[ad_1]

Piramal Capital & Housing Finance, has come out with Piramal Capital & Housing Finance Ltd NCD (Tranche 1) providing 9% and opens for subscription from July 12, 2021.

Piramal Capital & Housing Finance, integrated in 2017 is a non deposit taking housing finance firm and 100% subsidiary of the Piramal Enterprises. The corporate offers in each wholesale and retail loans. Wholesale funding covers primarily actual property builders, corporates, and SMEs throughout sectors whereas Retail loans offers with housing finance, LAP, secured enterprise loans, buy finance, and private loans. Moreover, final month Nationwide Firm Regulation Tribunal has permitted the merger of DHFL with PCHF. piramal capital & housing finance ltd ncd

Piramal Capital & Housing Finance Ltd NCD – Vital Factors

- Provide Interval: July 12 to 23, 2021

- Annual Curiosity Charges for Retail Buyers: as much as 9% relying on tenure

- Value of every bond: Rs 1,000

- Minimal Funding: 10 Bonds (Rs 10,000)

- Max Funding Restrict for Retail Investor: Rs 10 Lakhs

- Credit score Score: CARE AA, ICRA AA with Outlook Unfavourable

- NCD Dimension: Base concern measurement of ₹200 crore, with an choice to retain oversubscription as much as ₹800 crore aggregating as much as ₹1,000 crores

- Date of Allocation: August 11, 2021

- Allotment: First Come First Serve

- Itemizing: Bonds could be listed on BSE & NSE and can entail capital positive aspects tax on exit via secondary market

Be taught All about NCDs

NCDs or non-convertible debentures or extra popularly generally known as Bonds are a bit advanced funding merchandise. You could perceive the product, danger concerned, the taxation on curiosity obtained and whenever you sale it. We now have finished a separate put up concerning this titled – Know all about NCDs.

Additionally you’ll be able to preserve observe of upcoming NCD points right here.

Piramal Capital & Housing Finance Restricted Bonds – Funding Choices

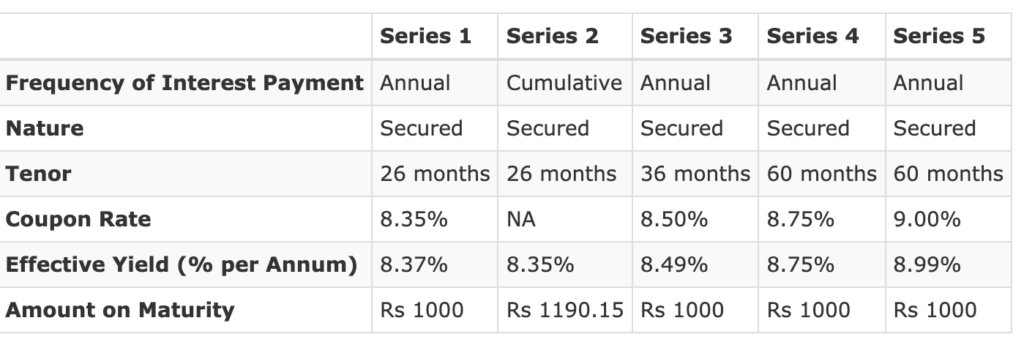

There are 5 choices of funding in PCHF NCD.

Piramal Capital & Housing Finance NCD – Who can Apply?

This concern is open to all Indian residents, HUFs and Establishments.

- Class I – Institutional Buyers – 10% of the difficulty is reserved

- Class II – Non-Institutional Buyers, Corporates – 10% of the difficulty is reserved

- Class III – HNIs – 40% of the difficulty is reserved

- Class IV – Retail Particular person Buyers – 40% of the difficulty is reserved

Nonetheless NRIs can not apply for this NCD.

PCHF NCD Evaluation

Why you need to put money into Piramal Capital & Housing Finance NCD?

- AA Credit standing means low doubtless hood of credit score default

- The rates of interest are 3% – 4% larger than your common Financial institution FDs

- No TDS as it will be solely issued in Demat Kind

- Enhance income and mortgage portfolio yr over yr

Why you shouldn’t put money into Piramal Capital & Housing Finance NCD?

- There have been points with some nicely rated corporations like DHFL, IL&FS the place score businesses out of the blue downgrade the score. This danger at all times existed nevertheless it has come to forefront in previous couple of months

- PHFL hase merged with DHFL – which can result in the worsening on the mortgage Portfolio resulting in elevated NPA going ahead.

Apply for Piramal Capital & Housing Finance NCD?

You’ll be able to apply on-line by ASBA facility supplied by banks. It’s the best approach to apply and likewise avoids numerous problem when it comes to KYC and paper work.

apply for NCD via ASBA?

If you wish to apply to NCDs, ASBA is the easiest way to take action. It’s straightforward, safe and the cash leaves the account solely when the bonds are allotted. We now have lined step-by-step course of for ASBA in SBI within the put up. You have got ASBA facility in most massive banks.

In case you don’t wish to do it on-line, you’ll be able to obtain the applying kind from firm web site or Monetary Establishments and undergo assortment facilities.

Suggestion:

- My suggestion is to make investments some a part of your Fastened Earnings funding in Piramal Capital & Housing Finance NCD Concern

- It’s best to at all times have diversified portfolio be it fastened deposit, NCD or fairness funding

- Its good concept to stay invested until maturity as a result of liquidity on exchanges are low and therefore you’ll get decrease than market worth

How a lot Taxes you Must Pay this 12 months? Obtain Our Earnings Tax Calculator to Know your Numbers

Are you aware how a lot tax it’s essential pay for the yr? Have you ever taken advantage of all tax saving guidelines and investments? Must you use the “NEW” tax regime or proceed with the outdated one? In case you’ve gotten all these questions simply Obtain the Free Excel Earnings Tax Calculator for FY 2021-22 (AY 2022-23) and get your solutions.

Piramal Capital & Housing Finance NCD FAQs

✅ apply for Piramal Capital & Housing Finance NCD?

You’ll be able to apply on-line by ASBA facility supplied by most banks. It’s the best approach to apply and likewise avoids numerous problem when it comes to KYC and paper work. In case you don’t wish to do it on-line, you’ll be able to obtain the applying kind from firm web site or Monetary Establishments and undergo assortment facilities.

✅ Is Piramal Capital & Housing Finance NCD Safe?

Piramal Capital & Housing Finance NCD is secured.

✅ What’s tax on Piramal Capital & Housing Finance NCD?

For Tax Goal NCDs are handled just like Fastened Deposits. The curiosity earned is added to your earnings as “earnings from different sources” and taxed accordingly.

In case the NCD is offered earlier than maturity on inventory exchanges, it will result in Capital Good points and taxed in accordance with the holding interval.

-If the NCD was offered inside 12 months of allotment, it results in Quick Time period Capital Good points and

-if the promoting interval is greater than 12 months its Lengthy Time period Capital Good points

-Quick Time period Capital Good points could be added to earnings and taxed accordingly

-Long run capital Good points could be taxed on the flat charge of 10% (u/s 112 of IT Act)

✅ Is Piramal Capital & Housing Finance NCD protected to speculate?

The credit standing for Piramal Capital & Housing Finance NCD is AA. That is funding grade and fewer more likely to default on principal or curiosity fee. Do do not forget that these scores are as of at the moment and these might change relying on firm’s efficiency and exterior conditions. So buyers want to trace the corporate intently.

[ad_2]

Source link