[ad_1]

As soon as the ITR is submitted and verified by the tax payer, the division goes via each return in automated/handbook trend to verify if every little thing was right and matches with the information obtainable with them. In case they discover a improper/uncertain entry or have additional questions on any declared or undeclared revenue or deduction or exemption, they ship communication to the tax payer for additional verification. That is the TAX NOTICE – probably the most dreaded factor for tax payers.

Nevertheless please observe that the majority notices are innocent (and a few instances completely happy as its about tax refund), as they ask for some extra particulars or inform about mismatch of your tax returns from Kind 16/16A/26AS. That is the rationale why we recommend to at all times match your ITR with Kind 26AS. The essential factor to know is discover is obtained beneath which part, what it means and what you want to do?

We checklist down the widespread tax notices despatched and tips on how to take care of the identical.

Tax Discover Part 143(1)(A)

This yr many tax payers are receiving tax Discover Part 143(1A). The explanation for the discover is due to discrepancy within the revenue or deduction talked about within the tax return and Kind 16/16A or Kind 26AS. The commonest motive being not together with curiosity revenue in returns, not submitting funding proof for tax saving or HRA to employer and claiming the identical whereas submitting ITR amongst others.

Time Restrict to Serve the Discover: NA

Time Restrict to reply: 30 days

What to Do?

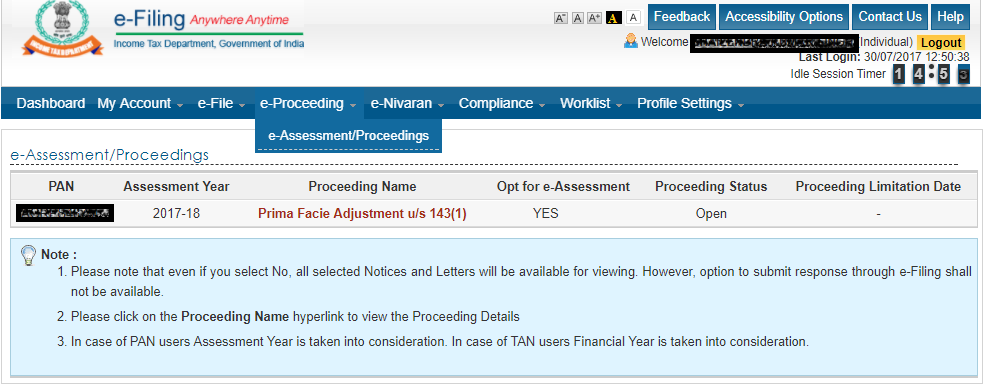

The reply to the discover might be carried out on-line. The tax payer have to login to the revenue tax efiling web site and reply via e-Continuing. It’s possible you’ll want to connect the related proofs within the reply.

Tax Discover Part 143(1)

That is extra of intimation than discover concerning the tax return you filed. This might be of three varieties:

- Your Closing tax evaluation matches with that of assessing officer

- Tax Refund – When tax payer is eligible for tax refund as extra tax was paid / deducted

- Tax Due – Tax payer must pay extra tax

Time Restrict to Serve the Discover: As much as finish of subsequent monetary yr from when the return was filed. So for AY 2021-22 the discover might be served by March 31, 2023

Time Restrict to reply: In case of Tax Due, the cost must be carried out in subsequent 30 days

What to Do?

In case there may be full match, you needn’t do something. In case of tax refund, the quantity could be transferred in subsequent few days to your checking account. For Tax due case, make tax cost in 30 days of receiving discover.

Tax Discover Part 143(2)

That is the scrutiny discover that follows preliminary evaluation of returns. This may be of three varieties relying on the severity.

- Restricted goal scrutiny: The tax division wish to make clear on a number of factors/numbers and so tax payer must confirm the identical.

- Full scrutiny: On this case the tax division has discovered critical discrepancies and therefore an in depth scrutiny is required.

- Handbook scrutiny: That is hand-picked by evaluation officer and might be despatched solely after approval from Earnings Tax Commissioner.

Time Restrict to Serve the Discover: As much as 6 months from the top of economic yr from when the return was filed. So for AY 2021-22 the discover might be served by September 30, 2022

Time Restrict to reply: As per the Discover

What to Do?

Gather all paperwork associated to your revenue, expenditure and funding particulars for the yr and meet with the Evaluation Officer as said within the letter. You too can ship your consultant if required. In case you don’t reply to note or not meet the evaluation officer following actions might be taken:

- The officer can calculate tax legal responsibility as he appears match, which can result in further tax legal responsibility

- Penalty of Rs 10,000 for every failure beneath Part 271(1)(b) and/or

- Prosecution beneath Part 276D, which can prolong as much as one yr with or with out nice

How a lot Taxes you Must Pay this Yr? Obtain Our Earnings Tax Calculator to Know your Numbers

Have you learnt how a lot tax you want to pay for the yr? Have you ever taken good thing about all tax saving guidelines and investments? Must you use the “NEW” tax regime or proceed with the previous one? In case you might have all these questions simply Obtain the Free Excel Earnings Tax Calculator for FY 2021-22 (AY 2022-23) and get your solutions.

Tax Discover Part 139(9)

Discover beneath Part 139(9) is distributed if the ITR was faulty. This will primarily be due to following causes:

- Used the improper ITR Kind

- If the ITR was filed with out paying full tax

- If the refund was claimed for TDS for which the corresponding revenue was not talked about in ITR

- Mismatch within the identify on the ITR & PAN

That is simply an indicative checklist.

Time Restrict to Serve the Discover: NA

Time Restrict to reply: 15 days. Extension attainable by writing to your assessing officer

What to Do?

In case you don’t reply the return filed is taken into account invalid. The tax payer must obtain the right ITR Kind and choose the choice `In response to a discover beneath Part 139(9) the place the unique return filed was a faulty return.’ Quote the reference quantity and acknowledgement quantity and fill the ITR kind with rectifications as required.

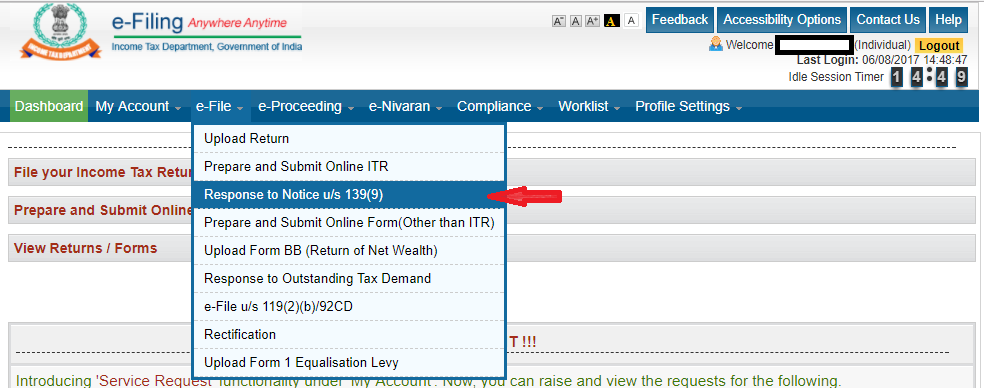

Then login to the revenue tax efiling web site and Choose e-file >>`e-file in response to note us 139(9)’ and add it utilizing the password within the discover.

Tax Discover Part 148

Tax payers obtain this discover if any revenue has not been disclosed and has escaped evaluation.

Time Restrict to Serve the Discover: If the revenue is lower than Rs 1 Lakh, the discover must be despatched inside 4 years from the top of evaluation yr and inside 6 years if the revenue is greater than Rs 1 Lakh.

Time Restrict to reply: 30 days or as laid out in discover

What to Do?

The tax payer must file the return of the evaluation yr as requested by the assessing officer.

23 Most typical Investments and How they’re Taxed in 2021?

Taxes eat a big chunk of returns that we make on investments. Maintaining this in thoughts we’ve got compiled checklist taxes relevant for commonest investments in India. We cowl every little thing from mounted deposit to inventory markets to actual property.

Tax Discover Part 234(F)

That is the brand new part launched in Finances 2017 and relevant from evaluation yr of 2018-19. In line with this the tax payer must pay a nice of Rs 5,000 if the tax return isn’t filed by due date. In case the tax return isn’t filed even by December 31, the penalty would enhance to Rs 10,000. Nevertheless for revenue as much as Rs 5 Lakh the nice wouldn’t exceed Rs 1,000.

Time Restrict to Serve the Discover: NA

Time Restrict to reply: NA

What to Do?

From subsequent yr file your returns on time!

We hope a quick overview of all tax notices would assist you to to be higher ready in case you obtain it. Don’t panic and seek the advice of an knowledgeable in case of any points!

[ad_2]

Source link