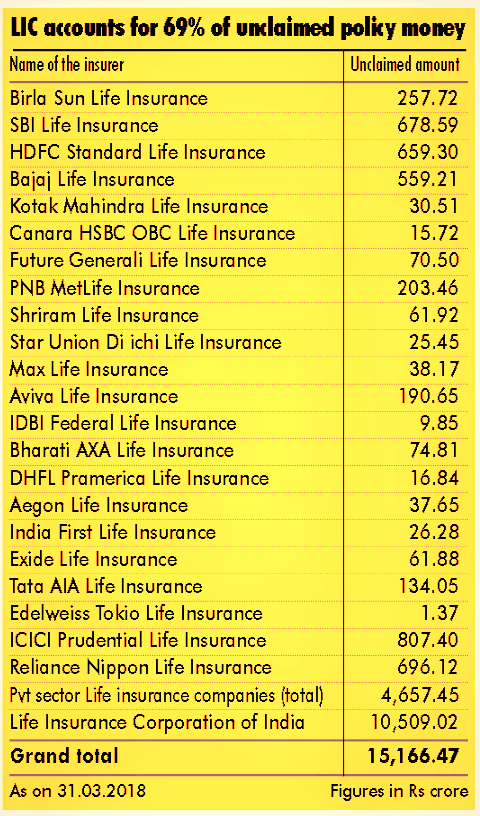

LIC alone had near 10,509 crore mendacity unclaimed with them as of Mar 31, 2018 and one other 4,657 crore was with non-public insurance coverage corporations. The present figures as per IRDA is at whooping 24,586 crore with all of the insurance coverage corporations mixed. Most of that is with LIC and you recognize there are such a lot of insurance policies that are by no means claimed after maturity resulting from numerous causes.

Right here is the previous breakup of those quantities corporations smart as per monetary chronicle report

Rs 3,460 crores with IEPF

An enormous chunk of cash can be mendacity with IEPF in type of unclaimed dividends and debentures and so forth., which have been mendacity idle and nobody, claimed them again on time. These quantities are transferred to one thing known as IEPF after 7 yrs which is then utilized in issues like traders’ consciousness and safety of the pursuits of traders. Moneylife did an in depth story on this whole subject

Rs 2000 crore from Revenue Tax Refunds

As per a 2015 report by NDTV, near Rs 2,000 crore of tax refunds have been mendacity unclaimed with them. If an individual pays further tax resulting from extra TDS deduction, one can declare the refund again by submitting the returns (for final 6 yrs). Nonetheless many a instances traders should not even privy to these refunds or resulting from laziness they don’t file the returns. Now the figures have to be on greater finish.

The place does all this unclaimed cash go?

The query is – If all this cash is unclaimed, who precisely will get benefitted? Does the financial institution or insurance coverage firm maintain all this cash and simply use it for their very own profit except somebody doesn’t declare it again?

The reply to that’s that govt has fashioned a few of the FUNDS the place these quantities shall get transferred after some variety of years and that fund might be used for some function. Listed here are these funds

1. Senior Citizen Welfare Fund (SCWF)

All of the unclaimed cash from EPF, PPF, Insurance coverage corporations and postal deposits go to Senior Citizen Welfare Scheme which works for the betterment of senior residents who’re under poverty line within the nation. I’m actually not clear that are the schemes or methods they do it.

2. Depositor Training and Consciousness Fund (DEAF)

All the cash which is mendacity claimed within the banks like saving checking account, fastened and recurring deposits, demand drafts and so forth. is transferred to this fund known as DEAF and it’s used for depositor’s consciousness and safety.. Which I actually don’t perceive what it means !

3. Investor Training Safety Fund Authority (IEPF)

IEPF is one other fund which is created for investor safety and monetary consciousness and it will get all of the unclaimed dividends, shares, matured unclaimed dividends and so forth. I’ve already written about methods to declare refund from IEPF right here

Be sure your cash doesn’t change into a part of unclaimed cash in future

The training from that is that you simply shall guarantee that all of your investments particulars and so forth. are shared with your loved ones correctly they usually shall remember about it.

[ad_2]

Source link