[ad_1]

Many individuals whose earnings doesn’t fall underneath the tax slab have largely invested in merchandise comparable to FD by way of which they will earn curiosity. However can we do something to guarantee that the financial institution doesn’t deduct TDS on curiosity earned if our whole earnings is just not taxable?

For those who all don’t know then let me spotlight to you that it’s necessary for banks to deduct TDS on our curiosity earnings. If our earnings is just not taxable and we additionally earn curiosity from different monetary merchandise and many others..then we should present Kind 15G and 15H to the financial institution in order that financial institution doesn’t deduct TDS since our earnings is just not taxable.

On this article, I will probably be discussing all elements associated to Kind 15 and 15H.

What are Varieties 15G and 15H?

Varieties 15G/15H are varieties that a person can submit to make sure that the Tax Deducted at Supply (TDS) is just not deducted on the curiosity earnings if she/he meets the relevant circumstances. All the time bear in mind, that if a person desires to say tax deduction by way of Kind 15G/15H, then the person should have a Everlasting Account Quantity (PAN).

Kind 15G is to be crammed by people aged under 60 yrs and Kind 15H is to be crammed by senior residents aged 60 yrs and above. You possibly can click on on this hyperlink if you wish to obtain the shape immediately from the web site. If you wish to take a look on the kind, click on on the hyperlink under,

Eligibility Standards to fill these Varieties –

a) For Kind 15G –

- An Particular person or HUF or belief or some other assessee

- Solely Indian Resident can apply

- Age ought to be lower than 60 years outdated

- Tax calculated on their Whole Earnings ought to be nil

- The overall curiosity earnings for the yr ought to be lower than the fundamental exemption restrict of that yr

b) For Kind 15H –

- A Resident Indian Particular person

- Age ought to be 60 yrs or extra (senior citizen) through the yr for which you’re submitting the shape

- Tax calculated on their Whole Earnings ought to be nil

Who all will not be eligible to fill these varieties?

The next will not be eligible for submission of Kind 15G/15H –

- Firm (Personal and Public)

- Partnership Agency

- Non-Resident Indian (NRI)

- An Particular person whose estimated whole earnings or the mixture whole earnings exceeds the fundamental exemption restrict.

Can these varieties be crammed on-line or simply offline?

a) Kind 15G (on-line and offline) –

A person can select to submit Kind 15G offline or on-line, relying on the amenities offered by their financial institution or financier. Firstly they should examine if their financial institution permits submission of Kind 15G on-line. If this facility is out there of their financial institution, they will merely go surfing to their web banking account and refill the shape on-line. After getting crammed up the shape, recheck the main points, and hit submit. On your future reference, you may obtain the submitted kind.

The opposite choice is to fill a bodily kind and submit it to the financial institution. The varieties can be found within the Earnings Tax Portal. You possibly can obtain the shape and get printouts of the identical. You possibly can then submit these duly signed paperwork to the financial institution or financier the place you’ve got the financial savings accounts. You may as well submit it on the put up workplace or the corporate you’re employed for relying in your requirement.

At present, there are 2 banks that present on-line filling of the varieties. If in case you have an account within the under 2 banks then you definately log in by way of web banking and fill these varieties –

b) Kind 15H (on-line and offline) –

You possibly can submit Kind 15H on-line or offline mode. To submit it offline, you have to obtain the shape from the Earnings Tax portal as mentioned above. After getting accomplished filling the shape, you may submit these varieties at your financial institution or put up workplace or your employer (within the case of Provident fund).

In case your financial institution or financier permits submission of Kind 15H on-line, you may go surfing to your web banking and refill the shape. You possibly can submit the shape immediately utilizing web banking. On your future reference, you may obtain the submitted kind.

At present, there are 2 banks that present on-line filling of the varieties. If in case you have an account within the under 2 banks then you definately log in by way of web banking and fill these varieties –

An in depth information on fill the shape by way of SBI Web Banking –

Completely different different eventualities the place these varieties might be utilized –

a) TDS on EPF withdrawal –

TDS is deducted on EPF stability whether it is withdrawn earlier than 5 years of steady service. If a person had lower than 5 years of service and plans to withdraw their EPF stability of greater than Rs.50,000, then they will submit Kind 15G or Form15H. Nonetheless, to fill this kind the tax on a person’s whole earnings together with EPF stability withdrawn ought to be nil.

b) TDS on earnings from Company Bonds –

If a person holds company bonds, then TDS is deducted on them if their earnings from these bonds exceeds Rs 5,000. They’ll submit Kind 15G or Kind 15H to the issuer requesting the non-deduction of TDS.

c) TDS on put up workplace deposits –

Publish places of work which are digitized additionally deduct TDS and settle for Kind 15G or Kind 15H, if a person meets the circumstances relevant for submitting them.

d) TDS on Lease –

TDS is deducted on hire exceeding Rs 2.4 lakh yearly. If the tax on a person’s whole earnings is nil, then they will submit Kind 15G or Kind 15H to request the tenant to not deduct TDS.

e) TDS on Insurance coverage Fee –

TDS is deducted on insurance coverage fee if it exceeds Rs 15000 per monetary yr. Nonetheless, insurance coverage brokers can submit Kind 15G/Kind 15H for non-deduction of TDS if the tax on their whole earnings is nil.

FAQs –

i) What is going to occur if I neglect to submit the shape on time to the financial institution?

For those who neglect to submit these varieties on time then the financial institution will deduct the TDS. Nonetheless, one can declare the deducted TDS by submitting an ITR.

ii) What’s the distinction between Kind 15G and Kind 15H?

Each are self-declaration varieties that a person should undergo the financial institution as soon as they open a set deposit. Whereas Kind 15G is for many who are under 60 years and are available underneath Hindu Undivided Households (HUF), Kind 15H is for everybody who’s 60 years and above.

iii) Is the shape offered by banks one and the identical? Or is it totally different?

The varieties which banks present are somewhat totally different from the precise kind which is out there on the earnings tax web site. Nonetheless, each kind of varieties serves the identical objective. You possibly can take a look on the kind within the above part.

iv) Can HUF, NRIs submit Kind 15G/Form15H?

HUF can submit Kind 15G if it meets the circumstances however Kind 15H is just for people. NRIs can’t submit Kind 15G or Kind 15H. These can solely be submitted by resident Indians.

v) Do I must submit Kind 15G/ Kind 15H in any respect the branches of the financial institution?

Sure, you need to submit one at every department of the financial institution from which you obtain curiosity earnings although TDS is deducted solely when whole curiosity earned from all branches exceeds Rs 10,000.

vi) Does submitting Kind 15G/Form15H imply my curiosity earnings is just not taxable?

Kind 15G/Kind 15H is just a declaration that no TDS ought to be deducted in your curiosity earnings for the reason that tax in your whole earnings is nil. Curiosity earnings from fastened deposits, recurring deposits, and company bonds is all the time taxable.

vii) Will my curiosity earnings turn out to be tax-free if I submit Kind 15G/Form15H?

Curiosity earnings from fastened deposits and recurring deposits is taxable. For senior residents deduction of Rs.50,000 is out there underneath part 80TTB for the curiosity earnings from fastened deposits/put up workplace deposits/deposits held in a co-operative society. It’s best to submit this kind provided that the tax in your whole earnings is zero together with different circumstances.

viii) I’ve submitted Kind 15G and Kind 15H however I even have taxable earnings, What ought to I do?

You have to inform your financial institution that the tax in your whole earnings is just not zero. The financial institution will make adjustments and deduct TDS accordingly. It’s best to report all the curiosity earnings in your tax return and pay tax on it as relevant.

ix) Do I’ve to submit this kind to the earnings tax division?

You don’t must submit these varieties on to the earnings tax division. Simply submit them to the deductor, and they’re going to put together and submit these varieties to the earnings tax division. At occasions these varieties can be crammed and submitted within the financial institution.

x) Is there any time restrict for submitting these varieties?

There is no such thing as a time restrict or due date for submitting Kind 15G/15H to the financial institution. Nonetheless, it’s advisable to submit it at the start of the monetary yr (i.e. Apr 01) or as and when the brand new deposit is created.

xi) What’s the time restrict throughout which these varieties are legitimate?

Varieties 15G/15H are legitimate for one monetary yr ending on Mar 31 of yearly. So, you’ll have to submit these varieties yearly if you’re eligible. Submitting them as quickly because the monetary yr begins will be sure that no deduction is completed on any curiosity earnings earned.

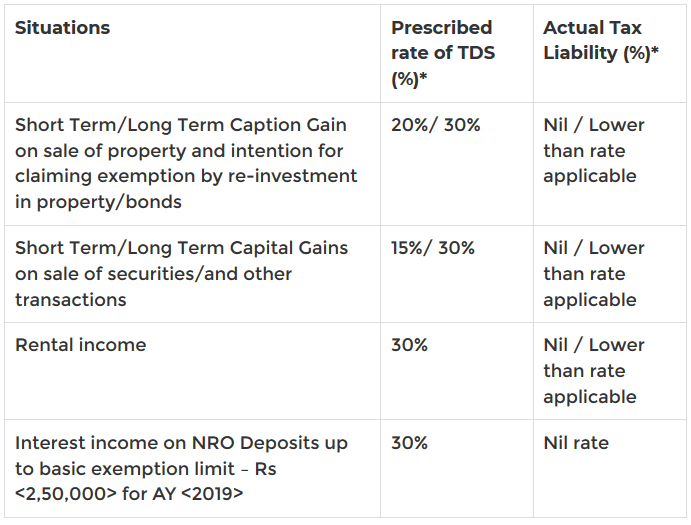

xii) Is there some other manner NRIs can chorus from TDS deduction as they don’t seem to be eligible for Kind 15G and 15H?

For any NRI, whose TDS is greater than his/her tax legal responsibility, such extra tax might be claimed as a refund from the Indian Tax Division (ITD) by submitting the Return of Earnings within the explicit Monetary Yr. Such extra TDS ends in loss to NRI because of the time interval between the tax deducted and refund of such extra tax, which can take usually 1 to 2 years.

To be able to handle the above scenario, a process has been prescribed underneath the Act, whereby NRI recipient of earnings can apply on-line to ITD (in a prescribed format) together with the related supporting paperwork to situation a Tax Exemption Certificates (TEC) authorizing the payer of earnings (who deducts tax) to deduct tax at a decrease charge or Nil charge, because the case could also be.

Within the case of NRIs, whose precise tax legal responsibility is decrease than the speed of tax prescribed underneath the Act, it’s helpful to acquire a TEC. An NRI ought to apply for TEC underneath few conditions listed under –

Process – The Jurisdictional Assessing Officer (from the Worldwide taxation ward of the ITD) of an NRI usually points a TEC between 2 to 4 weeks from the date of software.

Validity – TEC is often legitimate for the interval for which such TEC is obtained (i.e. a Monetary Yr) and for the precise earnings as acknowledged within the TEC.

Submitting Return of Earnings – NRI who has obtained the TEC has to compulsorily file his Return of Earnings in India for that Monetary Yr.

xiii) How can a person make use of those varieties?

These varieties can be utilized provided that the tax calculated on the person’s whole earnings is nil for the monetary yr. Each varieties – Kind 15G and Kind 15H – have a validity of 1 monetary yr. That’s the reason both of them is required to be submitted at the very least as soon as each monetary yr. Varieties 15G and 15H are principally submitted to save lots of TDS on curiosity earnings.

For instance, Banks deduct TDS on FDs when curiosity earnings is greater than Rs 10,000 in a monetary yr. But when the entire earnings is under the taxable restrict, then Kind 15G and Kind 15H need to be submitted to the financial institution requesting them to not deduct any TDS on the curiosity.

Factors to Bear in mind –

- A person can solely submit Kind 15G/15H to a financial institution with a sound PAN, if a person doesn’t have a sound PAN then, the tax will probably be deducted at 20%.

- It’s advisable to submit a duplicate of the PAN card with the duvet letter.

- The person ought to ensure that he/she receives an acknowledgement whereas submitting Kind 15G/15H. This acknowledgement might be stored for future reference.

- Acknowledgement of submission of PAN particulars is helpful if a dispute with the financial institution arises.

- The person might want to submit the main points of the Kind 15G/15H submitted by him/her to different banks in addition to the curiosity earnings quantity talked about in these varieties.

- As the person has submitted his/her PAN, the respective assessing officer could have entry to all the data submitted by the person to different banks and can cross examine if there may be any incorrect info submitted by the person or not.

- There’s a provision for imprisonment for at least three months if a person is discovered to have offered incorrect info within the declaration varieties.

A brief video on The best way to Fill these Varieties –

a) Kind 15G –

https://www.youtube.com/watch?v=3q4gpjHbSIo

b) Kind 15H –

https://www.youtube.com/watch?v=Dmszve9yqOw

Conclusion –

So this was all that I needed to share on this article. If in case you have any queries then you may put up them within the feedback part.

[ad_2]

Source link